AT40 = 9.4% of stocks are trading above their respective 40-day moving averages (DMAs) (oversold day #4)

AT200 = 14.7% of stocks are trading above their respective 200DMAs (new 34-month low)

VIX = 25.6 (no change!)

Short-term Trading Call: bullish (caveats below!)

Commentary

On Tuesday night, basketball great LeBron James, now of the Los Angeles Lakers, experienced an historic moment: Brooklyn Nets center Jarrett Allen blocked James’s attempt to dunk. Apparently such an epic block has only happened to James 7 other times in his professional career (consider the count unofficial as I read it on Twitter – the point is that this was a rare and astonishing event).

Who knew that this moment would serve as the perfect prelude to stock market trading around the Federal Reserve’s decision on monetary policy?

The Federal Reserve hiked rates by 25 basis points as the market expected and as several pundits greatly feared. The James-versus-Allen historic moment came with the Federal Reserve serving up a jarring rejection of market expectations for zero rate hikes in 2019. From the introductory statement of Fed Chair Jerome Powell:

Many FOMC participants had expected that economic conditions would likely call for about three more rate increases in 2019. We have brought that down a bit and now think it is more likely that the economy will grow in a way that will call for two interest rate increases over the course of next year.

I think Powell thought of the reduction from three to two as a wonderful compromise given the Fed sees “…growth moderating ahead. FOMC participants along with many other forecasters had long predicted some moderation of growth in 2019. The additional tightening of financial conditions we have seen over the past couple of months, along with signs of somewhat weaker growth abroad, have also led us to mark down growth and inflation projections a bit.” Perhaps Powell and company thought of any move lower from three would show good faith capitulation on the previous rate hike plan for 2019. Financial markets sure did not see things that way. Oddly, Powell earlier in his statement claimed that “these [economic] developments have not fundamentally altered the outlook.” That sounded like a sustained claim on unwavering hawkishness.

Regardless, the end result was a policy statement that, perhaps for the first time since the early days of the financial crisis, stood in stark contrast to market expectations and hopes. Understanding the significance of the contrast and contradiction, the subsequent sell-off in stocks was predictable. I just wish I had considered this particular scenario in my earlier assessments of the possibilities!

The Fed’s attitude was summed up pretty well during the Q&A session with this declaration (emphasis mine): “Nothing will deter us from doing what we think is the right thing to do.” In other words, an undeterred Fed does not care about the President’s tweets and protests, the punditry, or even the whining of financial markets. The Fed is comfortable thinking for itself and taking the lead rather than following the consensus leanings.

So perhaps the stock market simply has not fallen far enough to force the Fed to fully capitulate. Today’s trading may mark the beginning of what I will now call Operation Capitulation (OC). The name has a nice double meaning for a buying signal given the market wants the Fed to capitulate into a dovish corner at the same time that traders and investors want the OTHER person to capitulate on THEIR bullishness.

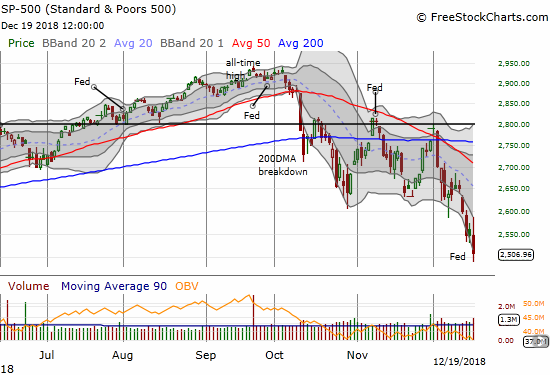

The S&P 500 (SPY) started the day well and rallied its way to a 1% gain just ahead of the Fed release. It was mostly downhill from there. The index closed the day with a 1.6% loss. The index traversed the entire range of its lower Bollinger Band (BB) channel and looks poised for further losses.

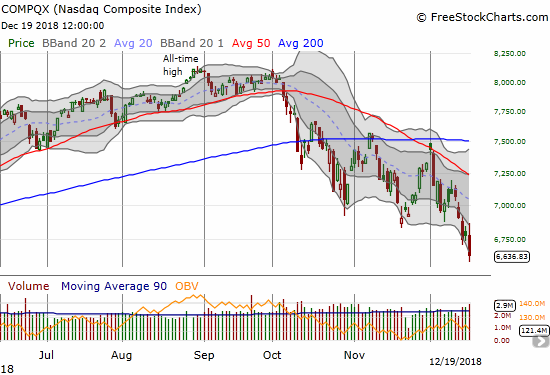

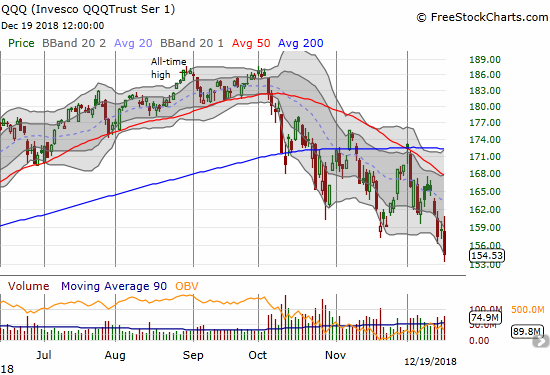

The NASDAQ and the Invesco QQQ Trust (QQQ) sold off for 2.2% and 2.5% losses respectively. The NASDAQ cracked through 2018’s important levels to a 14-month low while QQQ managed to keep to a 10-month low.

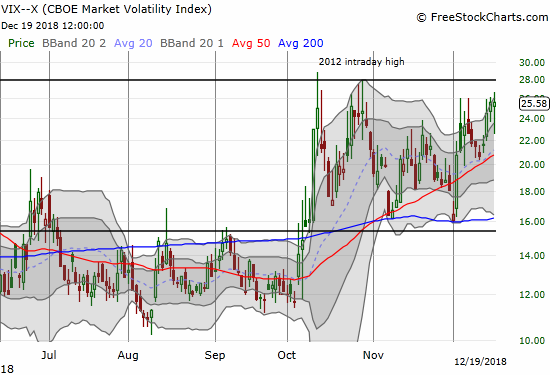

With this combination of shock, disappointment, and selling, I expected the volatility index, the VIX, to easily slam through the 26 level which has served as such tight resistance this month. Instead, the VIX once again demonstrated reluctance and sluggishness by closing FLAT with the previous day’s close. The VIX was even down as much as 12.0% just ahead of the Fed release.

Needless to say, the stock market market ended the day even more deeply oversold. AT40 (T2108), the percentage of stocks trading above their respective 40DMAs, dropped from 11.5% to 9.4%, just below the October closing low and a level last seen in January, 2016. AT200 (T2107), the percentage of stocks trading above their respective 200DMAs, dropped from 16.5% to 14.7%, a new 34-month low. As I mentioned before, these extremely low levels do not provide new information. The duration of the oversold period is much more important now. Given the succession of oversold periods just two months ago and the close call in November, the longer the market stays oversold here, the more it confirms the abiding bearishness of the market.

As I indicated above, I was not prepared for a defiant and undeterred Fed; I was heavily leaning toward a Fed that somehow figured out how to come up with just thee right salve without sounding any alarms on the economy. As a result, I had to force my brain to think more flexibly. I started off encouraged by a 1.0% gain in Walmart (WMT) off its 200DMa support, so I bought call options assuming support was confirmed. After I noticed the very deep drop in the VIX ahead of the Fed statement, I became suspicious: it made little sense to me that the volatility implosion was already underway and so steeply. The move looked premature, overly eager, and too quick to relief. Accordingly, I bought a call option in ProShares Ultra VIX Short-Term Futures (UVXY). In hindsight I realized I should have been more aggressive, but I will not complain about the 150% gain after I sold it. On the other hand, I incorrectly held onto my SPY call options expiring this Friday. With another tranche expiring next Friday, I should have been satisfied taking some profits ahead of the Fed release.

My short-term bullish trading call became a bit meaningless for the day’s trading action. With a Fed statement built for blocking the stock market’s hopes and dreams, I had to respect the weight of the bearish sentiments. I continued to hold onto my QQQ put spread. I even held off on taking profits on my put spread on Caterpillar (CAT). Both positions I plan to unload as soon as possible Thursday morning.

At this point, the oversold conditions in the stock market are very obvious. No one needs AT40 here to tell them the market is panicking and down deep in sell-off country. Perhaps such a widespread recognition can help explain the VIX’s inability to hold itself over the 26 level. Whatever is going on it looks like the big VIX spike is still a ways away. If I am correct about the dire implications of the stock market failing to hold Monday’s lows, I expect the VIX to get much higher.

CHART REVIEWS

Caterpillar (CAT)

I am surprised under these bearish market conditions that CAT is not already challenging its October low. This ability to stay embedded in a recent trading range would be mildly bullish to me except CAT is now failing at declining 50DMA resistance. The stock finally looks primed for a further fall.

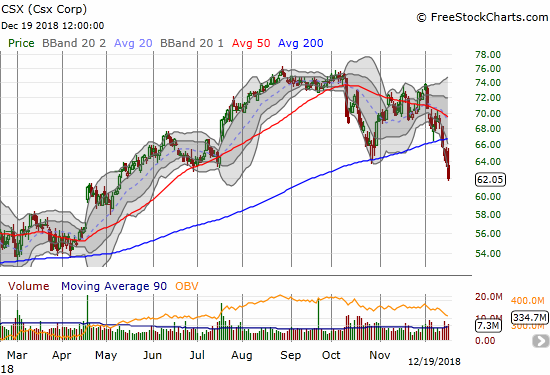

CSX Corporation (CSX)

CSX was on my buy list until now. Last week’s 200DMA breakdown and this week’s sharp follow-through that punched through October and summer support levels looks very bearish. A topping pattern is finally settling in.

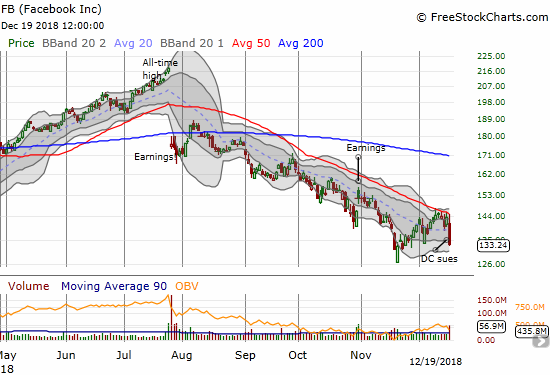

Facebook (FB)

The hits just keep coming for FB. My labels in the chart below hardly do the headline risks justice. Needless to say, I have the lowest of expectations for my residual calls from the pre-earnings trade. I look back on this chart and wish I just stayed short through the brief post-earnings rebound in August.

Federal Express (FDX)

FDX chose the exact wrong day to announce bad news that confirmed fears about a slowing global economy and domestic economic risks. I had a pre-earnings calendar call spread in play that completely blew up. I managed to make up for most of the loss by accumulating puts on FDX as the stock tried an intraday bounce; I thought the news was too poor to sustain a bounce for long. I took profits near the close.

Netflix (NFLX)

The strong rally in NFLX dulled my senses in the morning to the smell of a fade. I did not even double down on my existing put. I decided to sit on my profit overnight to see whether the stock can open for a gap down in the morning.

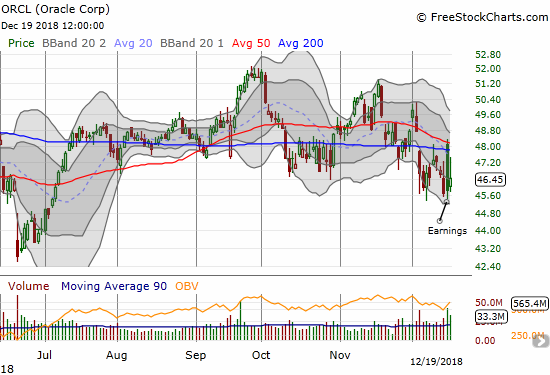

Oracle (ORCL)

ORCL traded up nicely post-earnings on Tuesday. By the close, the stock reversed all its post-earnings gains as 50 and 200DMA resistance held tough. I was very surprised to see ORCL outperform the market today even after a sharp fade from its intraday high.

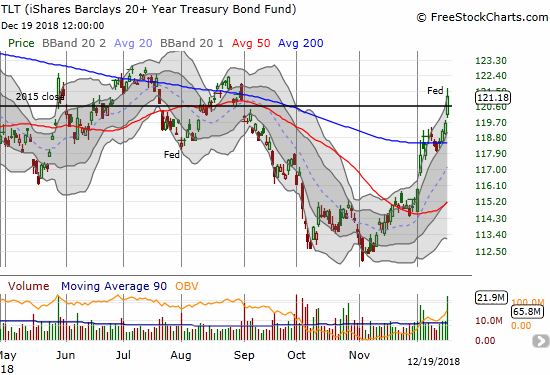

iShares 20+ Year Treasury Bond ETF (TLT)

Do not tell the bond market that the Federal Reserve hiked rates and plans two more in 2019. In a move that must represent growing fears of an economic slowdown, TLT jumped above the old 2015 close as part of a move that represents a sharp rise from the November low. Just to be a bit contrary, I bought TLT puts. I do not know what scenario brings TLT back down (and rates up), but I do know I am not quite ready to bet alongside an economic slowdown.

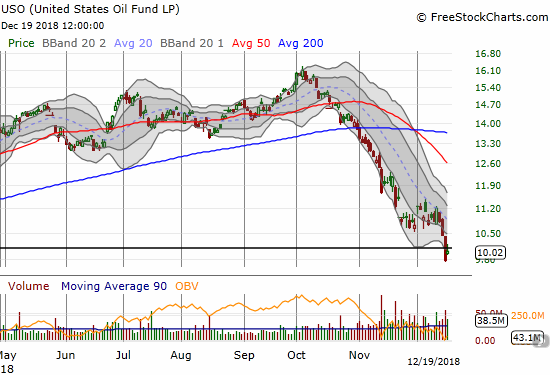

United States Oil (USO)

The continued plunge in oil prices sure caught me off-guard. I thought the OPEC agreement to cut production sealed the bottom. Now oil looks like it wants to join the bond market in anticipating an imminent economic slowdown.

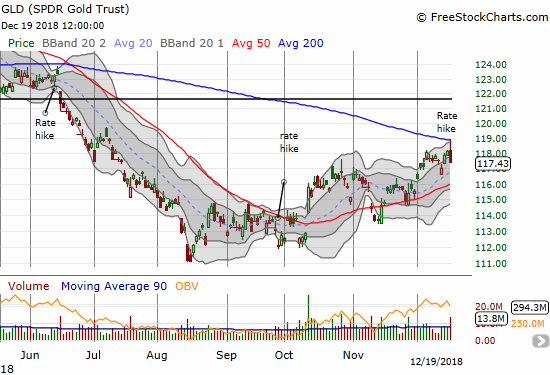

SPDR Gold Shares (GLD)

I was prepared to see GLD breakout above 200DMA resistance on the heels of a capitulated Fed. The undeterred Fed also strengthened the resolve resistance. I am assuming GLD should catch a bid again if rates continue lower and fears continue higher.

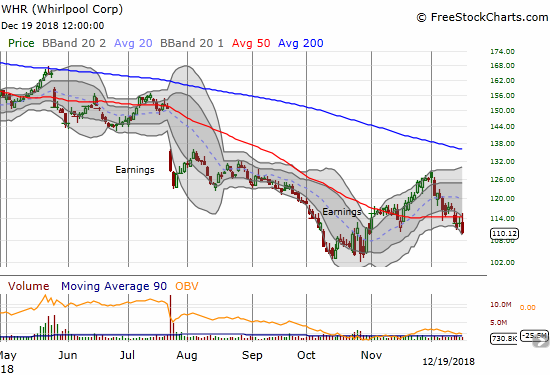

Whirlpool (WHR)

In earlier posts marveled at the ability of WHR to rebound nicely off its October lows. Now the stock is suffering a 50DMA breakdown and looks ready to retest the October low. I think it will trade closer to housing-related stocks.

— – —

FOLLOW Dr. Duru’s commentary on financial markets via email, StockTwits, Twitter, and even Instagram!

“Above the 40” uses the percentage of stocks trading above their respective 40-day moving averages (DMAs) to assess the technical health of the stock market and to identify extremes in market sentiment that are likely to reverse. Abbreviated as AT40, Above the 40 is an alternative label for “T2108” which was created by Worden. Learn more about T2108 on my T2108 Resource Page. AT200, or T2107, measures the percentage of stocks trading above their respective 200DMAs.

Active AT40 (T2108) periods: Day #4 under 20% (4th oversold day), Day #9 under 30%, Day #11 under 40%, Day #61 under 50%, Day #77 under 60%, Day #132 under 70% {corrected 1/6/19}

Daily AT40 (T2108)

Black line: AT40 (T2108) (% measured on the right)

Red line: Overbought threshold (70%); Blue line: Oversold threshold (20%)

Weekly AT40 (T2108)

*All charts created using freestockcharts.com unless otherwise stated

The T2108 charts above are my LATEST updates independent of the date of this given AT40 post. For my latest AT40 post click here.

Related links:

The AT40 (T2108) Resource Page

You can follow real-time T2108 commentary on twitter using the #T2108 or #AT40 hashtags. T2108-related trades and other trades are occasionally posted on twitter using the #120trade hashtag.

Be careful out there!

Full disclosure: long SSO, long SPY call options, long CAT put spread, long FB calls, long FDX calendar call spread, long NFLX put, long QQQ put spread, long TLT calls, long USO calls, long GLD shares and calendar call spread

*Charting notes: FreeStockCharts.com stock prices are not adjusted for dividends. TradingView.com charts for currencies use Tokyo time as the start of the forex trading day. FreeStockCharts.com currency charts are based on Eastern U.S. time to define the trading day.

Well, so much for buying ‘hand over fist’, hmmm? He might be OK in the long run, but we won’t know that for several years.

As you no doubt know, the VIX hit 30 intraday today. This is starting to remind me of markets of yesteryear, where T2108 went painfully to single digits and most people threw in the towel, only to see the market subsequently rally. That happened pretty consistently.

Is this time going to be….. different??

The two most dangerous predictions: 1) This time is different, 2) This time looks the same as last time. 😉

I did see the spike to 30 and that was my signal to do some nibbling. I don’t have time to write tonight about the market, but I will note here that I bought some UVXY puts and nibbled on some SPLK and bought more WMT call options. The only reason I did not buy SPY calls is that I already own SSO shares so I am content to wait for the whites of the eyes of the buyers before that kind of move.