A VIX Follow-Through Confirms Bearish Signal – The Market Breadth

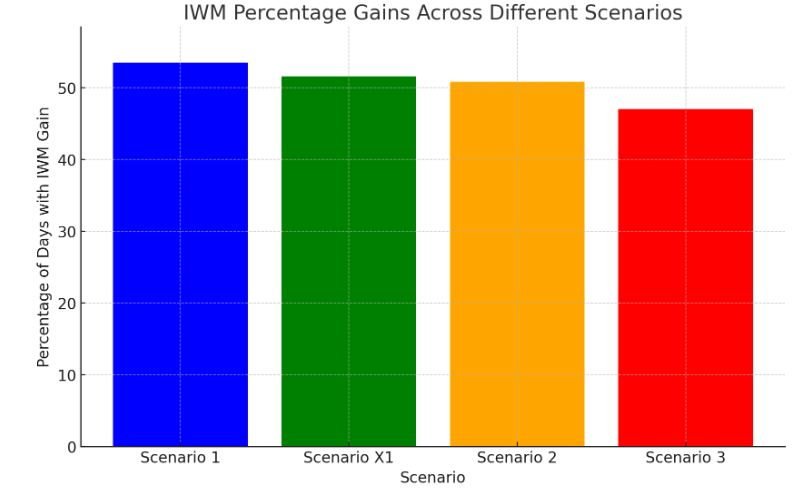

Stock Market Commentary Last week was a week like few other for the volatility index, the VIX. In my last Market Breadth I made the case for the VIX mattering again. A VIX follow-through demonstrated even more strength and resilience. The resulting closing high for the year is a firmer bearish signal for the stock … Read more