An Obvious Stock Market Breakout Leaves Open Questions – Above the 40 (September 6, 2019)

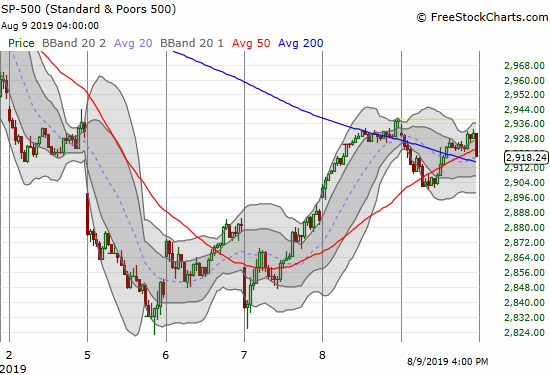

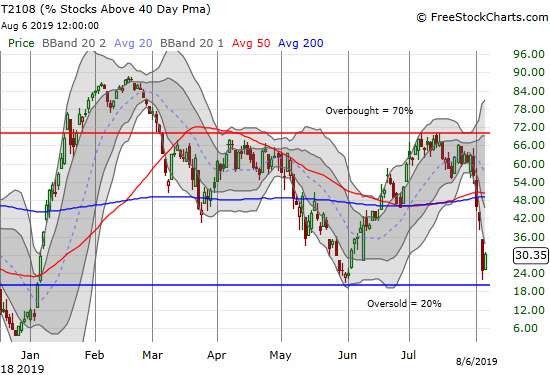

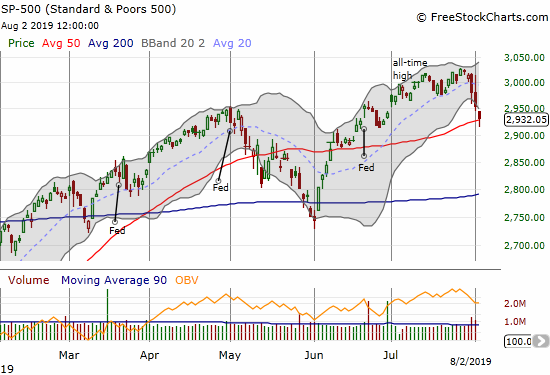

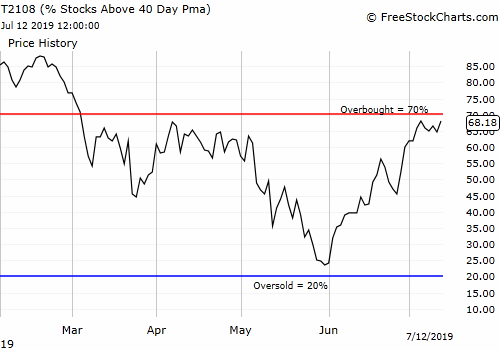

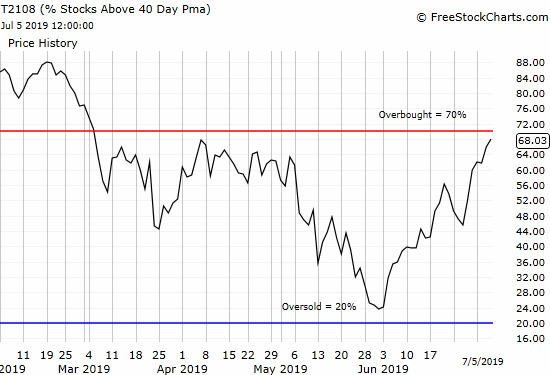

AT40 = 49.7% of stocks are trading above their respective 40-day moving averages (DMAs) AT200 = 48.1% of stocks are trading above their respective 200DMAsVIX = 15.0Short-term Trading Call: neutral Stock Market Commentary One Obvious Pattern to Another The S&P 500 (SPY) and the NASDAQ (COMPQX) transitioned from an obvious trading range to an obvious … Read more