AT40 = 55.3% of stocks are trading above their respective 40-day moving averages (DMAs)

AT200 = 56.8% of stocks are trading above their respective 200DMAs

VIX = 9.8 (volatility index)

Short-term Trading Call: cautiously bullish

Commentary

In my last Above the 40 post, I noted how the trading action made it hard for me to cling to my cautiously bullish short-term trading call. The stock market answered my criticism with a sudden burst of breadth. Who flipped the switch?

The S&P 500 (SPY) closed May with financials sounding fresh alarm bells. At the time, AT40 (T2108), the percentage of stocks trading above their respective 40DMAs, bounced back from its lows of the day. Yet, AT200 (T2107), the percentage of stocks trading above their respective 200DMAs, showed more signs of fatigue and highlighted the lack of breadth in the S&P 500’s rally.

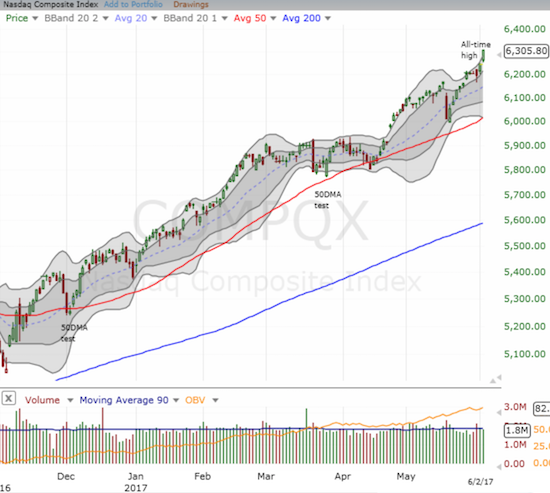

The breadth finally showed up as June trading kicked off. The S&P 500 sprinted forward two days straight and returned to the top of its upward trending upper-Bollinger Bands (BBs). AT40 came along for the ride with an impressive move from 43.8% to 53.5% on Thursday and a close at 55.3% to end the week. A LOT of stocks woke up over the past two trading days. AT200 moved from 52.6% to 56.4% on Thursday to confirm the return of breadth. Friday was much less impressive with a fractional gain following a large fade from the intraday high.

Even small caps, the iShares Russell 2000 ETF (IWM), and mid caps, the SPDR S&P MidCap 400 ETF Trust (MDY) stretched out to return to the top of their current trading ranges.

The volatility index, the VIX, set a new 14-year low by closing a tiny fraction lower than its May 8th close. Day-by-day, the VIX is trying to extend the case for a new norm of extremely low volatility.

The big story on Friday was the U.S. jobs report for May. The stock market clearly did not care about the low level of job creation but the bond market was a different a story (again). Interest rates dropped again. For example, the iShares 20+ Year Treasury Bond ETF (TLT) gained 1.2% and broke out above 200DMA resistance.

Along with the lower rates, the U.S. dollar index (DXY0) weakened further. The dollar last closed this low in early October, 2016. I remain as bearish as ever on the dollar.

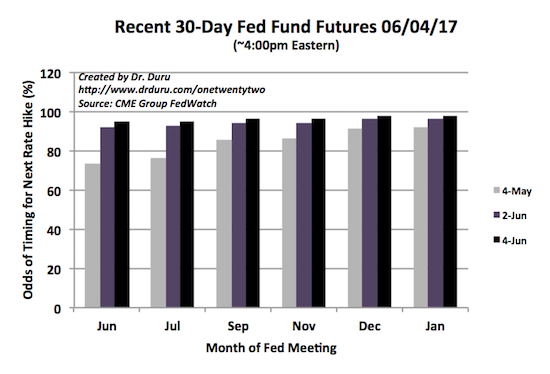

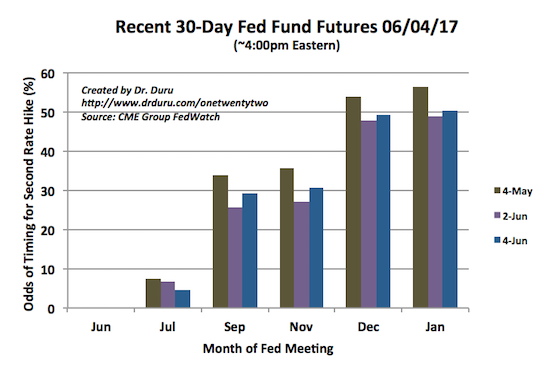

Alongside the on-going departure from the dollar is uncertainty about the timing for the next two rate cuts from the U.S. Federal Reserve. Two weeks ago, the 30-day Fed Fund Futures dropped December, 2017 off the radar for rate hikes and left June as the last month for a rate hike in 2017. Today, the futures market is even more sure about the June rate hike and has pushed toward 50% for a subsequent hike in December, 2017. Futures are pricing in a 50/50 chance for that subsequent rate hike to happen in January. It is interesting to see that the dollar is not benefiting from the slightly higher odds for December and January compared to two weeks ago.

Source: CME FedWatch Tool

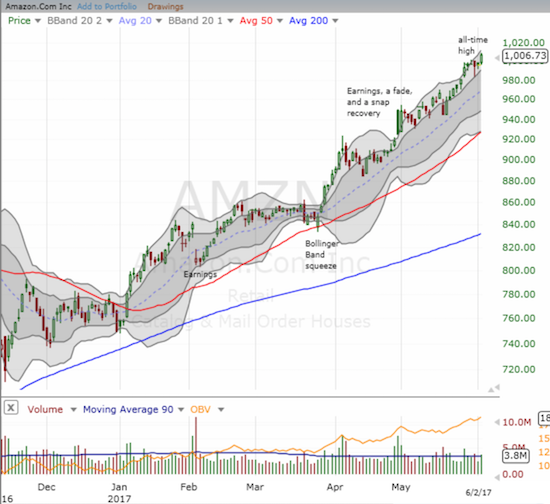

With breadth returning and major indices experiencing substantial 2-day moves, I can throw a dart and find a good/promising stock chart. So I will just post an obligatory chart of Amazon.com (AMZN) which closed above $1000 for the first time ever. This historic achievement is timely given an article I wrote using Jeff Bezos as a shining example of a high school student who was the top of his class who also went on to be a top performer in the global economy. I wrote this piece as a strong counterpoint to a recent flurry of articles I have seen throwing (bizarre) shade on academic achievement.

Be careful out there!

— – —

FOLLOW Dr. Duru’s commentary on financial markets via email, StockTwits, Twitter, and even Instagram!

“Above the 40” uses the percentage of stocks trading above their respective 40-day moving averages (DMAs) to assess the technical health of the stock market and to identify extremes in market sentiment that are likely to reverse. Abbreviated as AT40, Above the 40 is an alternative label for “T2108” which was created by Worden. Learn more about T2108 on my T2108 Resource Page. AT200, or T2107, measures the percentage of stocks trading above their respective 200DMAs.

Active AT40 (T2108) periods: Day #321 over 20%, Day #141 over 30%, Day #8 over 40% (overperiod), Day #11 under 50%, Day #23 under 60%, Day #93 under 70%

Daily AT40 (T2108)

Black line: AT40 (T2108) (% measured on the right)

Red line: Overbought threshold (70%); Blue line: Oversold threshold (20%)

Weekly AT40 (T2108)

*All charts created using freestockcharts.com unless otherwise stated

The charts above are my LATEST updates independent of the date of this given AT40 post. For my latest AT40 post click here.

Related links:

The T2108 Resource Page

You can follow real-time T2108 commentary on twitter using the #T2108 or #AT40 hashtags. T2108-related trades and other trades are occasionally posted on twitter using the #120trade hashtag.

Be careful out there!

Full disclosure: net short the U.S. dollar

*Note QQQ is used as a proxy for a NASDAQ-related ETF