Bring the Pain – The Market Breadth

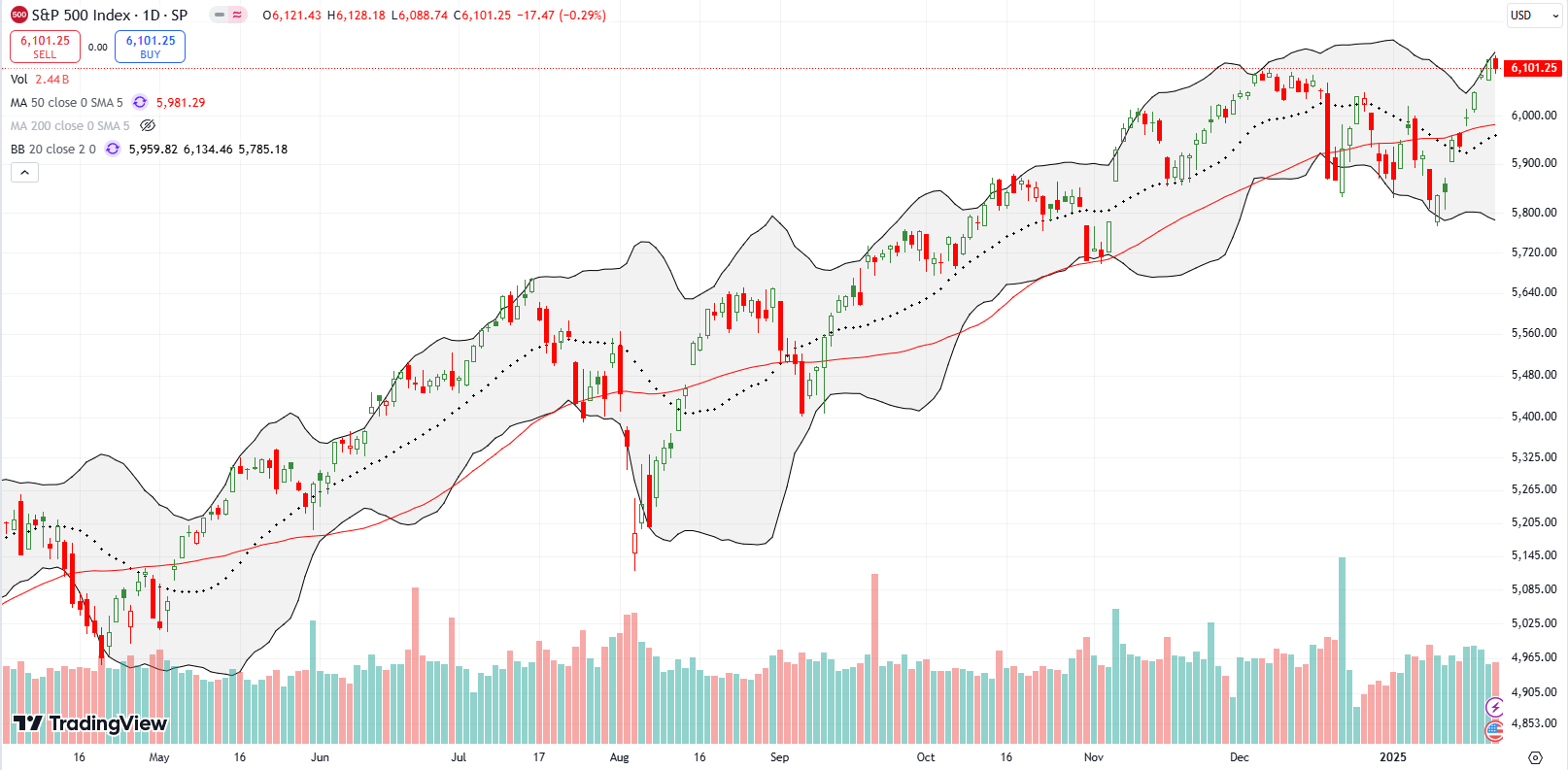

Stock Market Commentary The current administration’s policy of long-term growth through short-term pain in the form of austerity came into clear focus last week. I earlier introduced this concept in “Growth Scare or Overreaction – An Oversold Market or Something Worse?“. Last week, U.S. Treasury Secretary Scott Bessent laid out the strategy in detailed economic … Read more