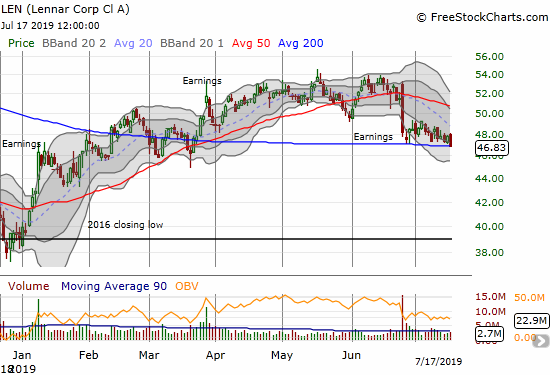

My wait for an entry point to buy Lennar (LEN) continues.

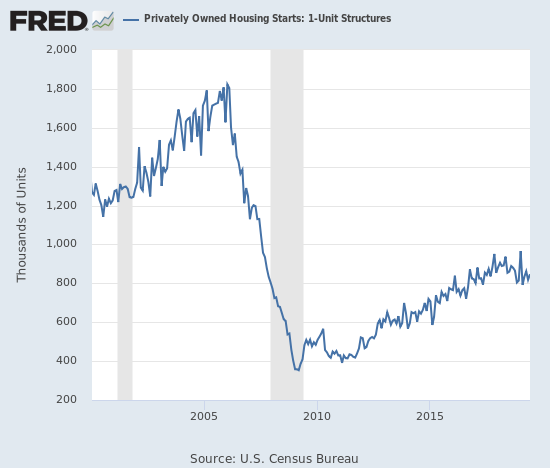

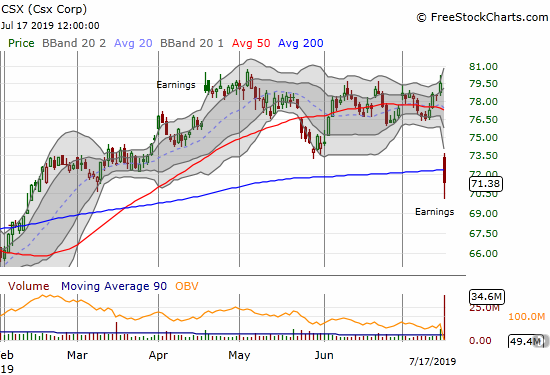

On a day with multiple warning signs about the U.S. economy from companies like Csx Corp (CSX), the Census Bureau piled on with lukewarm data on housing starts. While single-family housing starts for June increased month-over-month by 3.5% to 847,000, housing starts decreased on a year-over-year basis by 0.8%. This tepid activity belies the confidence from some home builders about near-term housing demand. With high expectations for rate cuts from the Federal Reserve, home builders should be eagerly ramping up housing starts in anticipation of stronger demand.

Source: US. Bureau of the Census, Privately Owned Housing Starts: 1-Unit Structures [HOUST1F], retrieved from FRED, Federal Reserve Bank of St. Louis, July 17, 2019.

Lennar (LEN) is one of those confident home builders despite an earnings report that greatly disappointed investors. The lingering wariness showed up today with the worst performance among the major home builders that I follow. LEN sank 2.0% and closed right on top of its precarious support at 200-day moving average (DMA), a 4-month low.

Source: FreeStockCharts

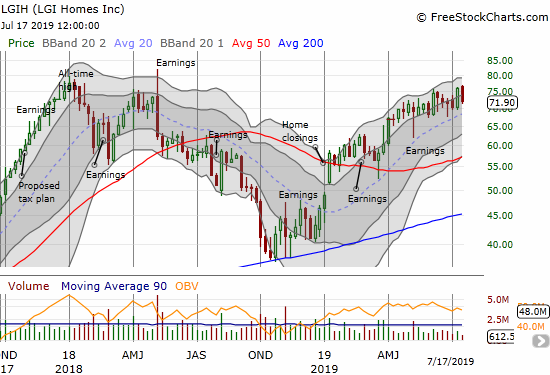

Only LGI Homes (LGIH) performed worse with a 3.6% decline. LGIH is just off its all-time closing high, so its current struggles to break out are increasingly looking like a double-top in the making.

The on-going weakness in LEN increasingly makes me doubt the sustainability of what was a widening breakout by home builders. If LEN suffers a 200DMA breakdown, I will remove the stock from my “pre-season” buying list. I find it hard to imagine that the breakout in home builders could push through a LEN breakdown. The gravity of the seasonal top may yet enact its yearly influence.

Source: FreeStockCharts

Be careful out there!

Full disclosure: long ITB calendar call spread, long CSX calls