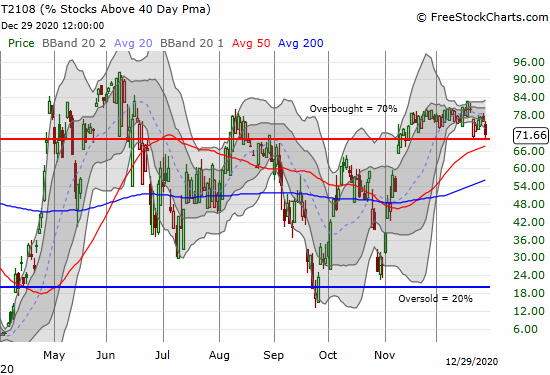

A Path of Least Resistance Offers A Reprieve – The Market Breadth

Stock Market Commentary: Yesterday’s surge in the Japanese yen (FXY) may have exhausted enough sellers to clear the path for some holiday cheer in the stock market. Suddenly, the market seemed to transition from the heavy burdens of a stubbornly hawkish Fed to the alluring hopes from a lack of (scheduled) negative catalysts for the … Read more