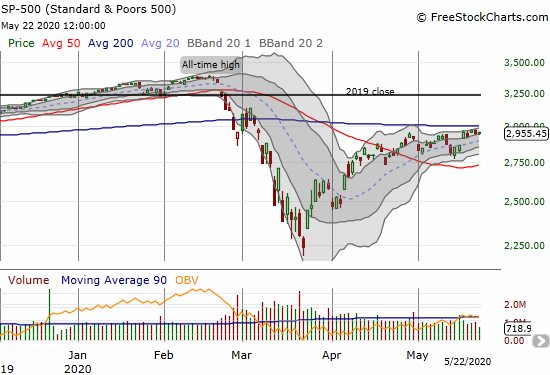

The stock market crash in March was stomach-churning and generated a lot of panic. At its lowest point, the S&P 500 (SPY) was down 33.9% from its all-time high set just the previous month. The rebound from that stock market sell-off has been heroic with a 32.1% gain taking the index within another 14.6% rally of its all-time high. With the S&P 500 churning below its 200-day moving (DMA) investors and traders face major decisions. For those who were disciplined and bought cheap stocks during the market crash, there are even gains to protect.

If an investor missed the bearish signals ahead of the market crash, then there might be even more anxiety about portfolio protection. Regardless of the current position, this period of relative market calm is the perfect time to rethink investing and trading strategies. I have created a list of potential options for protecting portfolios (note I am not taking into consideration tax implications). Each person should customize these options to fit their particular situation; customization may include cobbling together parts of these suggestions. Like life, there are no guarantees among these options, but I tried to configure options with good risk/reward balances. These options cannot fit every situation and goal, so feel free to use the comment section to start a discussion.

Financial Advisor

Investors who already have a financial advisor should talk to that professional about their fears. Have an honest discussion about goals and objectives. Do not simply accept the conventional mantra of buy and hold investing. Paying attention to basic signals in the market can provide greater portfolio protection. Presumably advisors refused to sell clients into a panic and, even better, encouraged purchases during the panic. The advisor should provide parameters for taking profits on new purchases to fund a good night’s sleep. This fresh cash could also fuel purchases during the next market sell-off.

Mutual Fund Investor

This is a good time to review the diversification of mutual fund portfolios.

Compare overall performance to that of the S&P 500. If a portfolio of funds lost more than the S&P 500 on the way down and gained less on the way up, then rebalance that portfolio. Such a portfolio is likely overly weighted in the worst sectors of the economy like travel, entertainment, energy, and financials. Rebalance toward technology funds; power up for the new digital economy.

If a portfolio lost less on the way down and gained more on the way up, the position should be solid. If bond funds were a big contributor to the out-performance, consider selling those bond funds (they are very “expensive” now!) to build up cash.

Individual Stocks: Bought the Dip

If an investor was disciplined enough to look for bargains while the stock market was oversold, then there are gains to protect. The action plan for these stocks can be created on a case-by-case basis. The options below assume exclude the most straightforward option: take profits now.

Breakout stocks

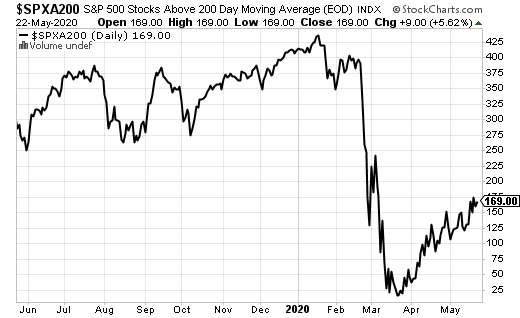

Breakout stocks are trading above their 200-day moving averages (DMAs). These stocks are in very bullish positions and hard to find. For example, only 169 of the 500 stocks in the S&P 500 are currently trading above their respective 200DMAs.

Source: StockCharts.com

Breakout stocks should be held in spite of fears of losing profits. Take profits if the stock closes below its 200DMA and confirms that breakdown with a second lower close.

Chipotle Mexican Grill (CMG) is a great example of a breakout stock. Selling after February’s close below the 200DMA would have freed up cash for buying March’s dip. On April 17th, CMG broke out above its 200DMA but closed below the 200DMA two days later. Fortunately, CMG did not suffer a second lower close and bullish investors could keep holding. Even better, CMG gapped up the next day on earnings and quickly (re)confirmed its 200DMA breakout. The stock has yet to look back.

CMG demonstrates why it is important to let your winners run. The stock is at all-time highs, and there is no telling how much higher it can still go before next topping out. Note that as CMG trades further and further above its 200DMA, prudent investors and traders should start considering taking at least partial profits.

Readers interested in scanning for stocks experiencing 200DMA breakouts should check out the automated lists from swingtradebot.com.

Range-bound Stocks

Range-bound stocks are trading below their 200DMAs like the majority of the stock market. Time is ticking on these stocks to make their move for a 200DMA breakout. Fortunately, investors can get paid to wait and even get some cushion against the downside risks that loom larger the longer the S&P 500 thrashes below its own 200DMA. Investors can sell a call option against their stock holdings. Investors can sell one call option for every one hundred shares of stock. This creates a short position in the call that is completely covered by the stock. The seller collects premium in the form of the value of the option. The only risk from the option is the potential for the stock to close above the strike price of the option before expiration. In such an event, the short call gets assigned and the stock called away.

Advance Auto Parts (AAP) is one example where an investor should consider selling call options. Advance Auto Parts reported earnings last week. The subsequent rally failed to punch AAP through resistance from its 200DMA. The stock may be setting up for extended trading between its 50 and 200DMAs. The preferred duration and strike price of the call will depend on goals and expectations. For example, looking out 4 months, I think $150 is an optimistic upside scenario, including another round of earnings. The September $150 call option currently sells for about $7.00 which gives the seller a $700 premium. That $7 means I do not need to consider selling the stock and locking in remaining profits until AAP hits around $126. To the upside, I would be very happy to gain another 13% on the stock in 4 months AND keep the $700 premium as a bonus.

Uptrending Stocks

Up-trending stocks are the best stocks to own. Price momentum is working in favor of the buyer and, most likely, the underlying company is enjoying strong fundamentals or at least a strong market narrative. Even wary investors should strive to just hold these stocks. Selling call options on an uptrending stock will unnecessarily cap gains. Instead, investors should hold until the uptrend breaks down. At that point either 1) sell if the fundamental story is also breaking down, or 2) sell a covered call to cover the time period over which you think the stock will go trendless before resuming its upward trajectory. In case #2, investors should also sell the stock if it confirms a 200DMA breakdown.

The stock of Chipotle Mexican Grill is an example of an up-trending stock. The uptrend for CMG is intact as long as the 20-day moving average is rising. A breakdown below the 20DMA creates the decision point.

Put Options

Put options are another protection option. However, this method is very expensive. For example, the September $120 put option on Advance Auto Parts could cost as much as $9. An investor could lose all that premium AND the 11% in the value of the stock if AAP closes around $120 by expiration. An investor can reduce the price of the protection with a put spread by selling a lower strike put option. Such a move also caps the downside protection at the maximum value of the put spread. For example, a September $120/$100 put spread costs about $6 and provides just $14 of maximum downside price protection.

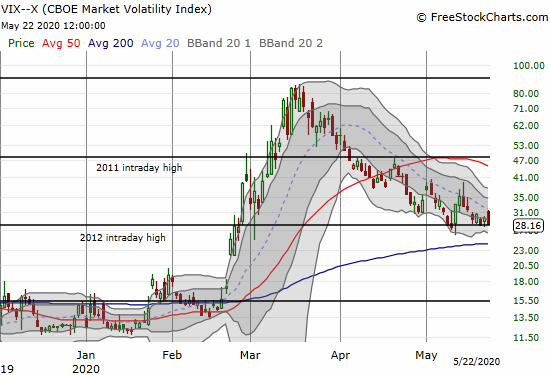

Options are generally expensive because volatility remains elevated. The volatility index, the VIX, is a measure of the market’s expectation for price moves in the next 3 months for the S&P 500. The VIX is considered “elevated” above 20. The VIX currently trades at 28.2. When the VIX drops below 20, investors should start to favor buying put options over selling call options as a portfolio protection tool.

Source for stock charts: FreeStockCharts

Individual Stocks: Back to Even

Investors probably wring their hands most over stocks where the position is finally back to even. Investors had to bite their lips, wipe away streams of sweat, and grind teeth in the middle of prayers for a comeback. Investors can apply the same rules from above for these stocks. The main difference here is investor psychology that will keep a person stuck looking backward. All that emotional pain is a sunk cost: the price is paid and no refund awaits. The stock is not obligated to reward that investment in emotional turmoil. Estimate the potential upside over a period of time, draw a line in the sand at a lower price level (replacing the use of the 200DMA as a line of support), and apply the rules above.

Accepting Loss

No matter what combination of protection options investors choose, loss is an ever-present risk – whether it is a downside loss or lost upside opportunity. Hopefully, investors who have made it this far have also achieved the healthy mental state that allows for accepting the reality of loss.

Selling a covered call caps upside potential for the duration of the call. An investor must be mentally prepared to let go of the stock at the strike price of the call. Be happy and grateful that the market delivered the upside gains in the form of the stock and perhaps the premium from the option. Use the cash for the next opportunity.

The downside risk for a stock is always present whether an investor recognizes the risks or not. None of the protection options above prevent a stock from losing value. So an investor must always know their individual risk tolerance and stop out of losses in accordance with that risk tolerance. However, never, never, ever sell into a panic. Did I say never? Yes, NEVER. Panic is not an investing or trading strategy. For more information on trading and investing through the extremes of the stock market see my “Above the 40” series.

Be careful out there!

Full disclosure: long SSO

Great article. Thank you.

Thanks for reading!