Stock Market Statistics

AT40 = 43.8% of stocks are trading above their respective 40-day moving averages (DMAs) (hit a 2 1/2 – month low the previous day at 34.9%)

AT200 = 26.0% of stocks are trading above their respective 200DMAs

VIX = 27.3

Short-term Trading Call: neutral

Stock Market Commentary

A strange and two-speed market got even more strange and more divergent last week.

AT40 (T2108), the percentage of stocks trading above their respective 40-day moving averages (DMAs), hit a 2 1/2 month low of 34.9% on Thursday even as the NASDAQ (COMPQX) hit another all-time high. The S&P 500 (SPY) lost 0.6% but rebounded sharply off its intraday low to remain within a tight trading range for the week. AT40 plunged from 60.2% to 45.9% on Tuesday when the S&P 500 lost 1.1% and the NASDAQ lost 0.9%. Those were lows for the week for both indices while AT40 made its low 2 days later. AT40 delivered a distinct bearish divergence at a level where I typically start salivating over a shopping list of stocks.

I am accustomed to acting on bearish divergences at much higher levels for AT40, so this trading moment is truly confounding. The stock market is very narrow: most of the gains are going to a very select group of stocks. AT200 (T2107), the percentage of stocks trading above their respective 200DMAs, even sits at a lowly 26.0%. The gains in the stock market are failing to improve the technical position of a large majority of stocks. The widening divergence between the NASDAQ and the S&P 500 is a headline example of this imbalance.

The Stock Market Indices

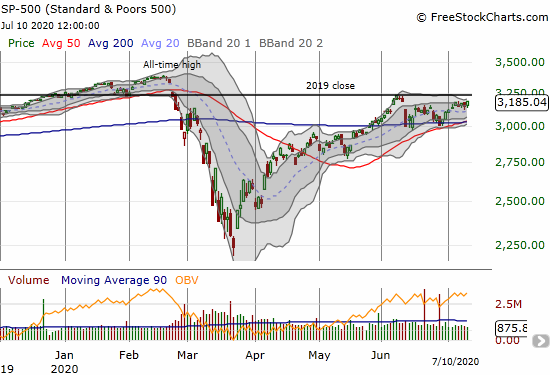

The S&P 500 (SPY) remains on edge. The week’s tight trading range stopped the index just short of officially closing the gap down from June 11th. This churning is a big tease below the big dividing line formed by the 2019 closing price.

The dictionary has run out of superlatives for the NASDAQ (COMPQX). The tech-laden index easily prints new all-time highs led by a few mega-cap stocks. Tech stocks have had such an easy time that the latest talk is about what stock will hit the TWO TRILLION market cap level first!

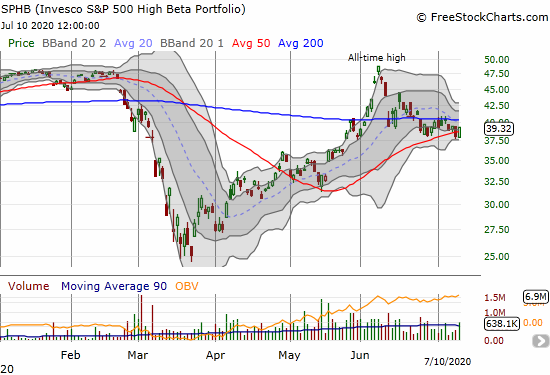

To make the bearish divergence even more strange, the high beta stocks in the S&P 500 are leading the way downward for the index. In other words, investors are not as interested in high-risk stocks as a surging NASDAQ might imply. The Invesco S&P 500 High Beta Portfolio (SPHB) topped out on June 8th at an all-time high. Last week SPHB finally cracked 50DMA support. SPHB might be the first index I buy on a breakout and/or during oversold trading conditions.

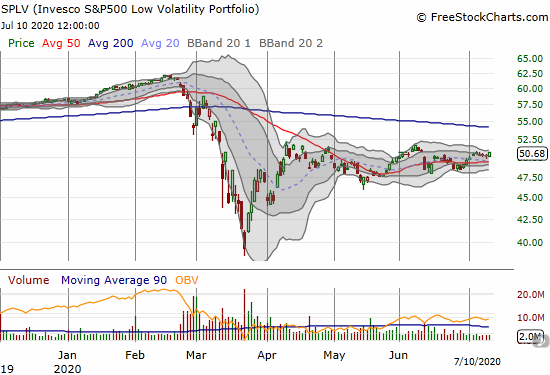

The Invesco SP500 Low Volatility Portfolio (SPLV) is helping to stabilize the S&P 500 by gently bouncing around for 4 months. SPLV is an eye-catching picture of contentment in a divergent stock market.

Volatility

The volatility index (VIX) looked like it was forming a base to launch much higher. On Friday, the VIX gapped to a high for the week only to attract the attention of the volatility faders. The VIX ended Friday with a 6.7% loss. It still managed to close at recent support.

The Short-Term Trading Call

Per my introductory commentary, I am staying neutral on the stock market. I do not see a point in flipping bearish with AT40 so low, the S&P 500 trading comfortably in a range, and the NASDAQ riding unrelenting upward momentum. The next sell-off in the stock market should send AT40 right into oversold trading conditions (below 20%).

A big caveat resides with the S&P 500. If the index breaks out above its trading range (over 3230), I will conclude last week’s dip in AT40 was “close enough” to oversold – meaning close enough to launch the next phase of buying in the stock market. Laggard stocks will be prime candidates for buys in a breakout case. Currently strong stocks in the stock market will be strong buys during oversold trading.

Stock Chart Reviews: A Video Summary

Stock Chart Reviews – Below the 50DMA

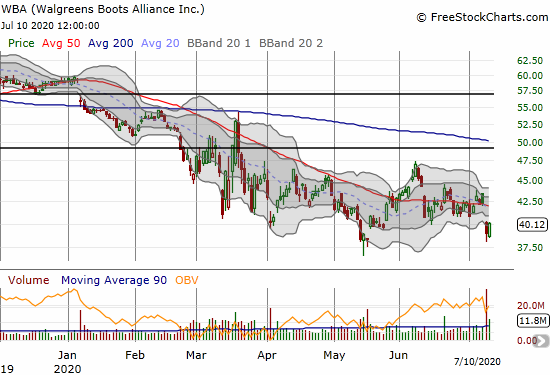

Walgreens Boots Alliance (WBA)

Drug store Walgreens Boots Alliance (WBA) continued its struggles with a post-earnings 7.8% loss that took the stock down toward 7 1/2 year lows. A 2.9% bounce on Friday granted WBA a “stay of execution” that delays a major breakdown for another day.

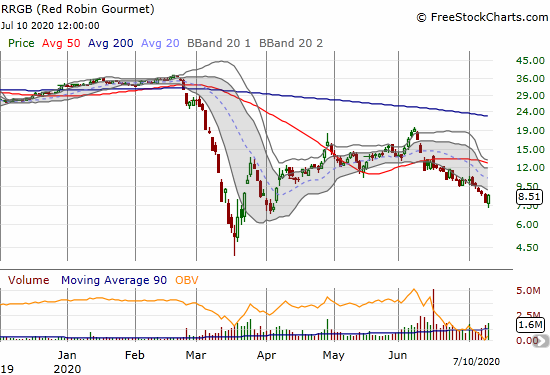

Red Robin Gourmet (RRGB)

On Thursday, I saw a briefing.com alert flagging a surge in trading volume in August $7.50 put options in burger restaurant Red Robin Gourmet (RRGB). Expiration is on the day of earnings. I joined the fray by selling two put options around $1.05. I am betting that RRGB will close above $7.50 post-earnings, but I also like making an implicit purchase of the stock around $6.50/share. I am still holding out expectations that RRGB will eventually survive the economic crush of the pandemic.

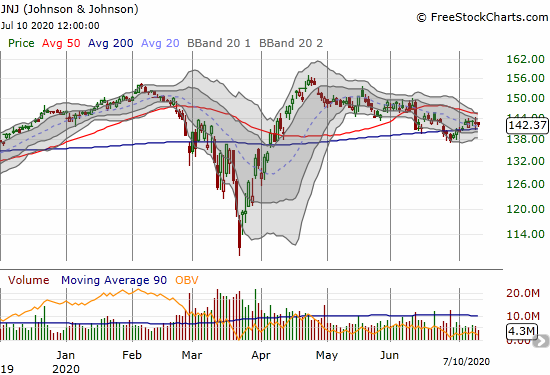

Johnson & Johnson (JNJ)

I was surprised to see healthcare product company Johnson & Johnson (JNJ) suffering a slow bleed since hitting a post-crash high in April. Even with earnings coming this week, I like buying JNJ here. I will likely start with speculative call options and decide on further moves post-earnings.

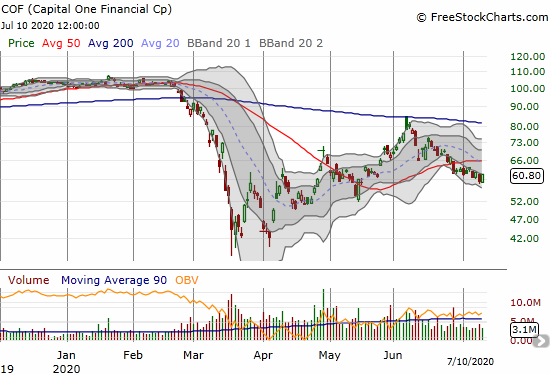

Capital One Financial (COF)

Capital One Financial is following the weakness in financials. The downtrend since failing at 200DMA resistance is remarkably steady and consistent. The stock is a short until it can recover 50DMA as support.

Beyond Meat (BYND)

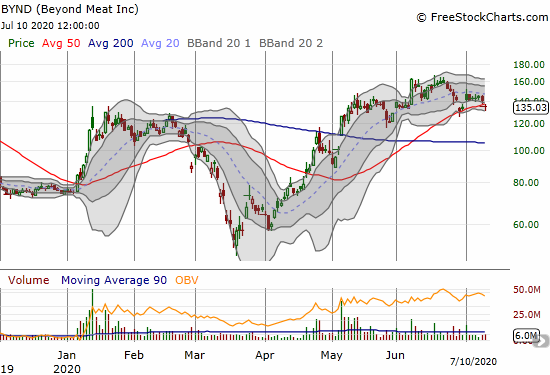

Plant-based food products company Beyond Meat (BYND) has caused a lot excitement with every headline about a new market or new product placement. The trading action has recently wavered.

First BYND lacked follow-through on its June 8th news about a partnership with Chinese food distributor Sinodis. The stock market finished reversing that move with a 7.3% gap down on June 29th. On that day, McDonalds (MCD) announced an end to its trial in Canada. Given how big the news was when MCD started the trial, I am surprised BYND did not trade a lot lower. Two days later BYND recovered all its MCD-related loss with news of placement in Chinese Alibaba grocery stores. Friday’s 4.4% gap down on a downgrade nearly reversed THOSE gains. This trading action looks everything like the beginning stages of exhaustion: the stock cannot follow-through on gains. BYND is a clean 50DMA breakdown away from going into my bearish column.

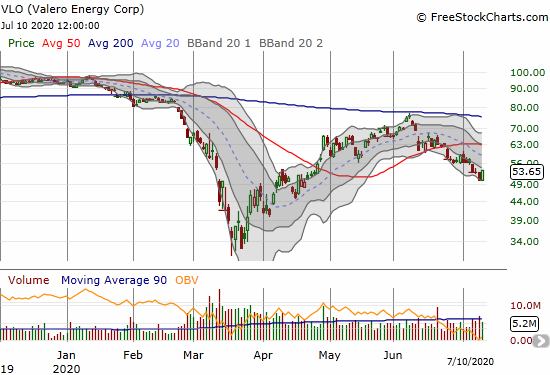

Valero Energy (VLO)

Valero Energy (VLO) was a key trade for me coming off the March lows even though I did not stick with the trades long enough. Like so many stocks in this two-speed, bearish divergent market, VLO has been sinking in a downtrend since a June failure at 200DMA resistance. A new entry point beckons around $44 where an April dip was well-supported by an uptrending 20DMA.

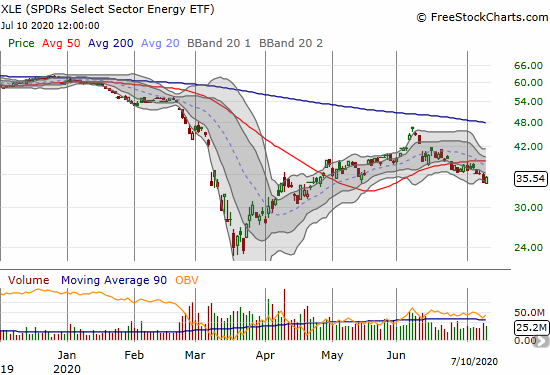

SPDRs Select Sector Energy (XLE)

Yet another stock or index that peaked in early June either at or just short of 200DMA resistance. The SPDRs Select Sector Energy (XLE) is on a one-month downtrend that includes a bearish 50DMA breakdown.

Stock Chart Reviews – Above the 50DMA

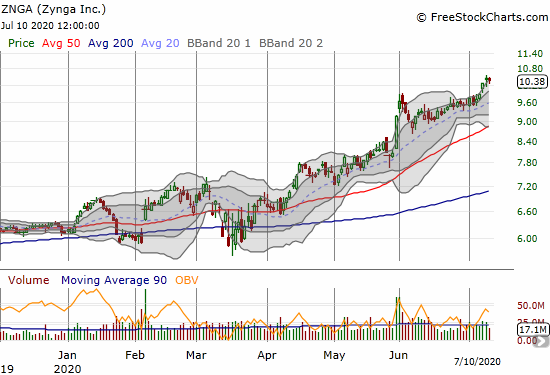

Zynga (ZNGA)

Zynga (ZNGA) is suddenly fashionable again. I left the stock for dead soon after the promise of the Facebook (FB) IPO failed to materialize for ZNGA. The stock went into a 4-month freefall starting in the Spring of 2012. ZNGA made a new marginal all-time low in February, 2016. A friend recently woke me up to ZNGA’s resurgence. I bought into the shallow dip in June. I thought I might have an opportunity to grow the position at lower prices. Instead, ZNGA has yet to look back. (I have played Word with Friends for over 8 years now. You can challenge me at screen name “@DrDuru”).

Upwork (UPWK)

Upwork (UPWK) was a breakout special two months ago. UPWK is finally fulfilling its potential in the last month with clear follow-through. On Thursday, traders were snapping up August 20 calls. I hopped aboard and plan to buy more shares into the current dip. Note that insiders bought up a lot of stock during the market crash and even more in May. The company is doing a lot of growth-related hiring. “Something” is up here…

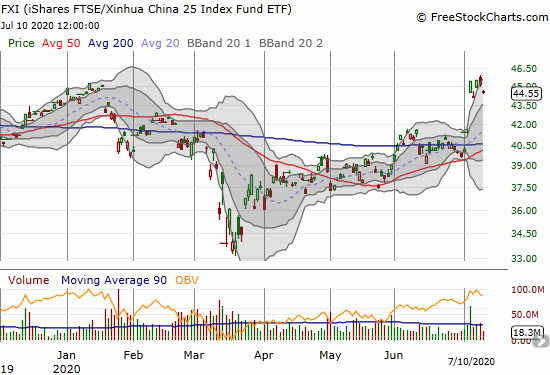

iShares FTSE Xinhua China (FXI)

I was caught completely flat-footed when iShares FTSE Xinhua China (FXI) opened the week gapping up to a 9.5% gain. My decision to avoid Chinese stocks starting late May has caused me to miss several key opportunities. I dipped a toe back in by buying Baidu (BIDU) call options when the stock fell 3.8% following its 7.8% gain on Monday. I took profits two days later. China is back in play for me (no shares though!)

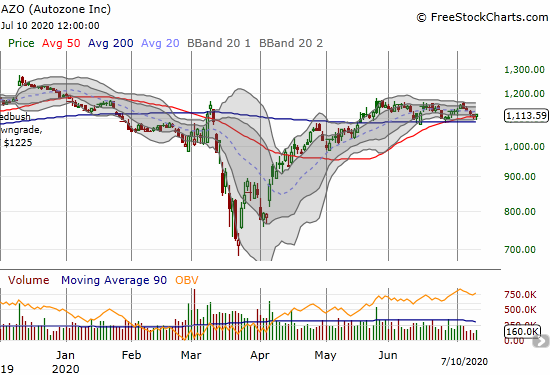

Autozone (AZO)

Autozone (AZO) has run out of gas since its 200DMA breakout in May. The recent convergence of the 50 and 200DMAs are hopefully providing support for a strong breakout from this extended period of consolidation.

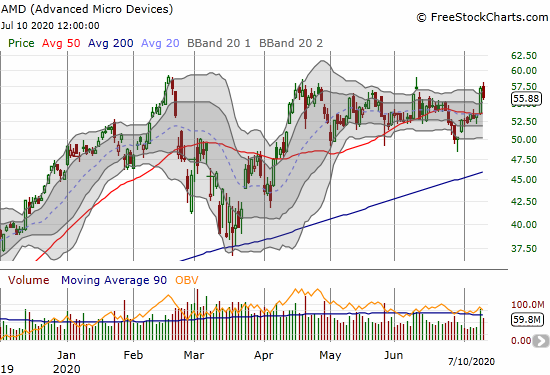

Advanced Micro Devices (AMD)

I was all set to buy Advanced Micro Devices (AMD) on Thursday. The stock soared 7.2% before I could blink. Now I await Friday’s pullback to extend just a little bit further…

Stock Chart Spotlight – Bullish Breakout

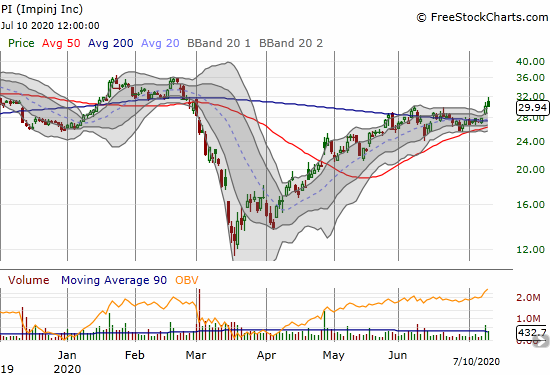

Impinj (PI)

In a market that feeds off momentum in a few select stocks, the 200DMA breakout play has become my favorite.

Internet-of-things (IOT) tech company Impinj (PI) pivoted around its 200DMA for a month before an 8.1% breakout on Thursday. While a sharp fade on Thursday prevented a clean confirmation, PI is on my list for a buy. The stock formed what looks like a solid base at the 200DMA with extra underlying support at the 50DMA.

— – —

FOLLOW Dr. Duru’s commentary on financial markets via email, StockTwits, Twitter, and even Instagram!

“Above the 40” uses the percentage of stocks trading above their respective 40-day moving averages (DMAs) to assess the technical health of the stock market and to identify extremes in market sentiment that are likely to reverse. Abbreviated as AT40, Above the 40 is an alternative label for “T2108” which was created by Worden. Learn more about T2108 on my T2108 Resource Page. AT200, or T2107, measures the percentage of stocks trading above their respective 200DMAs.

Active AT40 (T2108) periods: Day #62 over 20%, Day #56 over 30%, Day #1 over 40%, Day #4 under 50% (underperiod), Day #12 under 60%, Day #15 under 70%

Daily AT40 (T2108)

Black line: AT40 (T2108) (% measured on the right)

Red line: Overbought threshold (70%); Blue line: Oversold threshold (20%)

Weekly AT40 (T2108)

*All charts created using FreeStockCharts unless otherwise stated

The T2108 charts above are my LATEST updates independent of the date of this given AT40 post. For my latest AT40 post click here.

Be careful out there!

Full disclosure: long AAPL call calendar spread; long UPWK shares, short covered call, long calls; long UVXY, short RRGB puts, long ZNGA, long AZO

*Charting notes: FreeStockCharts stock prices are not adjusted for dividends. TradingView.com charts for currencies use Tokyo time as the start of the forex trading day. FreeStockCharts currency charts are based on Eastern U.S. time to define the trading day.