Beyond Believable, Beyond Meat

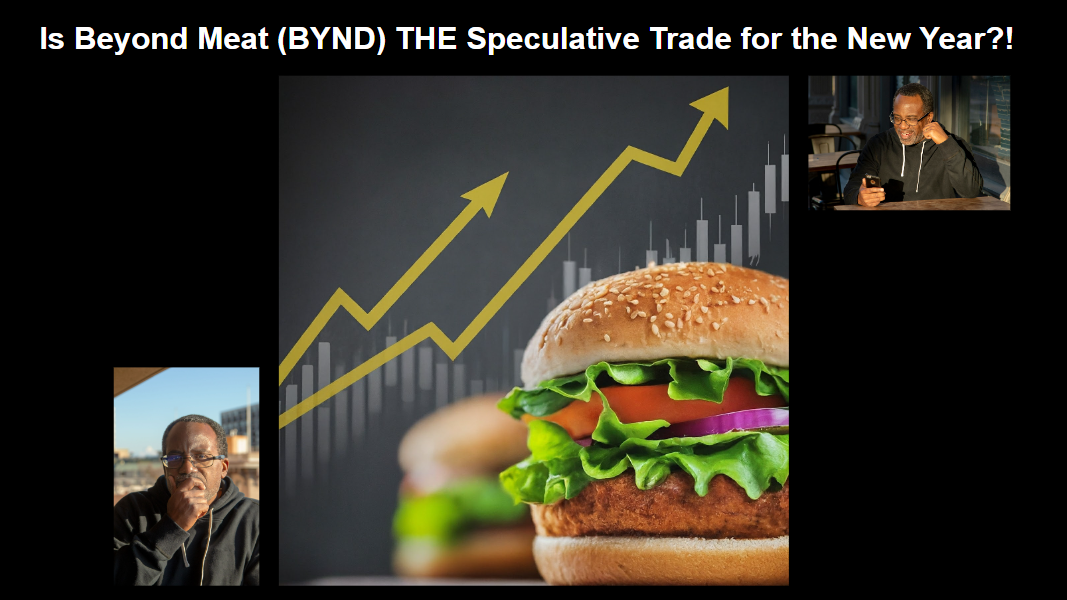

Sometimes it pays to be stubborn. In December, I asked whether Beyond Meat (BYND) would be the speculative trade of the new year. I presented a simple thesis that managed to work out. However, the path from A to B was totally unexpected, and I broke rules along the way. In response to earnings, BYND … Read more