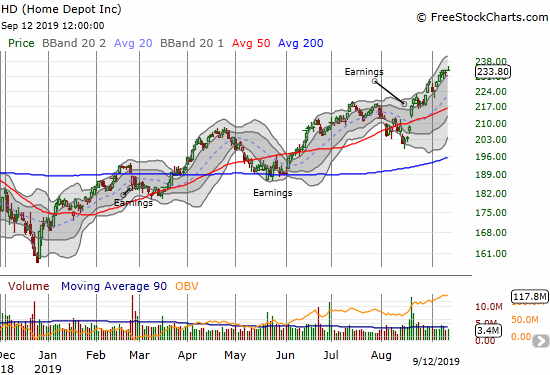

A Home Depot and Lowe’s Companies Mismatch for the Holidays

Valuation Gap Lowe’s Companies (LOW) gets a bad rap relative to Home Depot (HD) for being the weaker operator for the home improvement and do-it-yourself (DIY) crowd. Investors are willing to pay a trailing 36 P/E, forward 17 P/E, 1.2 price/sales, and 33.5 price/book for LOW. Investors are willing to pay a trailing 23 P/E, … Read more