“…the CBN [ Central Bank of Nigeria ] has no comfort in cryptocurrencies at this time and will continue to do all within its regulatory powers to educate Nigerians to desist from its use and protect our financial system from activities of fraudsters and speculators..”

The Central Bank of Nigeria (CBN), “Response to Regulatory Directive on Cryptocurrencies“, February 7, 2021

Crypto Admonishment from the Central Bank of Nigeria

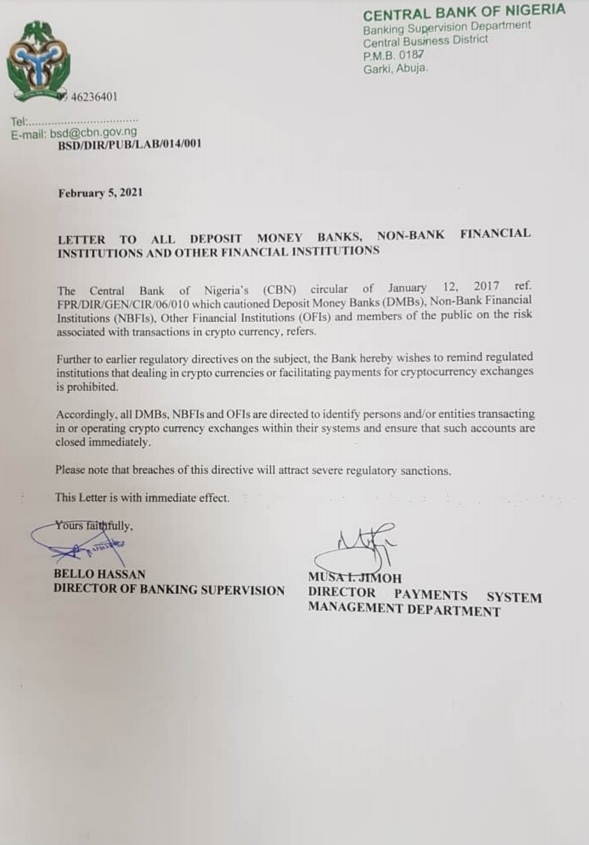

The Central Bank of Nigeria (CBN) issued a simple reminder to its financial institutions that monetary policy bans them from dealing in cryptocurrencies. This February 5th press release, in the form of a photograph turned into a PDF document, created enough of a stir that the CNB followed-up with a complete explainer on February 7th titled “Response to Regulatory Directive on Cryptocurrencies.”

In the CNB’s words “…there appears to be a need to provide further justifications about our position, especially to the general public.” The CNB rehashed known criticisms and skepticisms directed at cryptocurrencies. Here is a summary:

- Warren Buffet denounced cryptocurrencies as a “gambling device.”

- The current Governor of the Bank of England (BoE), Andrew Bailey, called cryptocurrencies flawed as a “lasting means of payment” because of their extreme price changes. (Note as far back as December 17, 2017, Bailey warned: “If you want to invest in bitcoin, be prepared to lose all your money”). The CBN added “small retail and unsophisticated investors also face high probability of loss due to the high volatility of the investments in recent times.”

- “…Cryptocurrencies have become well-suited for conducting many illegal activities including money laundering, terrorism financing, purchase of small arms and light weapons, and tax evasion.” The CBN also referenced the 2011-2015 drug trafficking case on the infamous website “Silk Road.“

- These cryptocurrencies are used more as a means of speculation on higher prices than as a means of payment (for example, the incentive to hoard what is a limited supply of assets).

- Cryptocurrencies have no intrinsic value and generate no returns: “cryptocurrencies do not have fundamentals and would never have fundamentals.”

- New cryptocurrencies effectively create an infinite supply of digital assets.

Shared Prudence with the Central Bank of Nigeria

The CBN also made it clear that Nigeria has good company: “China, Canada, Taiwan, Indonesia, Algeria, Egypt, Morocco, Bolivia, Kyrgyzstan, Ecuador, Saudi Arabia, Jordan, Iran, Bangladesh, Nepal and Cambodia have all placed certain level of restrictions on financial institutions facilitating cryptocurrency transactions.” The CBN went on to note that China maintains a complete ban on cryptocurrency exchanges.

Most importantly, the use of cryptocurrencies run counter to existing law in Nigeria:

“…in light of the fact that they are issued by unregulated and unlicensed entities, their use in Nigeria goes against the key mandates of the CBN, as enshrined in the CBN Act (2007), as the issuer of legal tender in Nigeria.”

A FinTech Angle

To avoid sounding completely negative and anti-progress, the CBN went on to reassure Nigerians that it fully supports innovations in FinTech (financial technology).

“These developments in the payments and settlements space has helped to grow the financial system, improving financial inclusion, the quality and convenience of financial services and has also created millions of direct and indirect jobs for teeming youth population.”

The CBN also listed a number of FinTech achievements in Nigeria.

Nigeria’s Enduring Crypto Fever

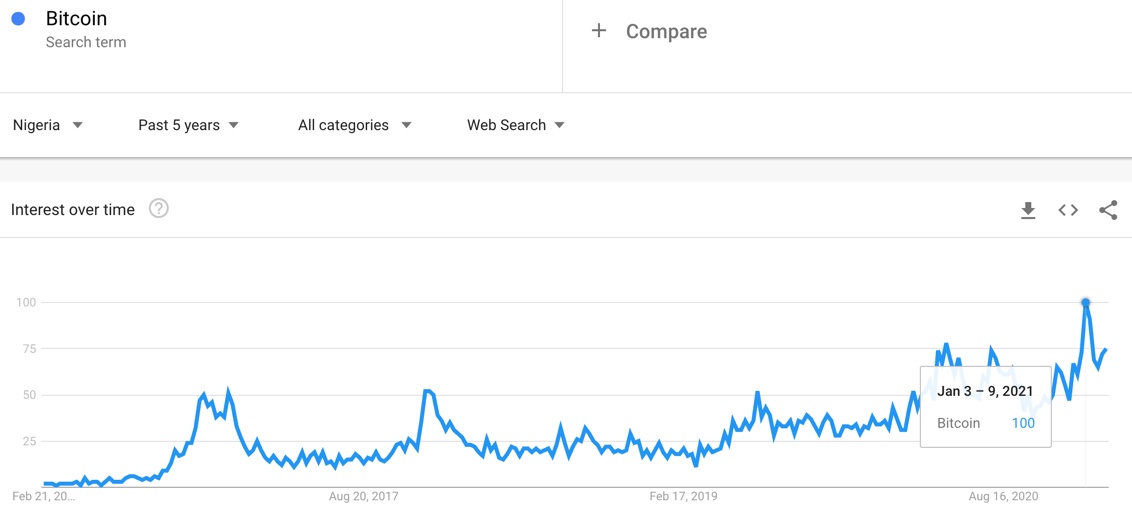

Of course, a key tenet of decentralized currencies is the circumvention of currency control by a centralized authority like a central bank. So, needless to say, the crypto community rejects all of the CBN’s objections. Accordingly, the enthusiasm in Nigeria for cryptocurrency endures. Arguably, the Nigerian excitement is higher than ever and sits at a fevered pitch. The Nigerian currency, the naira, is NOT a store of value. According to the CBN, inflation is currently a (painful) 15%. As a result, enterprising Nigerians naturally seek out alternatives. According to Google Trends, search interest in “Bitcoin” reached an all-time high in Nigeria in early January, 2021.

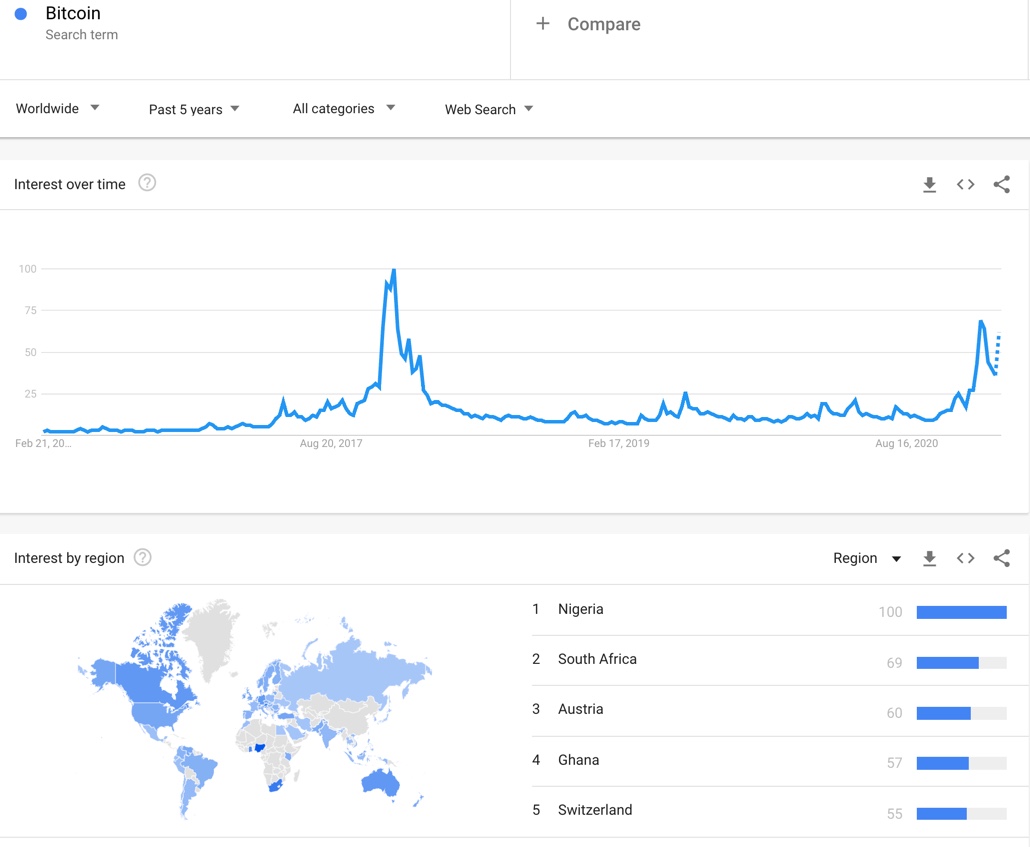

This persistent passion keeps Nigeria tops in the ranks of countries with Google searches that include Bitcoin. In fact, Nigeria is well ahead number two South Africa with almost 1.5 times the search volume (100/69). For reference, the United States is a distant number 15 with an index of 34.

The Trade

Note that although Bitcoin (BTC/USD) is riding at all-time highs, the worldwide search interest is not at all-time highs like in Nigeria. Thus, plenty of room remains for additional euphoria across the globe. According to the Google Trends Momentum Check (GTMC), the pullback from the January extremes is already in the rearview mirror. The next topping signal from the GTMC will occur when/if the Google trends index surges close to or past the January high alongside soaring prices.

Be careful out there!

Full disclosure: no positions