A Triumph of Liquidity: New Overbought Period for Stocks Despite Political Chaos

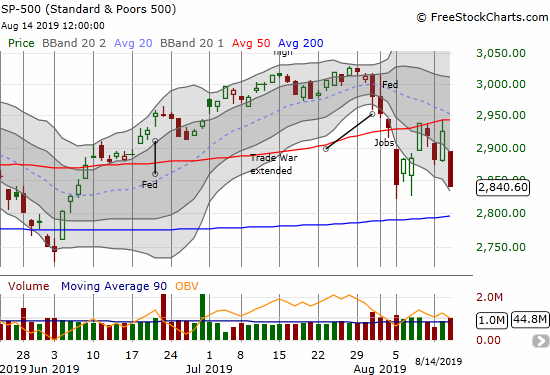

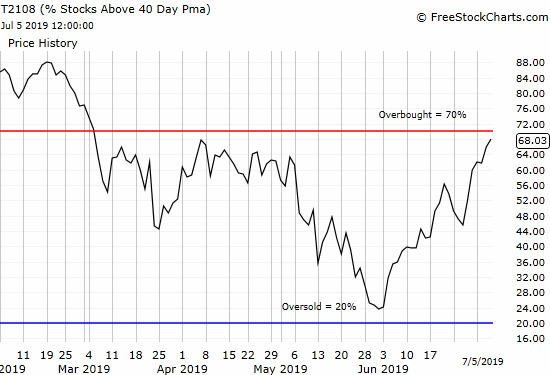

Stock Market Commentary One hundred and fifty minutes. The bearish signal that hit the stock market after the last overbought period ended essentially lasted just 150 minutes. Buyers stepped into the market on Monday after lunchtime on the East Coast and essentially barely took a pause until the last 2 hours of trading today (Wednesday, … Read more