NVIDIA Races Ahead

Money manager Cathie Wood of ARK Invest is known for being unconventional by making concentrated bets on highly speculative companies, what Wood calls betting on innovation that solves problems. So of course Wood has AI-related bets in the various ARK funds. The ARK Autonomous Technology & Robotics ETF (ARKQ) in particular holds the shares of companies creating AI-related products and services. Yet, on a day that may forever be remembered as symbolic of this year’s AI mania, ARKQ lost 0.9% while NVIDIA Corporation (NVDA) soared 24.4% post-earnings. NVDA is a semiconductor company now making waves with GPUs tailor-made for the voracious computing appetites of AI computing systems. All sorts of AI-related stocks jumped in sympathy, but ARKQ failed to participate. Part of the disconnect comes from Wood’s focus on the users of AI instead of the companies that are supplying AI-enabling products, also known as the picks and shovels.

Picks and Shovels

A recent YouTube short clipped from one of Wood’s investment updates explains Wood’s AI investment approach: “The companies harnessing AI…so it is the users who are going to be the biggest beneficiaries…and critically [those with] proprietary data, data that no one else has, those will be the winners.”

Wood’s interest in companies using AI is not surprising. However, the approach overlooks the likely better risk/reward offered by the (generative) AI suppliers. The “pick-and-shovel” investment strategy provides participation in a fast-growing industry without having to guess about the winners and losers near or at the end of the supply chain.

The strategy gets its name from California’s gold rush days when suppliers to gold miners made less risky profits selling picks, shovels, and other material to the hoards rushing to the rivers and mountains in search of golden riches. Imagine trying to pick the few winners from among the hundreds of thousands looking for gold versus investing in the fewer thousands selling goods to the speculators. Thus, ARKQ, which includes large positions in UiPath Inc. (PATH) (down 11.2% on the day) and AeroVironment, Inc. (AVAV) (down 15.5% on the day) can lose ground on a day when the AI suppliers raced higher.

Wrong Picks, Lost Shovels

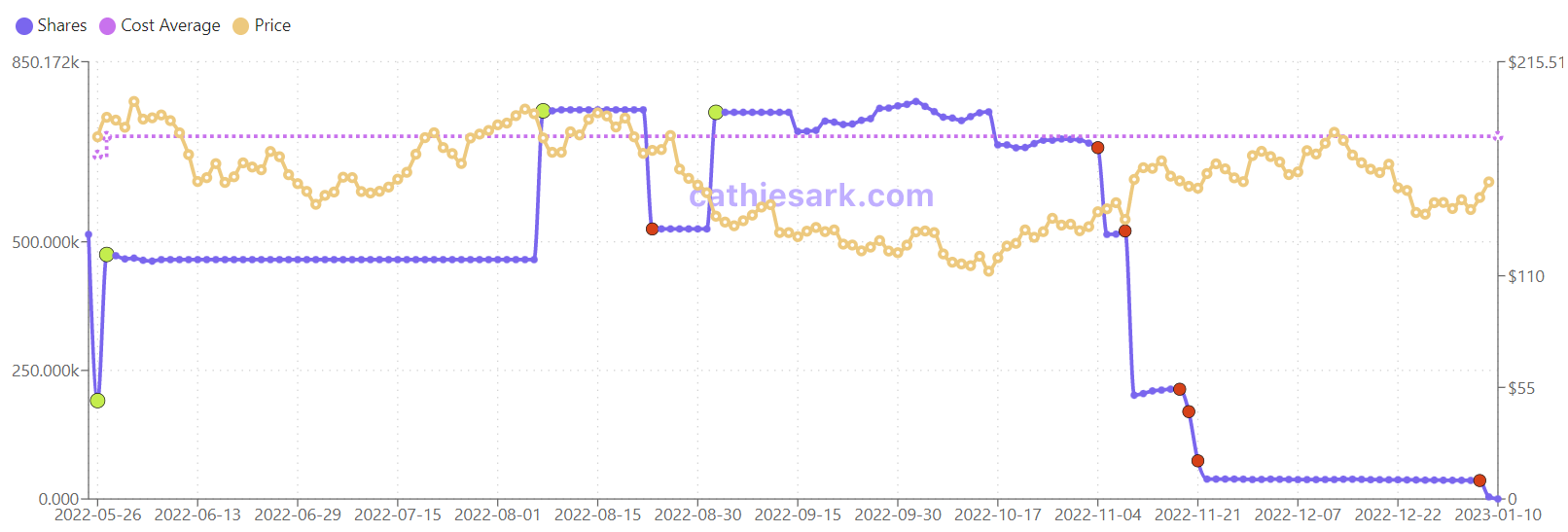

According to “Cathie’s Ark“, a site that collects data on ARK investments, ARK has significantly divested from AI suppliers NVDA and Alphabet (GOOG). Last November, ARK Innovation ETF (ARKK) sold the vast majority of its shares in NVDA just as it was rallying off a 14-month low. ARKK sold the rest of its holding in January.

So now ARKQ holds the lion’s (robot’s) share of NVDA Wood still wants to own. Those ARKQ holdings have been stagnant since last September. NVDA is currently ARKQ’s 9th largest holding with a 3.9% weighting.

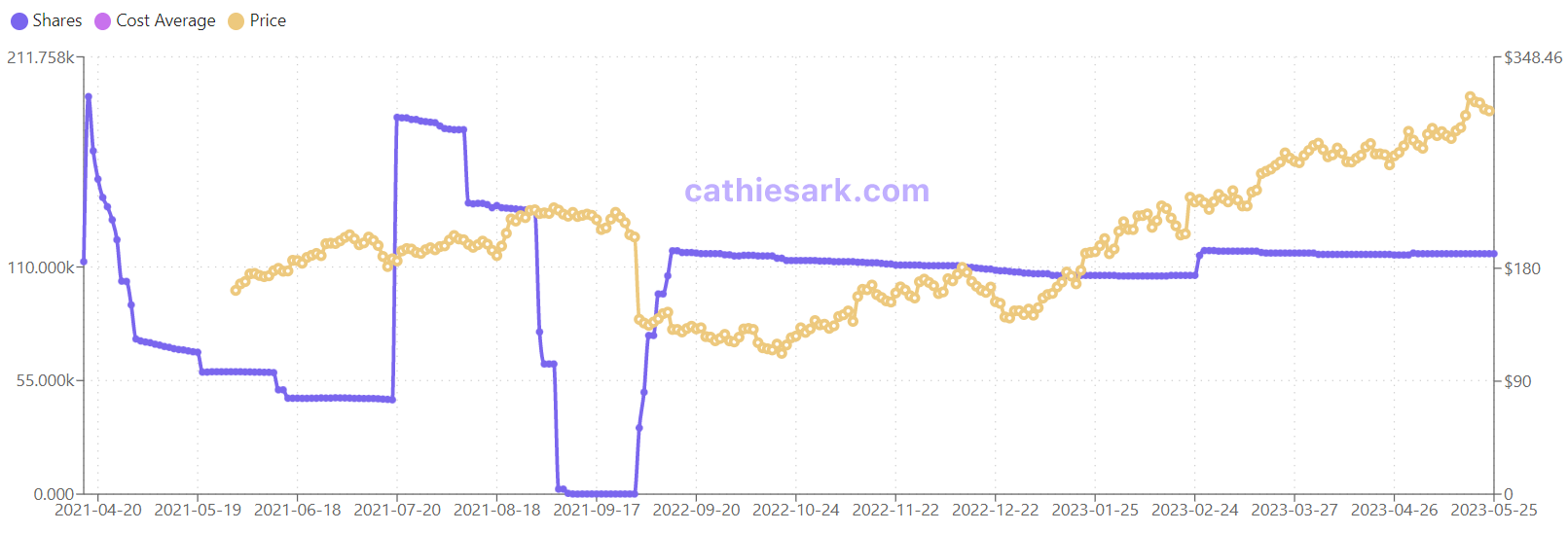

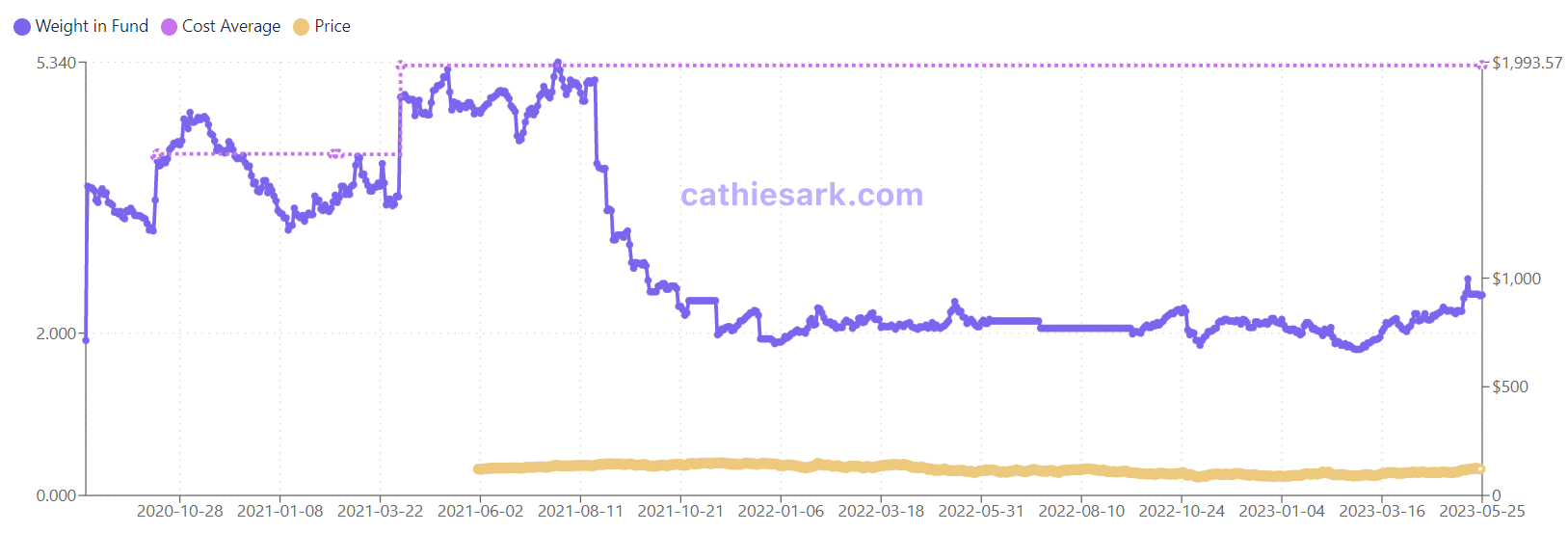

ARKQ’s investment in GOOG has also gone stagnant. Because Cathie’s Ark does not include an adjustment for the last stock split, I show the trend in weighting for ARKQ. GOOG’s weighting fell sharply in 2021 and has stayed just above 2% since November, 2021.

The Trade

While I think Wood should have increased her weighting in the AI suppliers, I too have come up short in my generative AI trading strategy. I started out well with a pairs trade I explained back in February in “A Sprint Trade on the Race in Generative AI.” Just one month later, the hype over ChatGPT was already reaching its first feverish pitch, and I wrote an update on the trade and the latest events.

If I had just closed my eyes until now, I would have essentially maxed out the profits on the trade. Instead, I got cute and decided to trade around my positions by taking early profits. While I expanded my trade to the semiconductors and added to an existing position in Advanced Micro Devices (AMD), I did not dip into NVDA. I got cute one more time and took profits today on AMD given the stretched technicals.

Despite my disappointment in sub-optimal execution, I am sticking with the current incarnation of my AI trading strategy by aggressively buying the dips. I currently have a weekly calendar call spread and weekly call options in place for GOOG. Close to or after next week’s expiration, I will do a strategy reset that takes into account the tremendous run-ups in the AI race.

ARKQ Epilogue

Speaking of a strategy reset, this whole episode reminded me that I need to do a refresh on my aging ARK trading strategy. Fading rallies in ARKQ worked relatively well as a hedge against other ARK positions, but I stopped actively trading in ARK until a recent dip into a calendar call spread.

Be careful out there!

Full disclosure: long GOOG weekly calendar call spread and weekly call options, long ARK shares and calendar call spread