Stock Chart Reviews – A Telling Mosaic from All-Time Lows to Breakouts

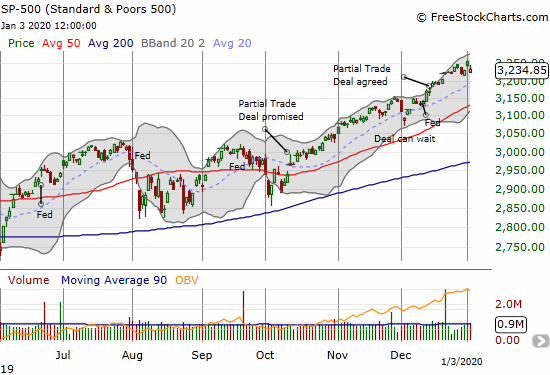

Stock Market Commentary The stock market is scraping by just above oversold territory. The churn of last week has created a mosaic different trading conditions. The bears are salivating at the all-time lows. The hopefuls like me are finding slivers of opportunity in the breakouts. The stock charts in this review cover some of everything. … Read more