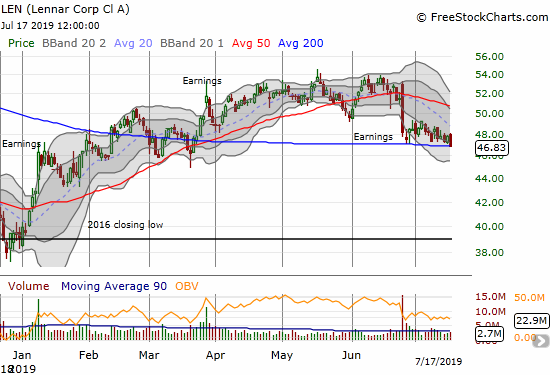

Lennar Hit Hardest By the Weight of Tepid Housing Starts

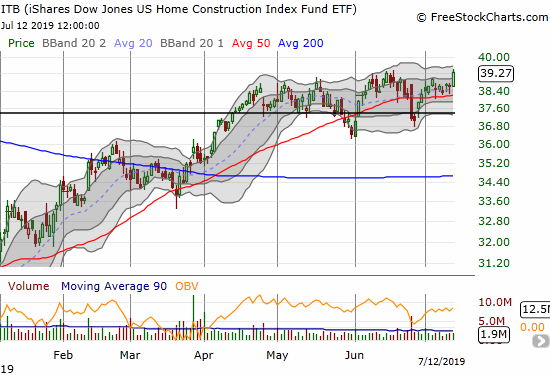

My wait for an entry point to buy Lennar (LEN) continues. On a day with multiple warning signs about the U.S. economy from companies like Csx Corp (CSX), the Census Bureau piled on with lukewarm data on housing starts. While single-family housing starts for June increased month-over-month by 3.5% to 847,000, housing starts decreased on … Read more