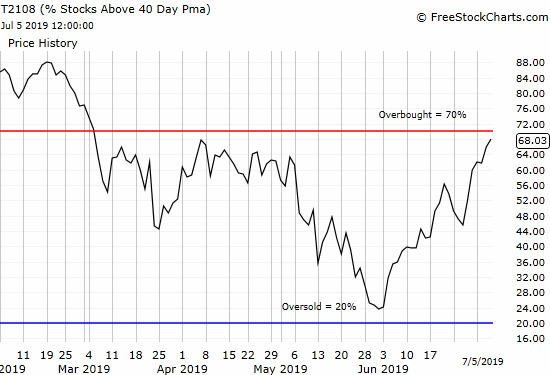

Oversold Trading Awaits – The Market Breadth

Stock Market Commentary The Federal Reserve helped unlock the stalemate in pricing action that stalled the bearish divergence tugging the market toward oversold trading conditions. Fed Chair Jerome Powell once again told financial markets the Fed remains as hawkish as ever. Expectations contracted for rate cuts next year, interest rates soared, and stocks plunged. While … Read more