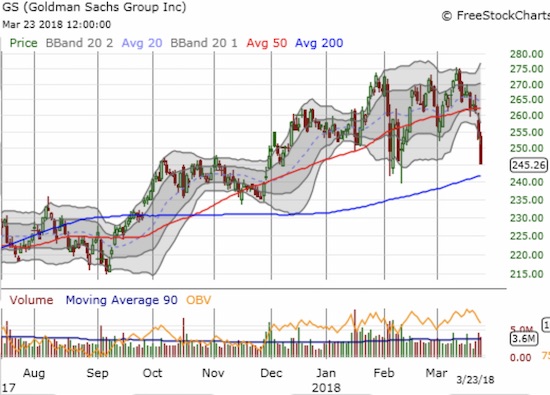

This week, I blithely accumulated call options on Goldman Sachs (GS) ahead of and after the Federal Reserve’s latest declaration on monetary policy. I assumed that the Fed’s calming influence would remind market participants that the economy is fine and the prospects are good. Under that scenario financial stocks would do well as long-term interest rates firmed up. The Fed did one better by upgrading its economic outlook. None of that news mattered as the stock market suffered two straight days of heavy selling. Amidst the shelling, GS lost 6.3% and broke down below its 50-day moving average (DMA).

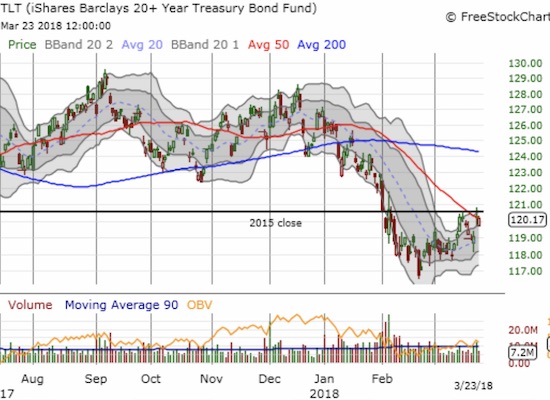

Instead of increasing, interest rates declined as scared investors took some refuge in government bonds. I chose to fade the iShares 20+ Year Treasury Bond ETF (TLT) with put options as it hit 50DMA resistance that happens to roughly coincide with the close from 2015. The time on this trade is surely already ticking!

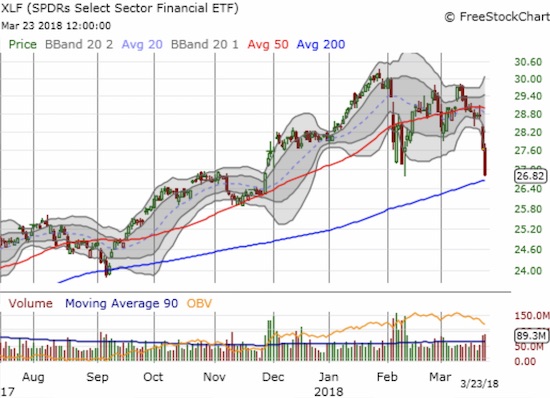

Suddenly, the financials have gone from promise to vulnerable. The Financial Select Sector SPDR ETF (XLF) lost 3.0% on Friday and closed just above its uptrending 200-day moving average (DMA). XLF lost 6.8% for the week.

While the carnage in financials is stark, the spotlight is REALLY on Germany’s Deutsche Bank (DB). DB gapped down on Wednesday on news that it had to drop the price on the IPO of its asset management unit. The CFO also talked about challenges to DB’s business from a strong euro (FXE) and increased costs. The stock plunged two more times to close the week. DB lost 13.1% on the week. The stock is also down 27.7% year-to-date and looks very vulnerable to further losses. Suddenly, I am not so sanguine about my bets on European growth!

Source for charts: FreeStockCharts.com

I still like financials, but this week taught me that I will have to be more discerning in accumulating a position. My ext financial buys will target XLF using longer dated call options to help ride out whatever storm is coming. First, I want to observe the index’s behavior around critical uptrending 200DMA support. Under normal circumstances I would be chomping at the bit to get started given XLF closed well below its lower-BB. The index is technically very oversold and poised for a sharp bounce at any time. Yet, the breakout from November is getting a second test, a precarious test of buyers’ resolve. I strongly suspect that sellers will need to get exhausted by a panic following a break of this critical dual support level. Sentiment is VERY vulnerable here…

Be careful out there!

Full disclosure: long GS calls, long TLT puts, long euro