Stock Chart Reviews – Bear Market Green Shoots

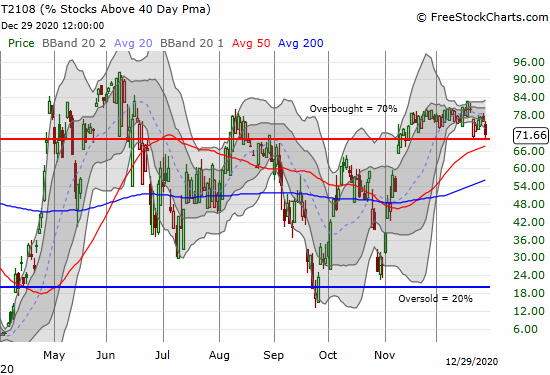

Stock Market Commentary: The stock market is delivering fertile ground for bear market green shoots. Market breadth in the form of AT50 (MMFI), the percentage of stocks trading above their respective 50-day moving averages (DMAs), closed at a one month high. Under the hood are individual stocks achieving convincing 50DMA breakouts and closing out primary … Read more