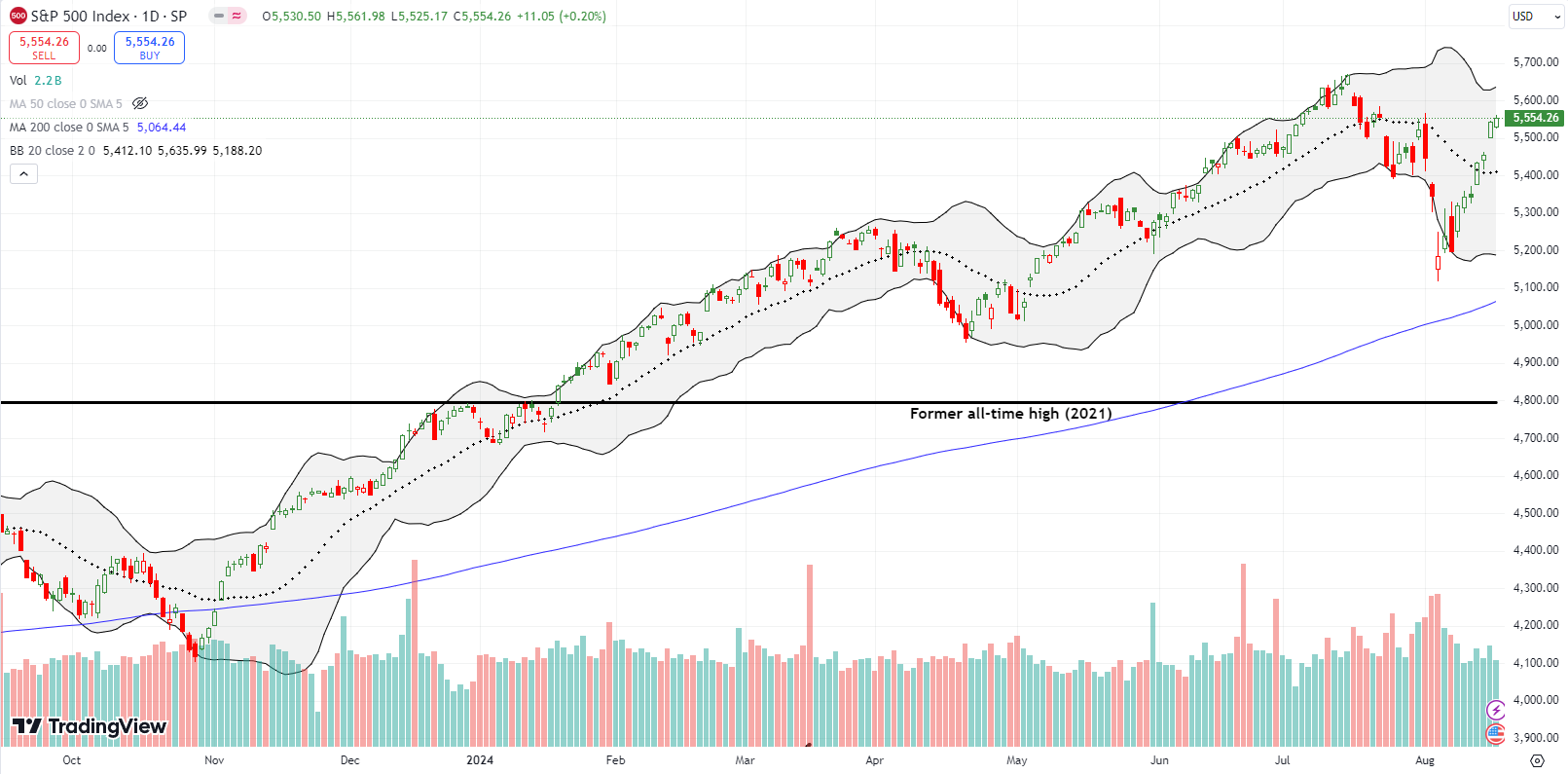

Tariff Flexibility Countdown Underway – The Market Breadth

Stock Market Commentary The market delivered a contradictory signal to end the week. For example, while swingtradebot flashed very bullish technical indicators, market breadth declined the last two days of the week. This divergence is symbolic of the swirling tensions in the air. After, the three-week sell-off into a bear market took advantage of rising … Read more