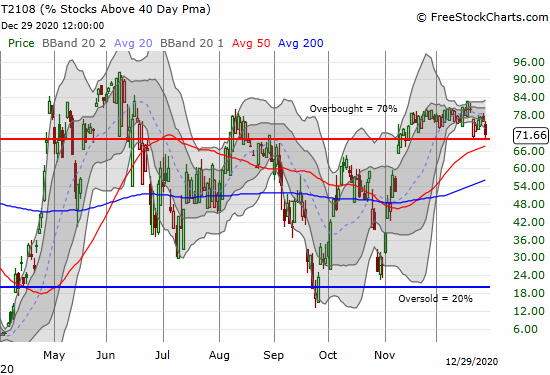

Sellers Weaken the Stock Market’s Hold On Overbought Conditions – Above the 40 (December 29, 2020)

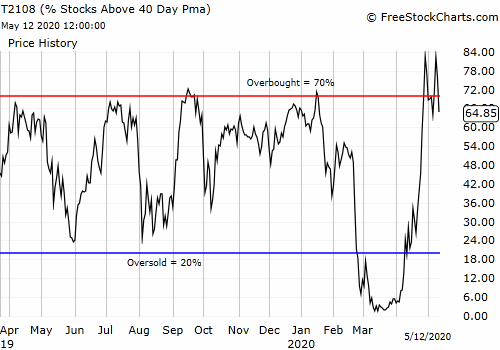

Stock Market Commentary The refresher for extended overbought conditions quickly transformed back into a close call. Sellers again created weakening overbought conditions for the stock market with the key indicator hitting the threshold. The minor selling in the major indices may mask a broader deterioration in the technical health of the stock market. Unlike the … Read more