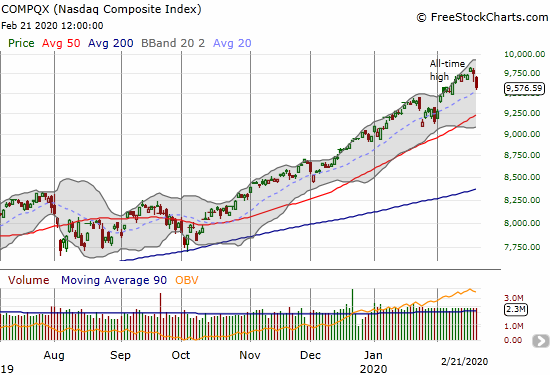

Buyers Tap the Brakes As Economic Data Stall In the Crosswalk – Above the 40 (February 21, 2020)

AT40 = 48.9% of stocks are trading above their respective 40-day moving averages (DMAs) AT200 = 56.7% of stocks are trading above their respective 200DMAs VIX = 17.1Short-term Trading Call: bearish Stock Market Commentary Sellers put on a rare performance: the S&P 500 fell for two days in a row. Buyers tapped the brakes on … Read more