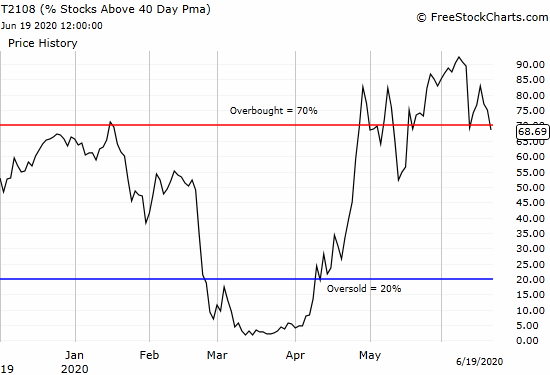

A Bearish Divergence Too Strong To Ignore – The Market Breadth

Stock Market Commentary The stock market’s bearish divergence is too strong to ignore. The S&P 500 and the NASDAQ achieved all-time highs while market breadth sunk again this week. Both short-term and long-term market breadth indicators are at key support levels. Even if market breadth somehow rebounds from current levels, I find myself getting yet … Read more