Green Shoots Push Into the Next Downtrend Threatening to Trample Stocks – Above the 40 (March 27, 2020)

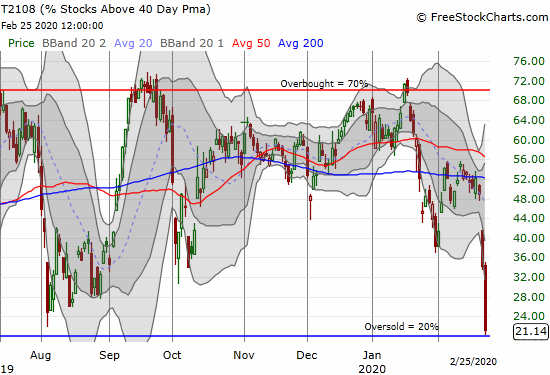

AT40 = 3.8% of stocks are trading above their respective 40-day moving averages (DMAs) (23rd oversold day)AT200 = 5.0% of stocks are trading above their respective 200DMAs (new low for the oversold period)VIX = 65.5Short-term Trading Call: bullish Stock Market Commentary First a dose of hope: “Coronavirus treatment: Palo Alto woman recovers from coronavirus after … Read more