Overbought Trading Conditions Come to A Swift and Ominous End – Above the 40 (May 1, 2020)

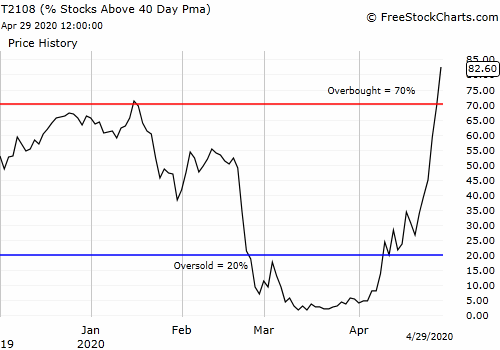

Stock Market Statistics AT40 = 68.6% of stocks are trading above their respective 40-day moving averages (DMAs) (ending 2 days overbought)AT200 = 12.2% of stocks are trading above their respective 200DMAsVIX = 37.2Short-term Trading Call: neutral Stock Market Commentary The Federal Reserve’s last statement on monetary policy may go down as the short-term peak in … Read more