A Bear Market Ends – The Market Breadth

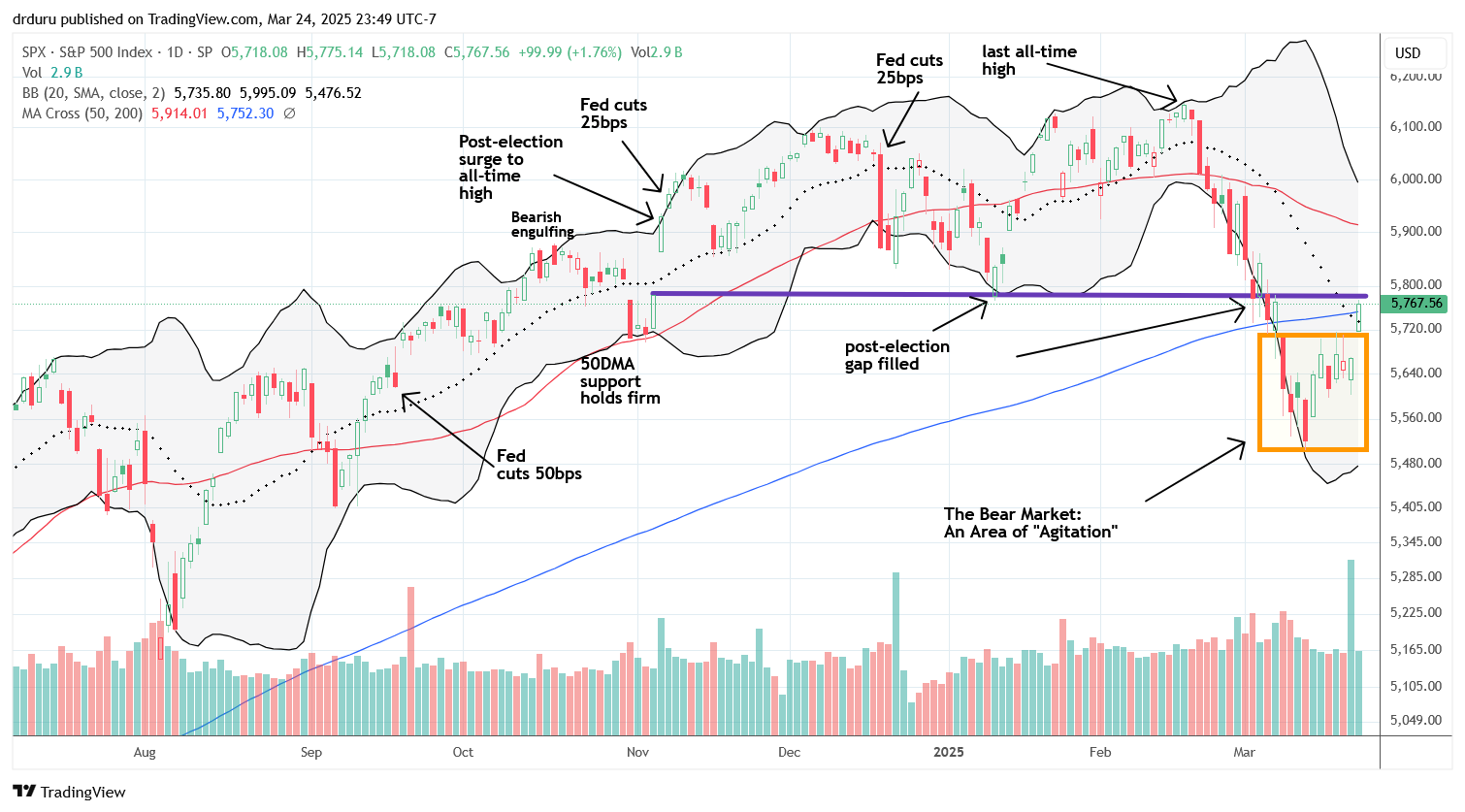

Stock Market Commentary And so a bear market ends, for the S&P 500 at least. The stock market enjoyed a strong follow-through day supported by previous oversold conditions. To represent the most recent technical developments, I created a well-defined area for the bear market called the “area of agitation”. The S&P 500’s breakout above this … Read more