Stock Market Almost Overbought After Sweeping Away Bearish Signals – Above the 40 (February 5, 2020)

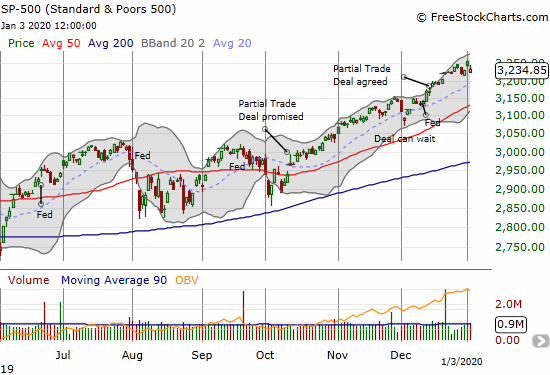

Stock Market Commentary Sellers beat a hasty retreat from the stock market as another bearish signal enjoyed a fleeting existence. The last bearish period lasted about three days. The previous bearish period barely survived a day. The stock market’s ability to quickly wipe away bearish signals is impressive. The buying force over the last week … Read more