Jackson Hole Redux: Stock Indices Are Back Where They Started – The Market Breadth

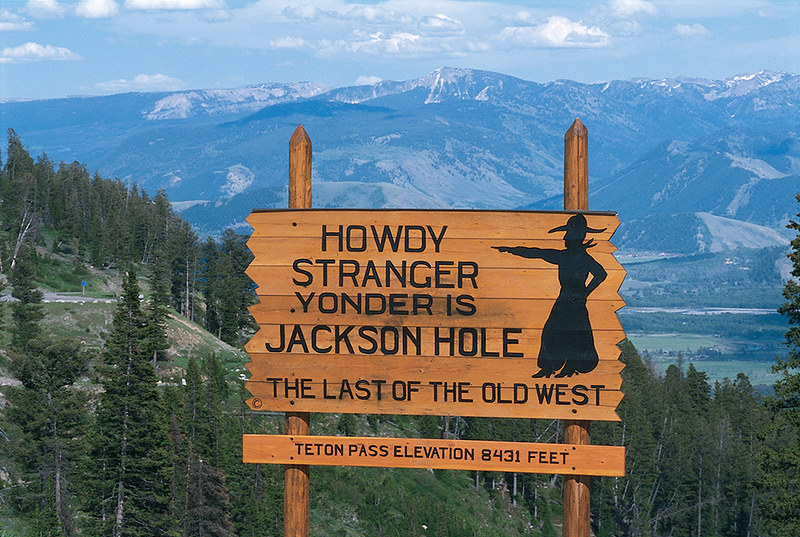

Stock Market Commentary The annual Jackson Hole confab of central bankers starts this coming Thursday. Almost like technical poetry, the S&P 500 and the NASDAQ are back to the highs directly preceding Jackson Hole 2022. Depending on your perspective, this Jackson Hole redux either represents a bullish confirmation of the market’s resilience after 18 months … Read more