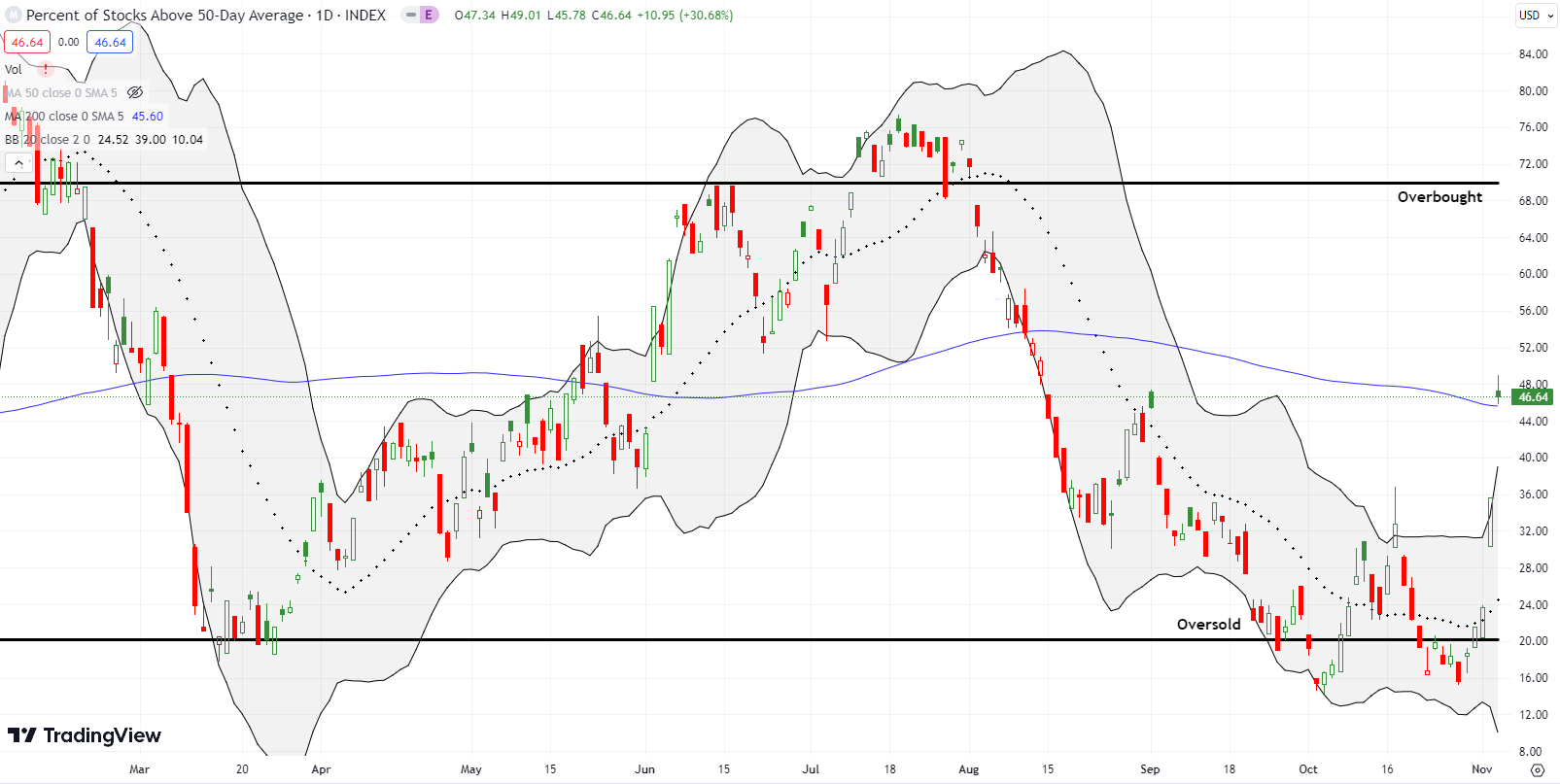

First Strike Against the Stock Market Rally – The Market Breadth

Stock Market Commentary The rally out of the stock market’s last oversold period finally suffered its first strike today as a strong open fizzled into some important fades. The S&P 500 and the NASDAQ tapped highs of the year only to fail into marginally negative closes. Most importantly, market breadth perfectly tapped the threshold for … Read more