Is the Latest Topping Pattern Another Tease for the Bears? – The Market Breadth

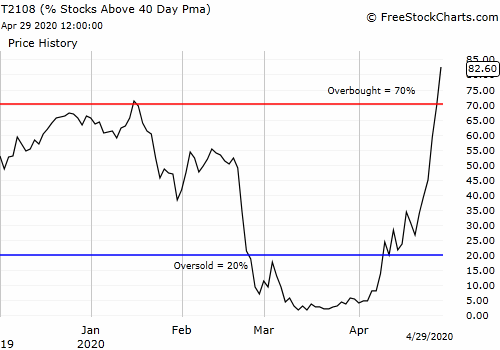

Stock Market Commentary Is another tease for the bears underway? The current bullish rally has included so many temporary bearish signals that I had to stop using baseball metaphors to call strikes. Now, the latest bearish signal looks like the most ominous yet. In the wake of February’s job report, price action delivered a wicked … Read more