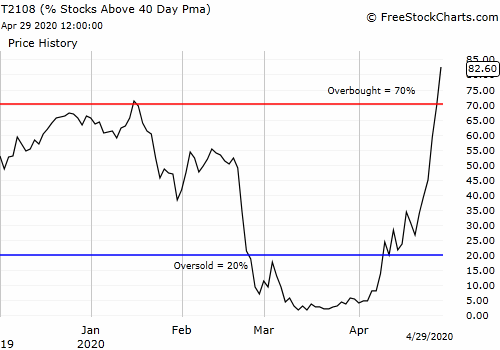

Overbought Conditions Slip Into An Apple Topping – The Market Breadth

Stock Market Commentary A week ago, buyers did their best to push against topping stock indices by restarting overbought conditions. That overbought period lasted just 3 days as a Fitch downgrade of U.S. Treasury debt freshly cooled the summer of loving stocks. The resulting selling confirmed topping conditions and greased the skids of the stock … Read more