Little Time to Rest for the Oversold Bounce – The Market Breadth

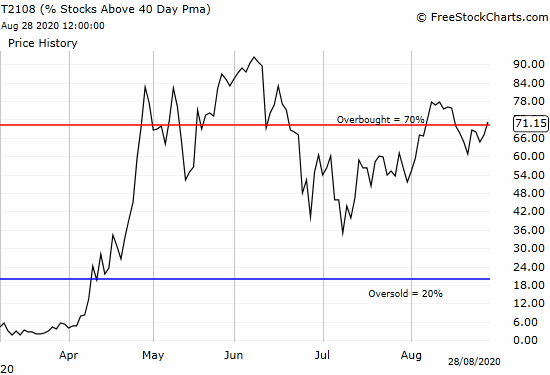

Stock Market Commentary Downtrends are over. Bullish breakouts abound. Sellers got one chance last week to try to keep the cork in the bottle of the oversold bounce, but they failed. The stock market insisted on pushing right through. With little time to rest, the S&P 500 and the NASDAQ ended the week with major … Read more