How Declining Market Breadth Delivered A Beating On Stocks – Above the 40 (July 16, 2021)

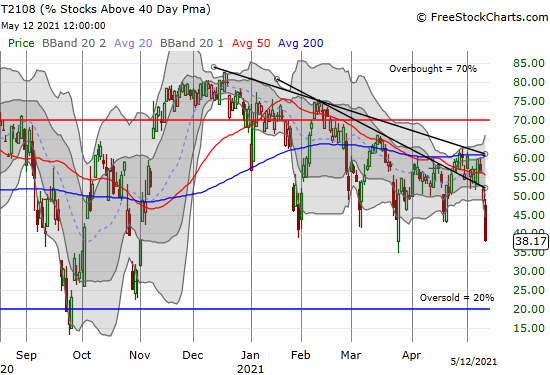

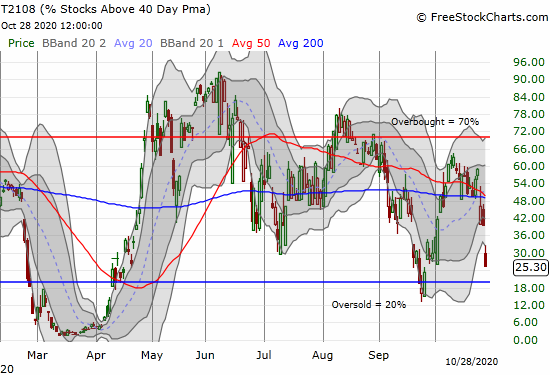

Stock Market Commentary The stock chickens have come to roost on declining market breadth. The stock market indices still generally appear fine, but an ever growing swath of individual stocks have fallen further and further behind. Last week in particular, sellers delivered an extended beating on individual stocks. The signs of waning confidence in the … Read more