Alexandria Real Estate (ARE), a real estate investment trust (REIT) specializing in life science buildings, gets much love from analysts. According to Factset, ARE is currently one of the most loved companies in the S&P 500 (SPY). ARE is just one of two stocks whose analyst coverage consists 100% of buy ratings. This high “occupancy rate” of buy ratings is the wrong kind of overcrowded with the stock plunging to a 7+ year low last week. The Federal Reserve’s latest missive on monetary policy sent interest rates surging and rate-sensitive sectors like REITs into a tailspin. With ARE overcrowded with optimistic analysts, the stock is left without upside catalysts to return the stock to the previous trading range. The sell-side is almost as optimistic as it can get on ARE.

With the rate environment freshly turning against ARE, some analysts will need to throw their optimism overboard. Those downgrades will chase price downward and serve to affirm the negative price action. Perhaps the stock will bottom when analysts are about as negative as they can get on the sector….wherever that point is.

The Bear Case

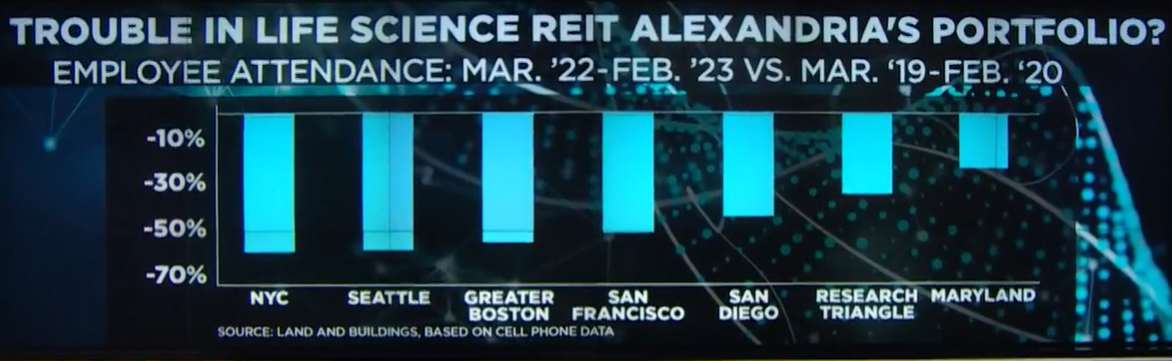

If investor Jon Litt is correct, the bottom for ARE is still a long ways away. On June 15, 2023 Litt appeared on CNBC’s Fast Money to proclaim this bear case for ARE. At the time, he targeted a decline of as much as 40%, a downside target around $73. ARE was last that low in early 2016. Litt’s research team used cell phone data to estimate a 50% decline in employee attendance at Alexandria. They filtered the data to cell phones that spent at least 60 minutes in the building. Litt also noted that 20% of leases are coming due over the next few years, and 20% of new supply is coming to market. As one particularly dire example, Litt claimed that renters in Washington DC are shrinking their footprint by 30%.

With such data in hand, it is surprising that Alexandria is one of the most loved stocks in the S&P 500! Alexandria needs the analyst overcrowding in its office spaces!

A Bullish Earnings Report

Alexandria’s Q2 2023 earnings report certainly gave analysts every reason to stay optimistic. Management provided strong numbers on occupancy rates and rental growth. From the Seeking Alpha transcript of the conference call (emphasis mine):

“Second quarter occupancy was in line with expectations at 93.6%, consistent with first quarter occupancy. Our outlook for 2023 reflects flat occupancy from the second quarter to the third quarter and occupancy growth in the fourth quarter. The midpoint of occupancy guidance is 95.1%, and occupancy as of June 30 of 93.6% included vacancy of 2.2% or approximately 900,000 rentable square feet from properties that were recently acquired in 2021 and 2022.

Now 23% of the recently acquired vacancy is already — has already been leased and will be ready for occupancy over the next number of quarters and an additional 14% is under negotiation.”

Management went on to reassure analysts that Alexandria could still achieve upside in its already high occupancy rate: “…we’ve been in the 98% occupancy range. So there’s plenty of room to grow there.” Moreover, management has strong visibility into its business for the next 2+ years: “…our pipeline is set to bring on a tremendous amount of NOI [net operating income] and that gives you visibility all the way into ’25 and a little bit going up to ’26 now.”

These numbers hardly reflect the alarm of the employee attendance rate numbers from Litt. Alexandria does not indicate any threat from renters reducing footprints to accommodate a high rate of working-from-home employees.

Moreover, Alexandria reported robust rent growth.

“…our outlook for rental rate growth for 2023 is a range of 28% to 30%, call it, a midpoint of 28.5%, 12% to 17% with a midpoint of 14.5% on a cash basis. Our rental rate growth for the first quarter, just to remind everybody, was pretty record at 48% and 24% on a cash basis…When you think about rental rate growth of 16% — 16.6% on a GAAP basis, 8.3% on a cash basis, that’s pretty outstanding in this type of market and when you think across the REIT sector today. So we’re very pleased with the rental rate growth that we actually delivered on the quarter and feel comfortable as we look out that we’re on track to hit the range of guidance that we gave.”

Management explained that its confidence is based on Alexandria’s unique brand, mega-campus strategy and its operational excellence.

The Trade

ARE’s breakdown plants the stock deeper into bearish territory. Before the breakdown, ARE traded over 50% below its all-time high from December, 2021.

However, at multi-year lows and trading well below its lower Bollinger Band (BB), ARE is short-term over-stretched to the downside. Moreover, the stock market as a whole is right at the edge of oversold trading conditions. Accordingly, I am not interested in shorting ARE until it rallies off these lows. If the stock continues to sell-off from here, I will just continue to wait for a rally to fade. I do not want to chase price downward in over-stretched, oversold conditions. If Alexandria’s financial conditions are as strong as management reports, then the poor employee attendance numbers may only translate into occupancy rates over an extended period of time. Accordingly, the overcrowded conditions in analyst buy ratings may take quite some time to ease.

Be careful out there!

I concur with your thought about employee attendance numbers (assuming the source and methodology are reliable). Attendance has probably bottomed and is recovering. I doubt such factors should be given much weight in forecasting MOB sector earnings, anyway. They are a fading pandemic effect; populace aging is more reliable and more powerful.

For any REIT with a well-covered dividend and no obvious problems on the horizon, at some point its yield provides a bottom. At Friday’s closing price ARE’s yield is 4.9%. A 10% drop – to, say, $90 – would put the yield around 5.5%. Given expectations about the Fed, that seems a reasonable target, with considerable price upside once the Fed starts to unwind the current raising cycle.

A 40% price drop from here would put ARE’s yield over 8%. That just doesn’t seem likely.

And it seems like their financial position is too strong to force a cut in the dividend yield. Still, this is some ugly, bearish price action. Can’t buy this for the yield when the losses in the stock are so large.