Bitcoin Uptrend Analysis

The trend is a friend for Bitcoin (BTC/USD) again. All three of the major moving averages are pointing upward for Bitcoin. This synchronization of the 20-day moving average (DMA), 50DMA, and the 200DMA supports a buy-the-dip strategy after the big March breakout in the wake of the banking Panic of 2023. Assuming the trend is sustainable, I created a Bitcoin uptrend analysis using theoretical buying points near the moving averages to demonstrate the potential power of the technical outlook.

Since downside risk always looms in the background for Bitcoin, the above chart also includes a theoretical stop-loss below the March, 2023 low. That point provides a major bottom given the episodic catalyst of the crisis in regional banks. If Bitcoin manages to break that point again, I have to assume crypto’s fresh concerns about the banking system are over (or less important than some new negative catalyst).

One irony of the banking crisis catalyst is that the rapid movement of money out of regional banks into other banks and investments demonstrated that the financial system has no problem moving money around at lightning speed. One of crypto’s many use cases is to facilitate the movement of money fast and low cost. To-date, the U.S.’s conventional financial system has no problem moving money fast in the most urgent of use cases: a bank run.

The 2024 Halving

The next halving in Bitcoin is coming in about a year. That event supports a case for the longer-term sustainability in the current uptrend. A recent CNBC article laid out the technical case for upside supported by the halving:

“Before the last halving, which took place on May 11, 2020, the price of bitcoin increased by 19% in the preceding 12 months, from $7,191.36 to $8,568.88, according to figures from CCData.

During the halving before that — which occurred on Jul. 9, 2016 — bitcoin rallied 142% compared with the 12 months prior, moving from $269.14 to $651.83.”

Of course, the last halving occurred in the middle of a major financial event caused by the pandemic. Bitcoin first collapsed and then soared on the wings of massive monetary stimulus. Fiscal stimulus helped put money in the pockets of people who may have used some of the windfall to chase cryptocurrencies higher.

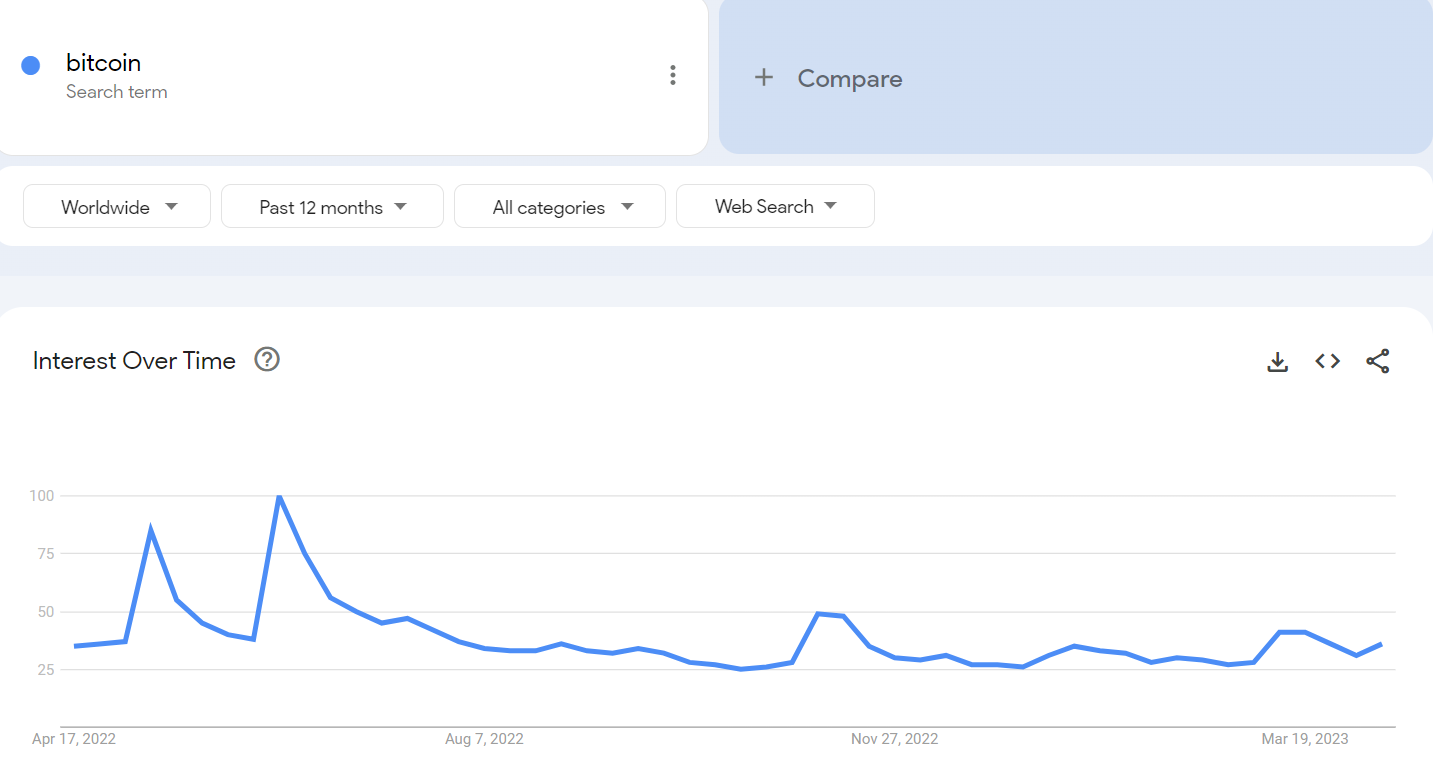

Google Trends

The Google Trends Momentum Check (GTMC) also suggests the coast is clear for a Bitcoin uptrend. The current upswing in search interest in Bitcoin remains small compared to past episodes. Thus sentiment is nowhere close to overheated or extreme. The last extreme in June, 2022 supported a temporary bottom in the middle of an on-going sell-off for Bitcoin. At that time, cryptocurrencies were reeling from the change in heart of the Federal Reserve to get serious about fighting inflation. Various crypto crises hurt as well. Bitcoin is now finally back to those June, 2022 levels. A climb above the 33,000 level would mark a freshly momentous breakout.

The Trade

I last sold BTC/USD and ProShares Bitcoin Strategy ETF (BITO) on the first surge from the Panic of 2023. I am still holding Grayscale Bitcoin Trust (BTC) (GBTC) and ProShares Short Bitcoin Strategy ETF (BITI) as a small hedge. Riding the bitcoin trend is my key strategy for this phase of Bitcoin trading.

Be careful out there!

Full disclosure: long GBTC, long BITI