I have been waiting since September, 2018 for the next opportunity to buy back into Nigeria through the Global X Nigeria Index ETF (NGE). The moment for me to buy is finally here.

NGE has printed all the encouraging signs of a tradeable bottom:

- A double bottom: August to October, 2019 at the all-time lows.

- A breakout above the 50-day moving average (DMA) in November confirmed by a successful test of 50DMA support in December.

- A 50DMA turning upward after a long downtrend.

- A breakout above the 200DMA confirmed by a gap up on high trading volume.

- High trading volume on up days

The Global X Nigeria Index ETF (NGE) is a highly concentrated bet on Nigeria. The ETF’s top 10 holdings constitute 71.4% of assets. Seven of those 10 holdings are banks. The other three are Nestle Nigeria PLC (12.3%), Dangote Cement (11.1%), and Nigerian Breweries (5.4%). Financials, construction, and consumer goods are major players in the economy beyond oil companies, so I interpret the developing turn-around in NGE as a vote of confidence in broader economic health.

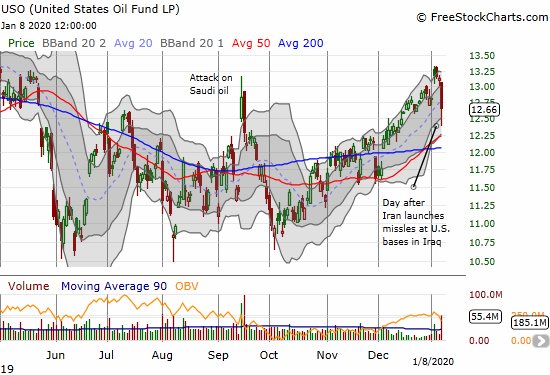

At a time when major indices like the S&P 500 (SPY) are making all-time highs, bargain shoppers are pacing up and down the aisles for discounts. Nigeria represents a major bargain: all the political and economic trials on the surface make Nigeria look unattractive. However, as Africa’s most populous country, opportunity abounds. With a stabilizing currency, the niara, the opportunity looks as good as ever in NGE even with a world awash in so much oil that the commodity cannot hold a rally on bad geo-political news.

Source for charts: FreeStockCharts

The Trade

I think NGE could easily get away from me here, so I will immediately buy a “no regret” position where I buy a small amount of shares to make sure I can participate in a runaway rally. If NGE pulls back, I will load up to a full position. My preferred entry point is on a retest of 200DMA support.

With NGE on the rebound, I am also incrementally more confident in doubling down on Jumia (JMIA) with its own breakout from all-time lows.

Be careful out there!

Full disclosure: long JMIA

A better time to buy was two weeks ago. NGE is up more than 11% in two weeks. For me it’s too risky to buy something that is up so much in such a short time.

I would definitely have preferred to buy even lower, but my perspective is that NGE is “at risk” of soaring on momentum. So I bought a small amount of shares to make sure I have something in play in that scenario. Otherwise, I will definitely buy a lot more at a discount. Also recall my perspective is of someone who last sold at much higher prices.

Eric, any reason why the NGE is suddenly up 11%, no great news coming from the Nigerian economy, while it’s been predicted Emerging Markets will outperform major markets, I don’t see it happening with the NGE, unless one goes short

Do you still trade NGE? or are there any other better ETFs with exposure to african markets

I do indeed still trade NGE. It has been an underperformer for sure. I do not know of any other pureplay way to trade on the Nigerian market. I don’t know of any pan-African ETFs. The ETF for South Africa (EZA) is a little better because the economy and currency are more stable than Nigeria’s.

The Niara has continued to devalue sharply. Until the currency stabilizes, NGE will continue to face pressure.

And what a timely question. NGE plunged today thanks to a massive cash distribution. I wasn’t expecting THAT given the losses on the year for the ETF. I haven’t found an explanation.

Yeah i am surprised with the timing. Is it a good time to start accumulating? oR do you see any other scenarios?

Given the economic reforms that are supposed to be happening, if NOW is not a good time to start accumulating, then I might as well sell and never look back!