Follow-Through Trades: Another Bounce from “Oversold Enough”

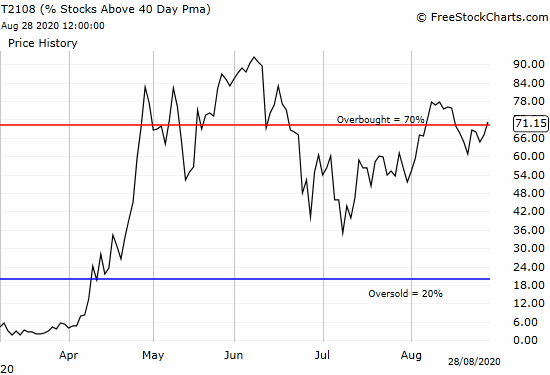

The Follow-Through Intro The stock market followed a rare stumble with a broad-based rebound from “oversold enough” conditions. Stocks were generally up across the board as buyers rushed in to grab “bargains.” AT40 (T2108), the percentage of stocks trading above their respective 40-day moving averages (DMAs), jumped from 37% to 46%. My favorite technical indicator … Read more