Housing Market Review (July, 2019) – Key Divergences Emerging Under the Surface of the Seasonal Top

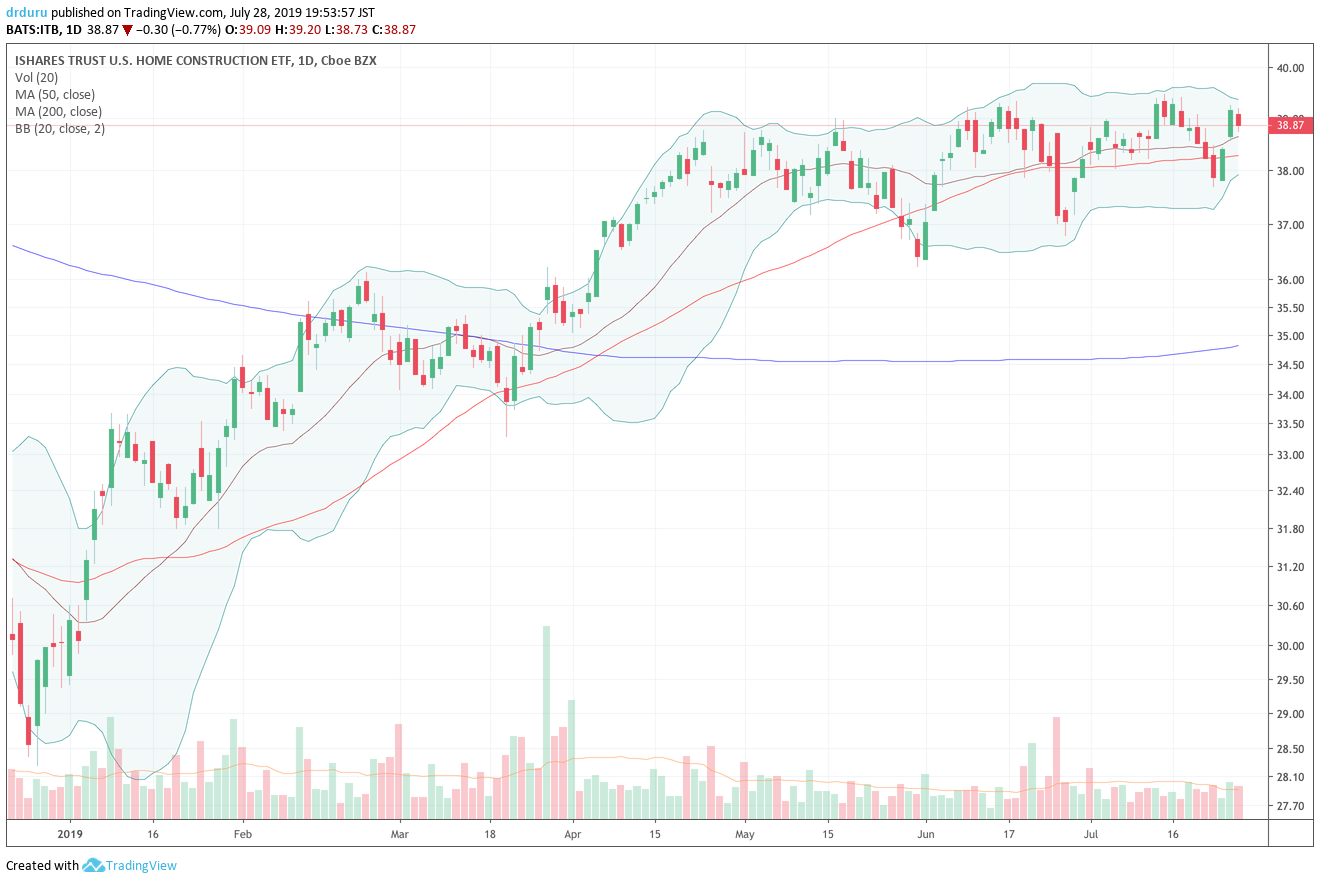

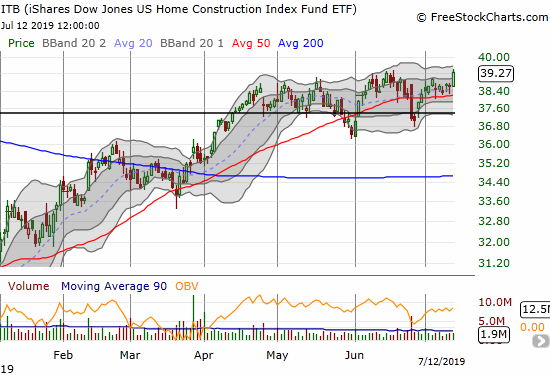

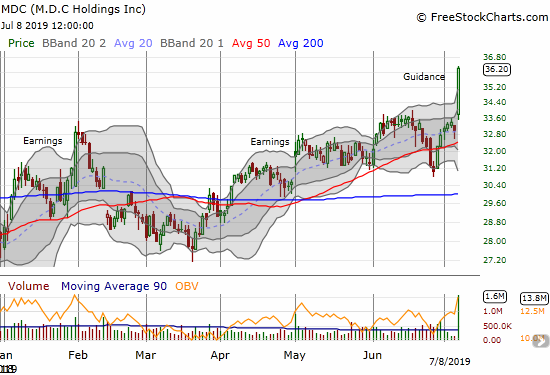

Housing Market Intro/Summary In the last Housing Market Review, I pointed out how the stocks of home builders were still making a surprising push against the expected seasonal top in their shares. Yet, I still expected iShares US Home Construction ETF (ITB) to remain constrained to a pivot around its 50-day moving average (DMA). Soon … Read more