Record Confidence, Rangebound Sales and Stocks – Housing Market Review (November, 2020)

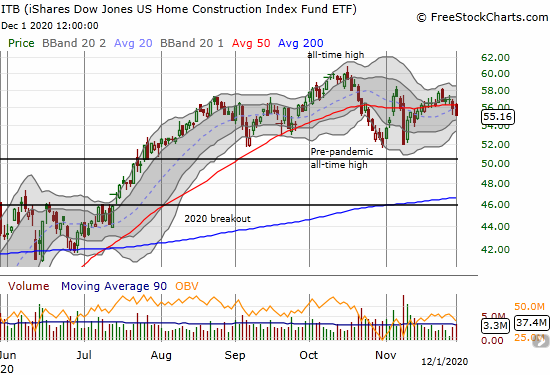

Housing Market Intro and Summary A divergence in the housing market emerged between rangebound home builder stocks and strong housing data. In October, new home sales recorded a third straight month at the 1 million mark. Since new home sales hit the August peak, the stocks of home builders have also largely gone nowhere. A … Read more