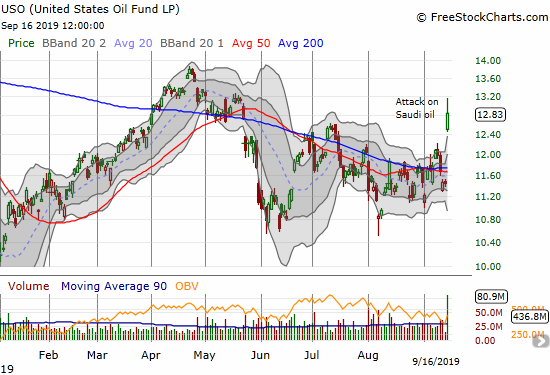

A Roundtrip for the United States Oil Fund

The sudden surge in oil prices two weeks ago seemed like such a big deal at the time. Yet, there was enough chatter at the time that made me doubt the sustainability of the run-up. I decided to make a hedged play of puts and calls on the United States Oil Fund (USO): “I am … Read more