Stock Chart Reviews – Snapshots of the Fresh Bearishness

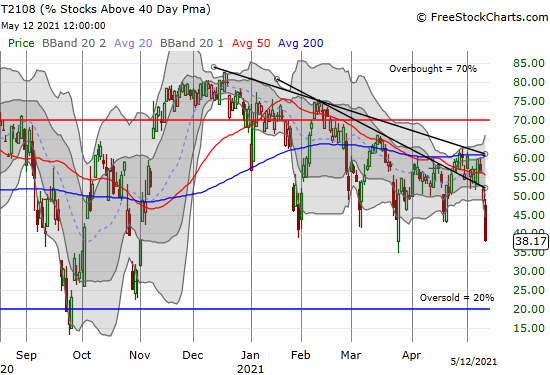

Stock Market Commentary: After much resistance to Fed hawkishness, the U.S. stock market gave way to fresh bearishness. The major indices dropped into new depths of the bear den. The stocks below are snapshots of the latest deterioration in the price action and decline in the technical health underlying the stock market. The ARK funds … Read more