An Appreciating Yen Is the Rally’s Second Strike – The Market Breadth

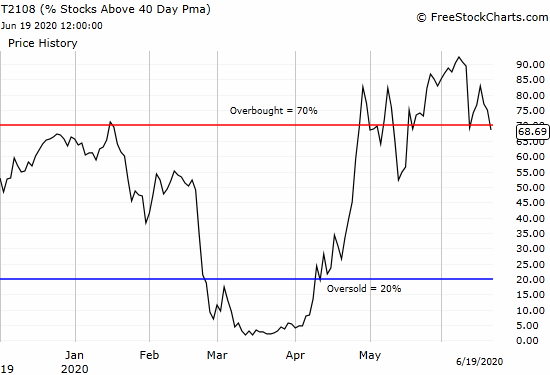

Stock Market Commentary Technical underpinnings are changing fast in the stock market. The first strike against the rally came in the form of initial struggles to break into overbought territory. A second strike has now emerged in the form of an appreciating Japanese yen (FXY). To the extent carry trades – borrowing cheap yen to … Read more