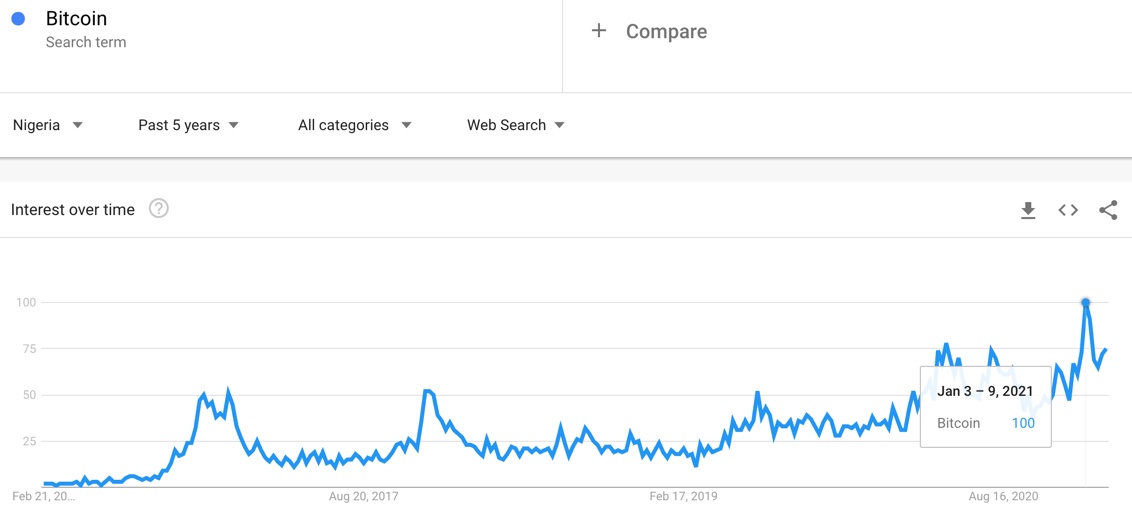

Why Nigeria Is Number One In the World for Bitcoin Searches

As the Nigerian naira plunges in value, Nigerians are scrambling for ways to protect their purchasing power. In this modern era, Bitcoin (BTC/USD) offers the promise of a digital store in value. Accordingly, Nigeria has returned to the number one spot in the world for national share of searches taken by Bitcoin according to Google … Read more