Stock Market Commentary:

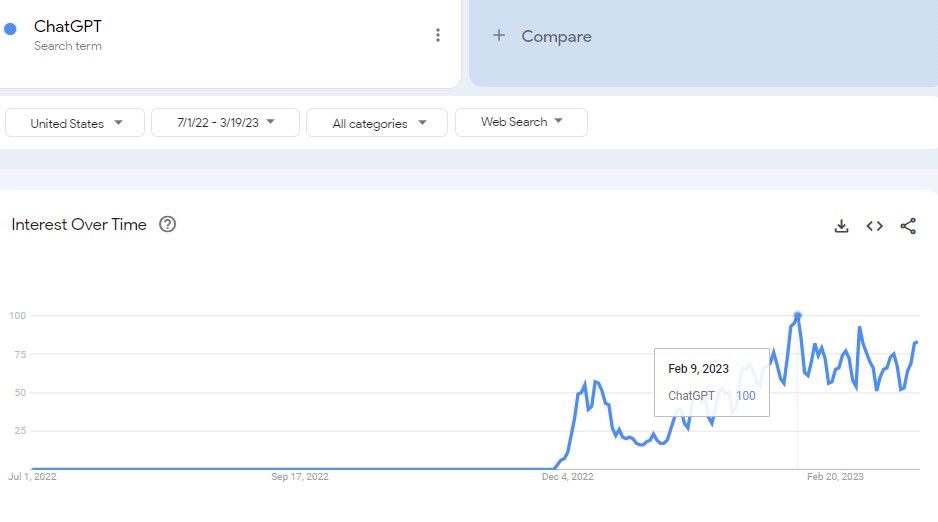

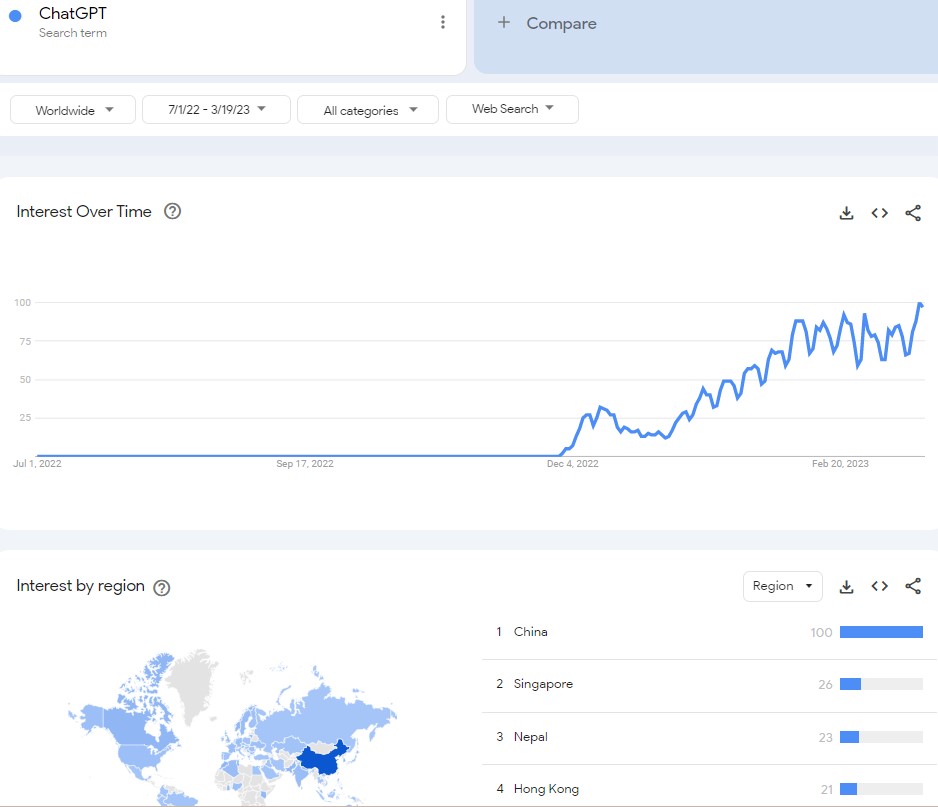

The trade on Generative AI took a surprising turn last week as investors and traders rushed to related names as if they offered safety from the banking Panic of 2023. Some stocks shot straight up for the week. The renewed interest surprised me because I just happened to write about this trade right at what looked like peak hype in the U.S. Google search trends for “ChatGPT” hit a peak over a month ago. Interestingly, the worldwide hype cycle continues to hit new highs. (It is possible that China’s restrictions on access to ChatGPT has pushed people in the country to Google (via VPN?) to find creative ways to gain access).

Perhaps a chorus of skeptics in the U.S. is working magic on dousing the ChatGPT enthusiasm among the masses. An accelerated news cycle that brought ChatGPT to mass attention is also quickly pointing out flaws and dangers. Yet, the stock market is telling a different story as astute investors and traders see immense future potential. The latest lap on the generative AI trade launched related stocks nearly straight up last week!

The Generative AI Revival

While skeptics stew, Alphabet Inc and Microsoft have busily spun out announcements about new and exciting product offerings. This news offered a handy respite from screaming headlines about regional bank failures.

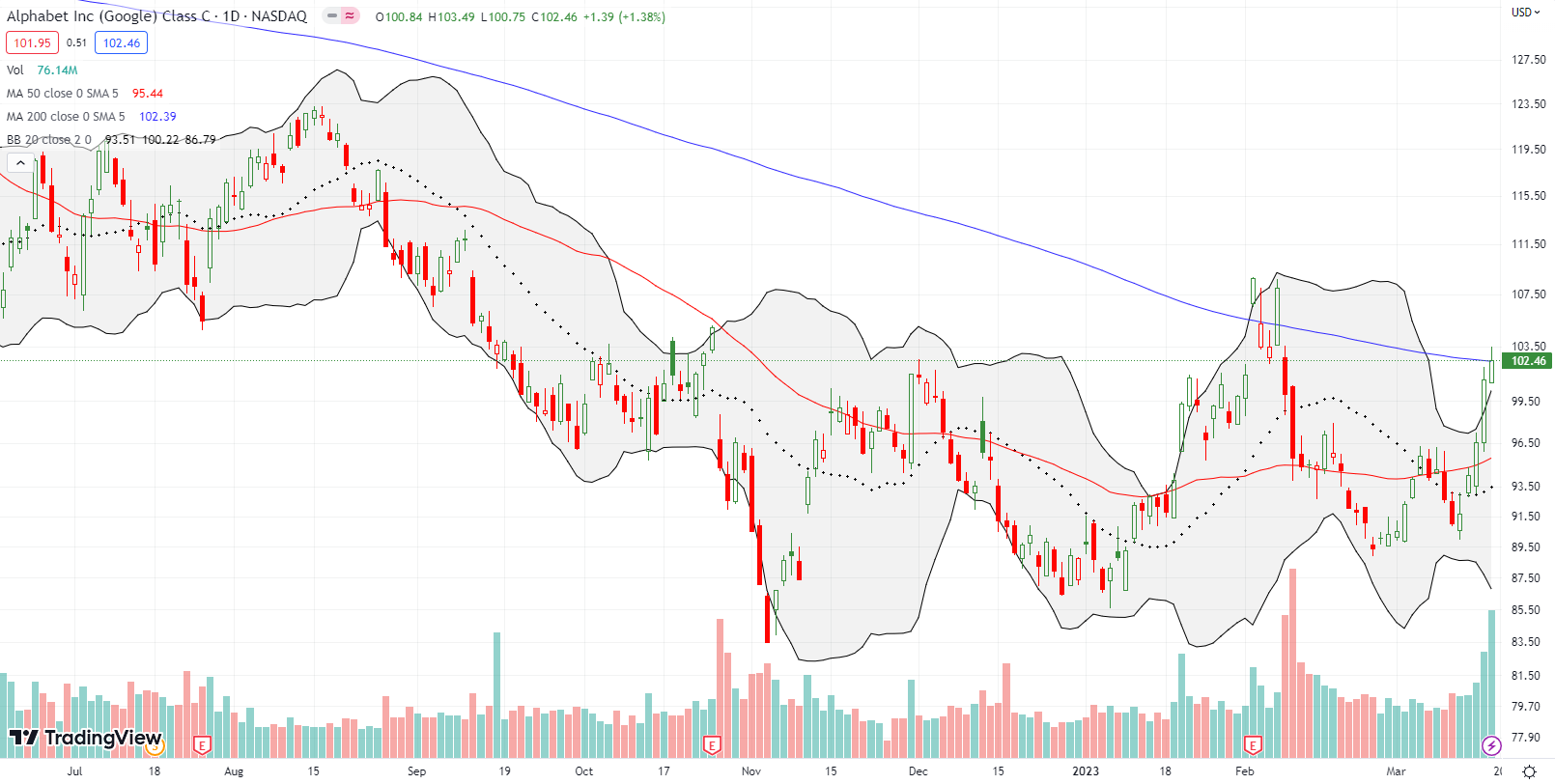

When I started the generative AI trade, I claimed the sell-off in Alphabet Inc (GOOG) was overdone. GOOG sold off another two weeks before bottoming. Last week, GOOG finally came alive with an eye-popping 12.6% gain. The buyers seemed determined to tap resistance at the 200-day moving average (DMA) (the bluish line). My call spread is now in the green. However, I fully expect a pullback from resistance given GOOG looks stretched with two straight closes above the upper Bollinger Band (BB).

While generative AI on search gets a lot of attention, Google’s more exciting offering is generative AI on Google Cloud. This technology enables companies to build generative AI into their websites and products. Google is hosting a Data Cloud and AI Summit on March 29th which could provide a fresh catalyst for the stock in the days going into or even after the event. It is possible a related news release on March 14th helped spark the run for in GOOG last week.

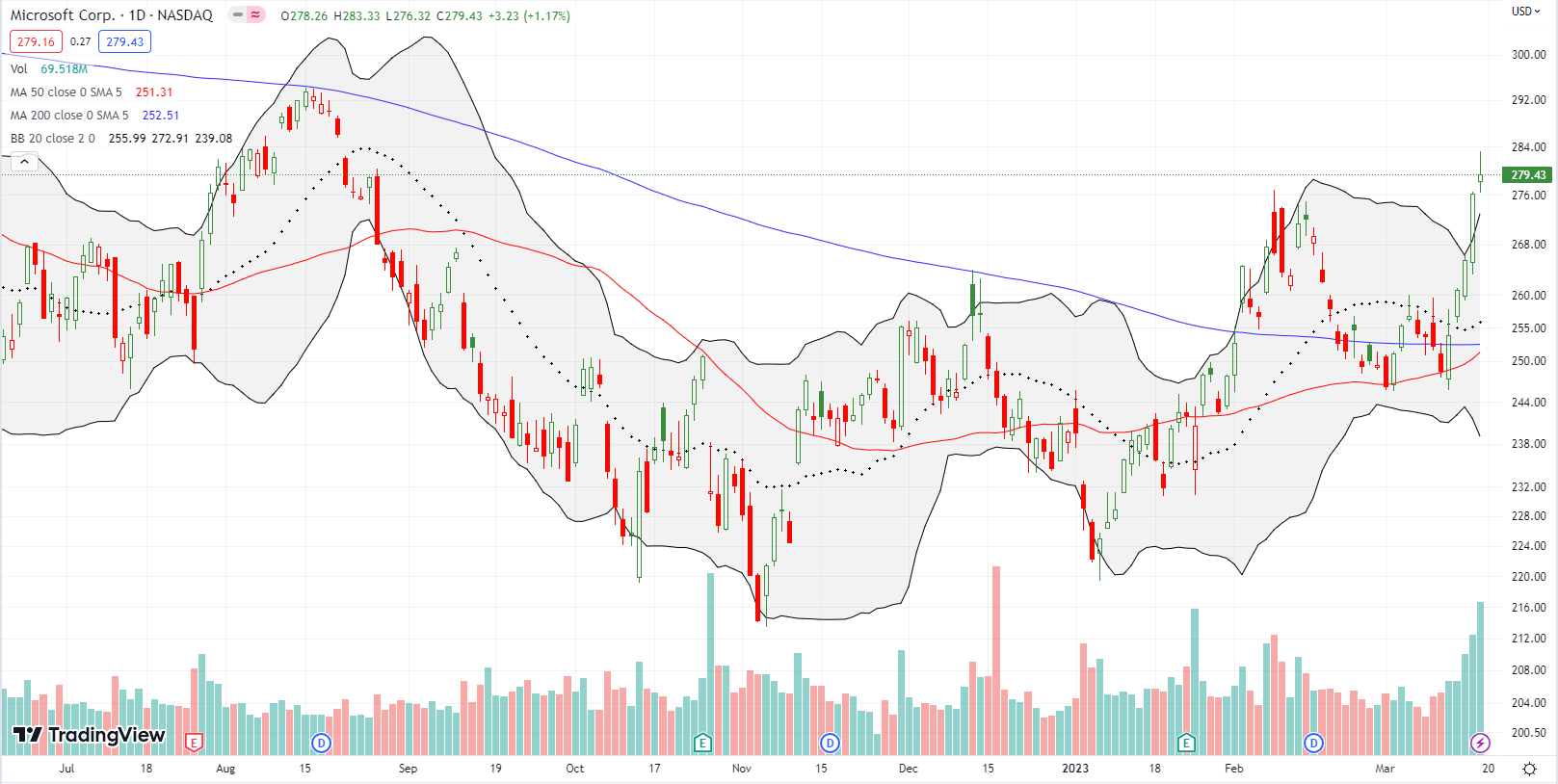

Microsoft (MSFT) marched higher right alongside GOOG with a 12.4% gain for the week. Unlike GOOG, MSFT burst through resistance. The stock zipped by the February high and closed at a 7-month high. My call spread is now well in the green. However, I fully expect a pullback from over-stretched conditions after two straight closes well above the upper-BB.

Scott Guthrie, EVP, Cloud & AI, spoke on March 7th at the Morgan Stanley TMT Conference. Guthrie talked about an “AI super computer” in Microsoft’s Azure cloud, a direct competitor of course to Google’s cloud AI offering.

“…what we’ve built with our Azure OpenAI service, as an example, is the ability for organizations or internal teams to kind of provide fine-tunings on the model specific for a use case to make it even better. And that promise of being able to leverage the large language models, which is trained in the public web, and then that ability for, say, a Morgan Stanley or another customer to be able to take proprietary data and tune it even further and know that that model is only going to be used by you, not by us, it’s not going to benefit anyone else, and you’re going to control access, you’re going to have the business model around it, is what I think enterprise customers in particular are looking for and all of the SaaS ISVs and startups that are going to serve those customers are going to need.”

On March 6th, Microsoft announced Dynamics 365 Copilot which puts the power of generative AI in the hands of sales (CRM) and marketers. Last week, Microsoft announced Power Platform Copilot which helps developers use natural language to build low code apps. And, of course, Microsoft also announced Office 365 Copilot which infuses generative AI features in Office 365 applications. Suddenly, paying for Office 365 became more attractive. So will Google do the same for Google Drive…but for free?

Behind Every Good AI Is A Strong Microprocessor

The software news from Alphabet and Google is made possible by powerful computers driven by strong microprocessors.

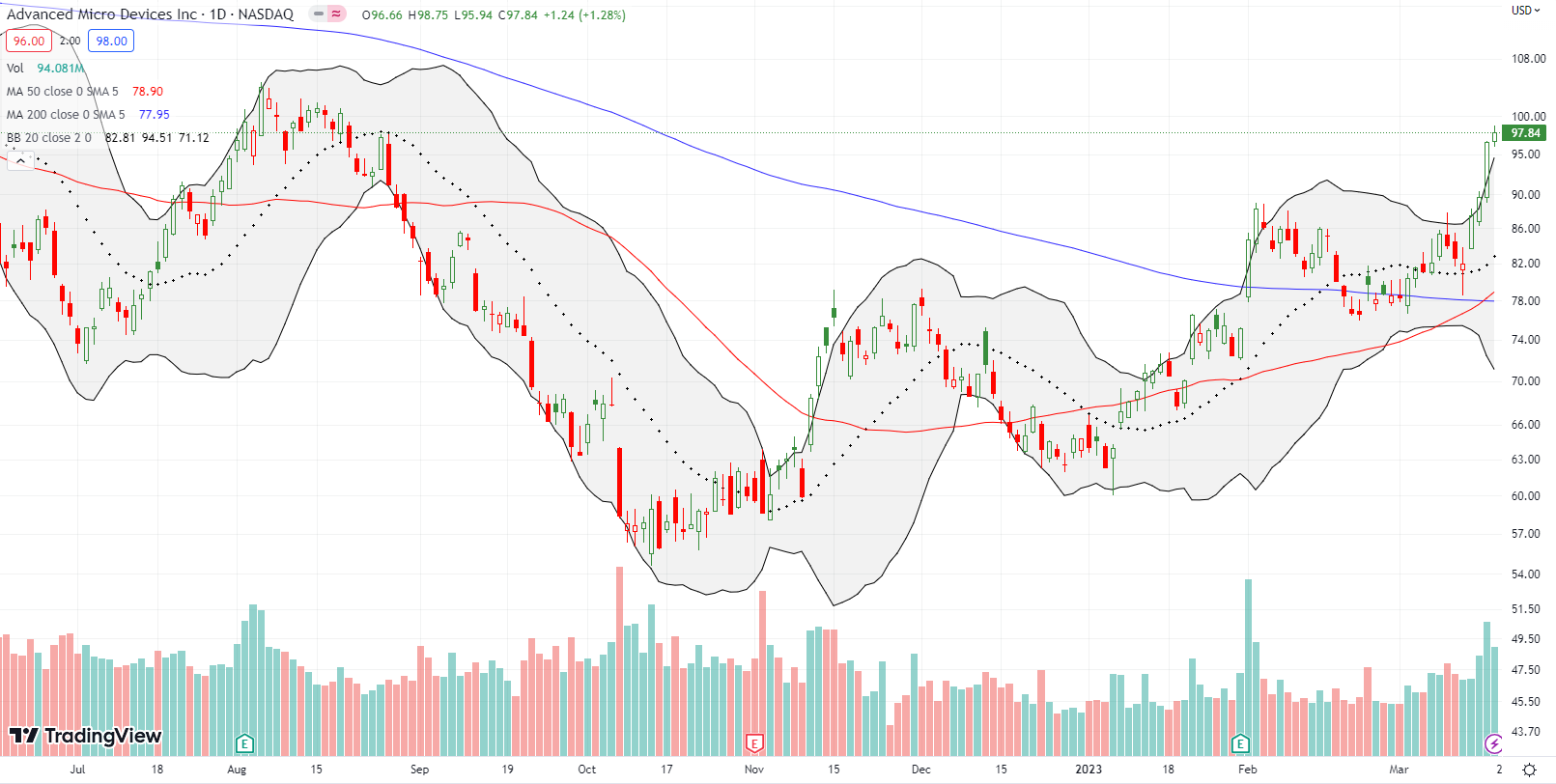

Nvidia (NVDA) is the well-known semiconductor play on Generative AI. NVDA is up 76% year-to-date. In January, TechTarget reported on new chips from Advanced Micro Devices (AMD) that are positioned to compete with NVDA. AMD launched into 2023 with a strong rally that paused in February and resumed this month. The stock gained 18.4% last week as a part of a rush away from finance stocks and into (AI-related) tech. AMD closed the week at a 7-month high and is up 51.1% year-to-date.

I am long AMD as a long-term investment. On the next dip, I may create a generative AI options trade around my core shares (stay tuned!).

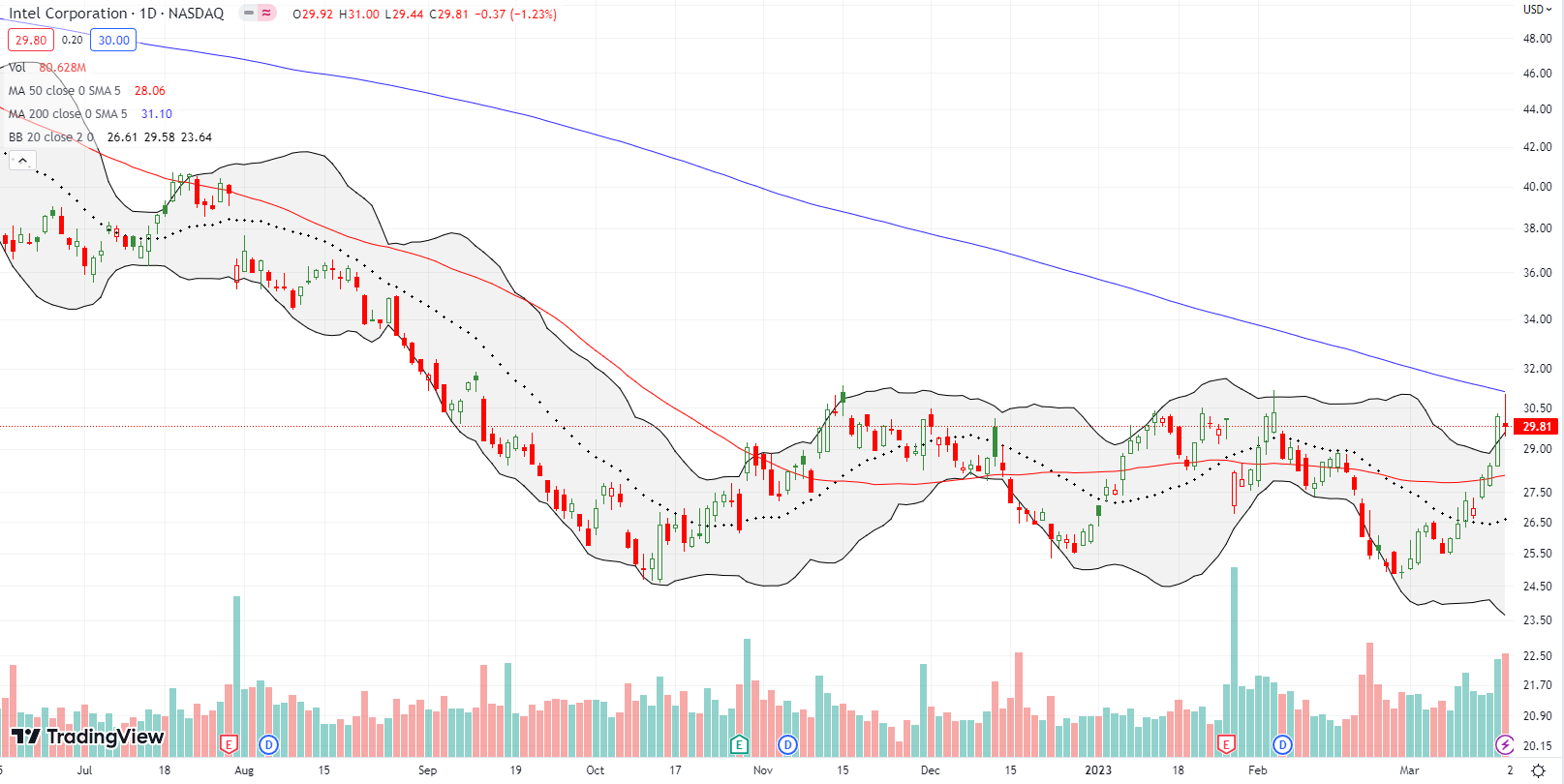

Even Intel Corporation (INTC) rallied last week. INTC gained 9.5% for the week after fading from resistance at its 200DMA. This resistance happens to align with tops in November, January, and February. Still, this recent display of strength brought INTC back to my attention. I gave up on the stock after what I read as an ugly earnings report in January. Now I will be watching for the next pullback for a buying opportunity.

That TechTarget article also educated me on the AI-related moves Intel Corporation (INTC) is making. Accordingly, I might pair an INTC play with an AMD play for generative AI.

The Hedge

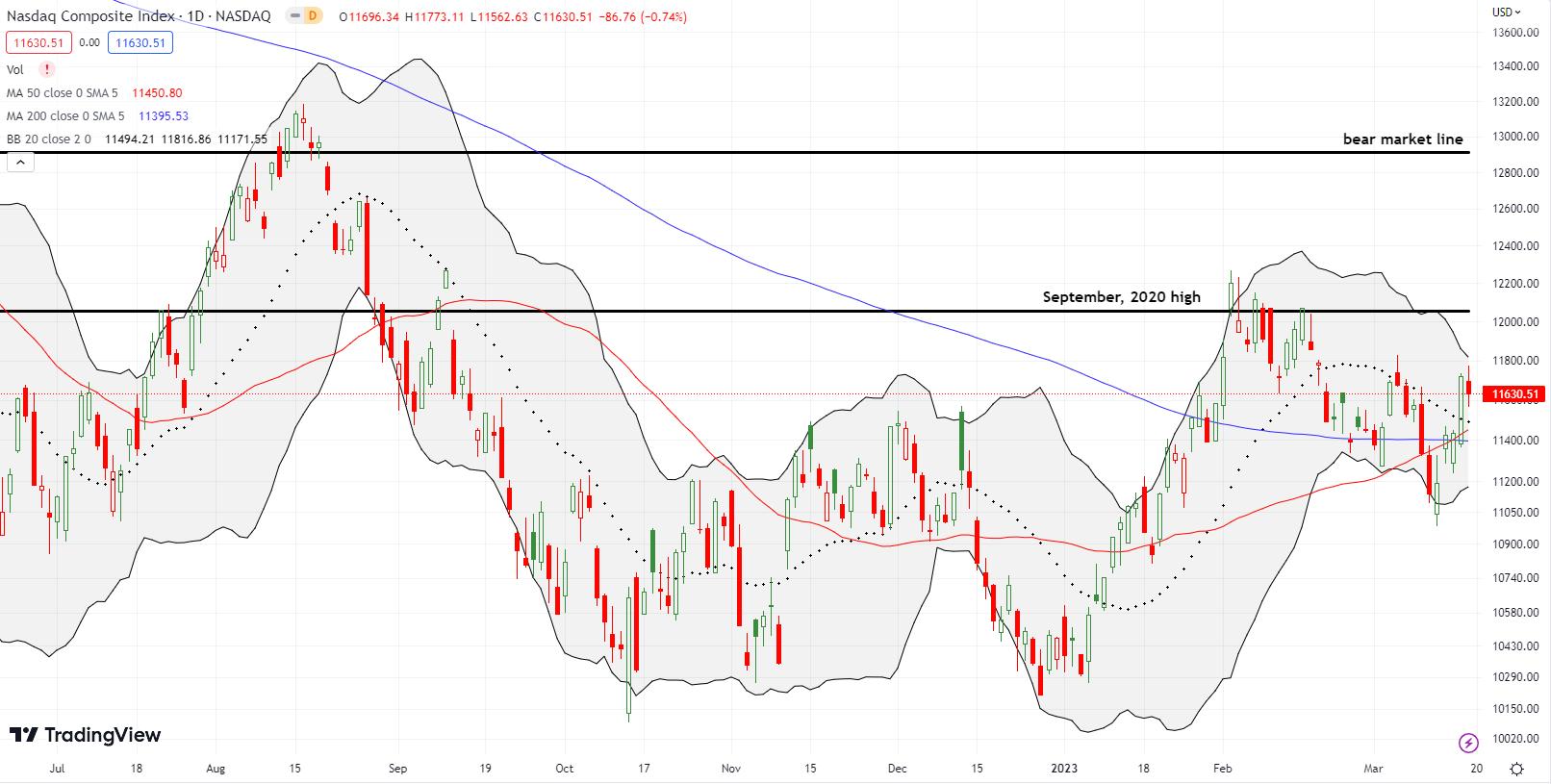

The NASDAQ is fractionally down and the Invesco QQQ Trust (QQQ) is fractionally up from where I started the generative AI trade. My hedge on the trade, a QQQ June 270/290 put spread, is flat, mainly thanks to a large increase in volatility (the VIX is up 27.5%). I expect the spread to rapidly lose value if the rally in generative AI tech pushes on from current levels and volatility continues downward in sympathy. (I discussed the short-term trading prospects in “Flirting with Oversold Trading Conditions Ahead of the Fed – The Market Breadth“).

Be careful out there!

Full disclosure: long AMD, long MSFT call spread, long GOOG call spread, long QQQ put spread

So, the internet is now the arbiter of truth?

This is going to end very very badly.

I’m not sure what that means relative to the product announcements I mention here. Note that what is being rolled out are natural language models whose output is limited to the domain of the application.