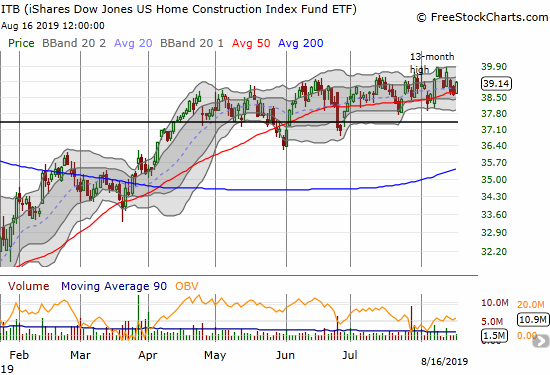

With just one day to go until expiration of the short side, my Aug/Oct $39 calendar call spread on the iShares Dow Jones US Home Construction ETF (ITB) hit its initial profit target. I was hoping the short side would expire worthless, and I could ride the long side expiring in October into the launch of seasonal strength for the stocks of home builders. This trade represented my small amount of deference to the ability of home builders to defy the seasonal top for stocks in the industry.

The chart above shows the grudging progress ITB is making grinding through incremental new highs to prices last seen in the summer of 2018. This kind of tightly wound price action is the perfect setup for a calendar call spread: it facilitates setting a good risk/reward strike price. The gentle trend provides a high confidence price forecast like the $39 I drew out for August.

Now that I have no position in ITB, I face a key question: did my close on the ITB position represent a timely exit ahead of a looming sell-off, or is it time for a position refresh?

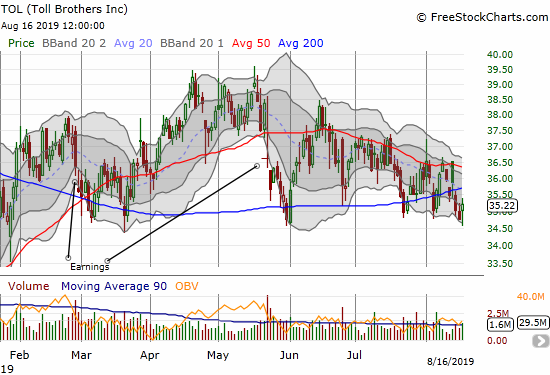

A Looming Warning from Toll Brothers?

On a relative basis, Toll Brothers (TOL) has been one of worst performing home builders. TOL is up just 6.9% year-to-date versus 30.3% for ITB and 15.2% for the S&P 500 (SPY).

Toll Brothers looks like a warning ahead of a larger sell-off. Yet, the stock’s poor relative performance makes sense given lower-priced and more affordable homes have out-performed the more expensive homes that are Toll Brother’s specialty. This divergence is clear in the earnings reports of builders like M/I Homes (MHO) and M.D.C. Holdings (MDC) who are focused on lower-priced homes in affordable housing markets versus the somewhat weaker performance of diversified and larger builders like Lennar (LEN) and Pulte Homes (PHM). When TOL reports earnings on August 20th after market, I expect the luxury builder to deliver at best lukewarm news as it tries to reassure investors about the market for luxury homes.

With TOL bearishly trading below its 200-day moving average (DMA), the stock looks like a good pick for a pairs trade against ITB. This pairs trade refreshes my potential upside opportunity for lower risk until the October/November start to the seasonally strong period for the stocks of home builders.

The Pairs Trade: iShares Dow Jones US Home Construction ETF Calls Versus Toll Brother Puts

The risk in TOL is imminent while the opportunity in ITB is over the horizon. As a result, I am OK buying some options premium in TOL, but I want to sell some in ITB. As of the close Friday, here are my preferred options configurations:

- Long TOL Aug 23rd $34 puts costing about $0.75 each OR Sep $34 puts costing about $0.95 each.

- Long ITB January 2020 $40/$44 call spread costing about $1.4. Potentially buy additional January 2020 $40 calls on dips.

I included the August weekly and the September puts on TOL to show the small gap in price. While I originally just wanted to buy puts against the risk of a major Toll Brothers disappointment, paying just a little more for TOL puts turns the position into a good short-term hedge on ITB. The January call spread on ITB allows me to ride well into the seasonally strong period for home builders. The $44 cap on the call spread is $2 short of the 10-year high set last January. If the aggregate counter-seasonal strength in home builders provides a launchpad for the seasonally strong period, ITB should easily reach $44 by January.

I am assuming a 10% downside risk in TOL for the month following a poor earnings report, so I will buy one TOL put for each ITB call spread. The target profit on the puts will almost pay for the ITB call spread. Ever since TOL set a 14 1/2 year high last January, the stock has suffered a series of post-earnings disappointments including sharp fades from initial post-earnings strength. So even if TOL jumps out the gate post-earnings, I will be looking for signs to double down on puts.

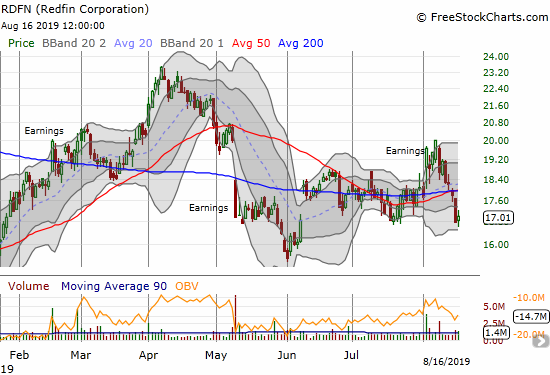

The Redfin Headwind

My refresh on the long Redfin (RDFN) versus short Zillow Group (ZG) pairs trade is off to a rough start. RDFN sliced through presumed support and is now severely lagging ITB as well as confirming a reversal of all its earnings gains.

Source for charts: FreeStockCharts

RDFN has struggled since April and is looking less and less capable of playing catch-up. The poor performance of RDFN and now Zillow Group (Z) (ZG) give me considerable pause and motivate me further to hedge ITB exposure with the likes of Toll Brothers…at least until the seasonally strong period begins.

Be careful out there!

Full disclosure: long PHM puts (remainder from a calendar put spread that hedged the ITB position