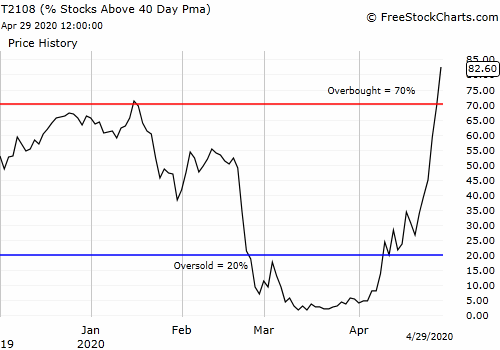

Stock Chart Reviews – Snapshots of Survival from Descents Into Oversold Territory

Stock Market Commentary Trading with on-going headline risk is difficult for bulls and bears. I find it useful to pick a narrative, pick an anchor, and stay as disciplined as possible. My foundation remains with the principles of trading contrary to extremes. Last week, the market tested the extremes of oversold trading conditions and survived … Read more