Autozone: When A Downgrade Becomes A Buy Signal

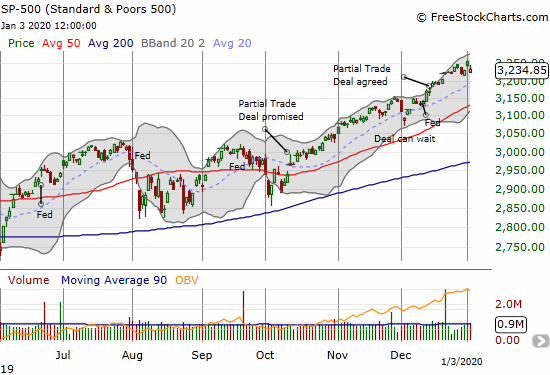

Suddenly, the persistent selling in Autozone (AZO) despite the stock market’s rally makes sense. I just finished marveling at the way sellers took over in AZO after the stock experienced an impressive 6.9% post-earnings gain to a fresh all-time high. A downgrade from Wedbush suddenly put the selling in perspective. Now the chart looks like … Read more