ChatGPT Speaks

I continue to find interesting and valuable ways to use ChatGPT. After listening to a segment on CNBC’s Fast Money that wrangled over the risks in commercial real estate, I decided to ask ChatGPT a topical question: “What publicly traded commercial real estate REITs struggled the most during the great financial crisis?” I figured the REITs that struggled the most at that time will surely struggle mightily in a time where workers have not or will not return to office buildings in full and debt must get refinanced at much higher rates. Here is what ChatGPT had to say (ChatGPT’s data is only current up to sometime in 2021):

During the Great Financial Crisis (GFC) of 2008-2009, many commercial real estate investment trusts (REITs) struggled as the economic downturn impacted their ability to generate rental income and property values declined. Here are a few publicly traded commercial REITs that struggled the most during the GFC:

- General Growth Properties Inc. (GGP) – This was one of the largest mall operators in the U.S. and filed for bankruptcy in 2009. GGP had over $27 billion in debt and was unable to refinance it due to the credit crunch caused by the crisis.

- Simon Property Group Inc. (SPG) – Simon Property Group is the largest mall operator in the U.S. and also saw its share price plummet during the GFC. However, the company was able to weather the storm and has since recovered.

- Vornado Realty Trust (VNO) – Vornado Realty Trust is a major owner of office and retail properties in New York City and Washington D.C. During the GFC, VNO’s share price dropped by over 70%, and the company was forced to cut its dividend to conserve cash.

- Boston Properties Inc. (BXP) – Boston Properties is a major owner of Class A office buildings in Boston, New York, San Francisco, and Washington D.C. During the GFC, the company’s share price dropped by over 60%, and its occupancy rates declined as tenants downsized or went out of business.

- Equity Residential (EQR) – Equity Residential is a REIT that owns and operates apartment buildings in the U.S. During the GFC, the company’s share price dropped by over 50%, and its occupancy rates declined as tenants struggled to pay rent.

It’s worth noting that many other REITs also struggled during the GFC, and the impact varied depending on the specific property types they owned and their geographic locations.

The Charts for Commercial Real Estate

I took ChatGPT’s target list and looked at three key views on these commercial real estate REITs: monthly chart, daily chart, and dividends. I think the technicals tell the whole story. The dividends offer a window into value for folks who want to be stubbornly bullish. They also flash a red flag for bears who interpret excessively high dividend rates as a source of funds for companies who need to preserve cash.

Simon Property Group (SPG)

SPG is down 15.4% month-to-date and trades well above its September lows. At the market’s top for the year in February, SPG somehow managed to break out to a 10-month high. In the immediate wake of the regional banking crisis (what I still like to call the Panic of 2023), SPG confirmed a bearish breakdown below its 200-day moving average (DMA) (the bluish line) and trades around a 5-month low. SPG is a short with a stop above the 200DMA. A juicy 7.0% dividend could keep the stock off its lows…assuming the company is not forced to cut its dividend if (when?) a recession finally visits the shores of the economy.

Vornado Realty Trust (VNO)

VNO is down 29.1% month-to-date and trades near a gut-wrenching 27-year low. VNO cracked its pandemic low back in August, 2022. The stock was a short at that point. The lows from the GFC became history this month. The regional banking crisis accelerated VNO’s slide. Something tells me the 10.7% dividend will not last, especially with net income dropping back into negative territory.

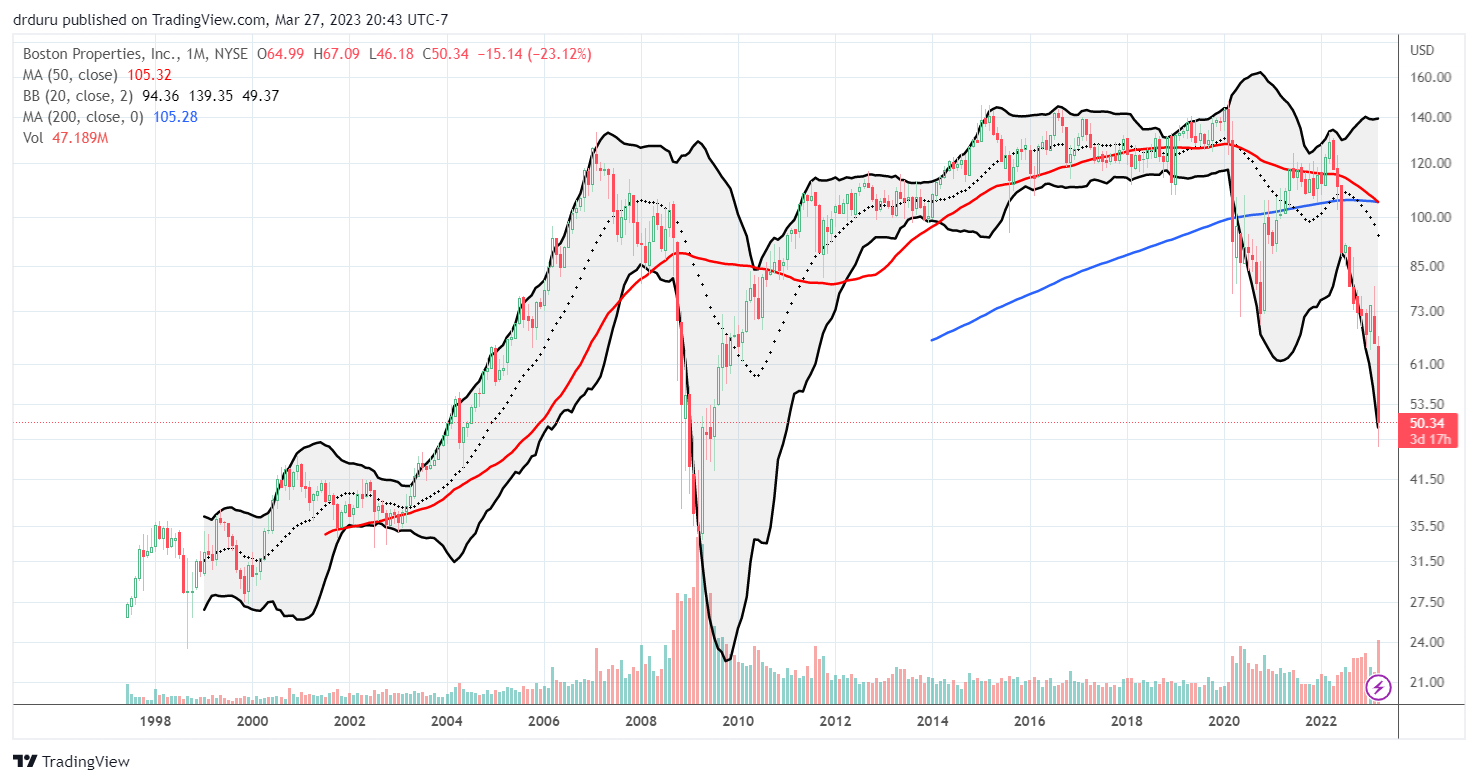

Boston Properties Inc (BXP)

BXP is down 23.1% month-to-date and trades near a stomach-churning 14-year low. BXP cracked its pandemic low last month. The stock was a short at that point although aggressive bears could have gone short by May, 2022 when BXP suffered its last 200DMA breakdown. The stock’s downtrend began in earnest after that technical milestone. The regional banking crisis accelerated BXP’s decline. Unlike VNO, BXP has not (yet?) slipped by its lows from the GFC. BXP offers an 8.3% dividend, but those spoils could vaporize quickly. BXP has a cushion with positive net income.

Equity Residential (EQR)

EQR is down 10.1% month-to-date and trades at a 16-month low. Incredibly, EQR started 2022 with a marginal all-time high before the current downtrend started. Of course, at that time the Federal Reserve had not yet begun the monetary tightening that slammed a tight lid over the real estate market. Accordingly, it makes sense that a month after the Fed delivered its first rate hike, EQR became a short when it sliced through 50DMA and 200DMA support.

Yet, the monthly chart makes EQR looks like it is still clinging to a long-term uptrend. A 4.7% dividend does not offer a margin of safety, but it likely confirms EQR is the healthiest REIT of the bunch that ChatGPT offered up. Of course, with rents still sky high and employment strong, EQR should be one of the better performing commercial real estate REITs. However, the onset of a recession could accelerate EQR’s downtrend.

The Trade On Commercial Real Estate

ChatGPT provided an interesting mix of commercial real estate REITs that face the ravages of higher interest rates and a likely slowing economy. Since I never short housing-related stocks, I have VNO and BXP in focus. Both stocks seem like ideal candidates for fading the next rally (I am currently short-term bullish on the overall stock market). The most likely catalyst for such a rally would be a market celebration on a change in policy stance from the Fed. Such a flip would offer a big fakeout as it could be just the beginning of an economic slowdown that will provide fresh pressures on the sector.

Be careful out there!

Full disclosure: no positions