Did Retail Save the Market from An NVDA Hangover? – The Market Breadth

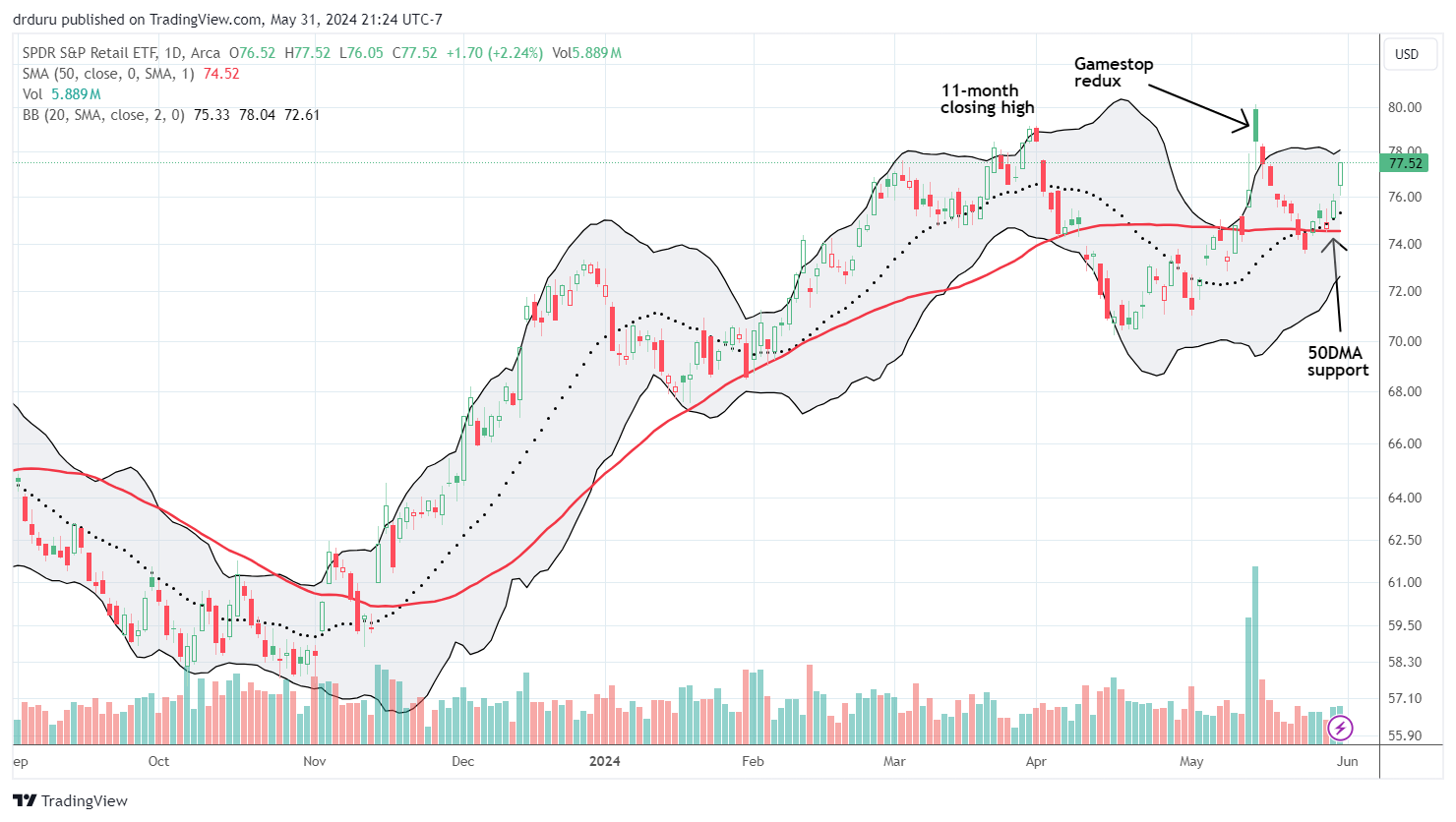

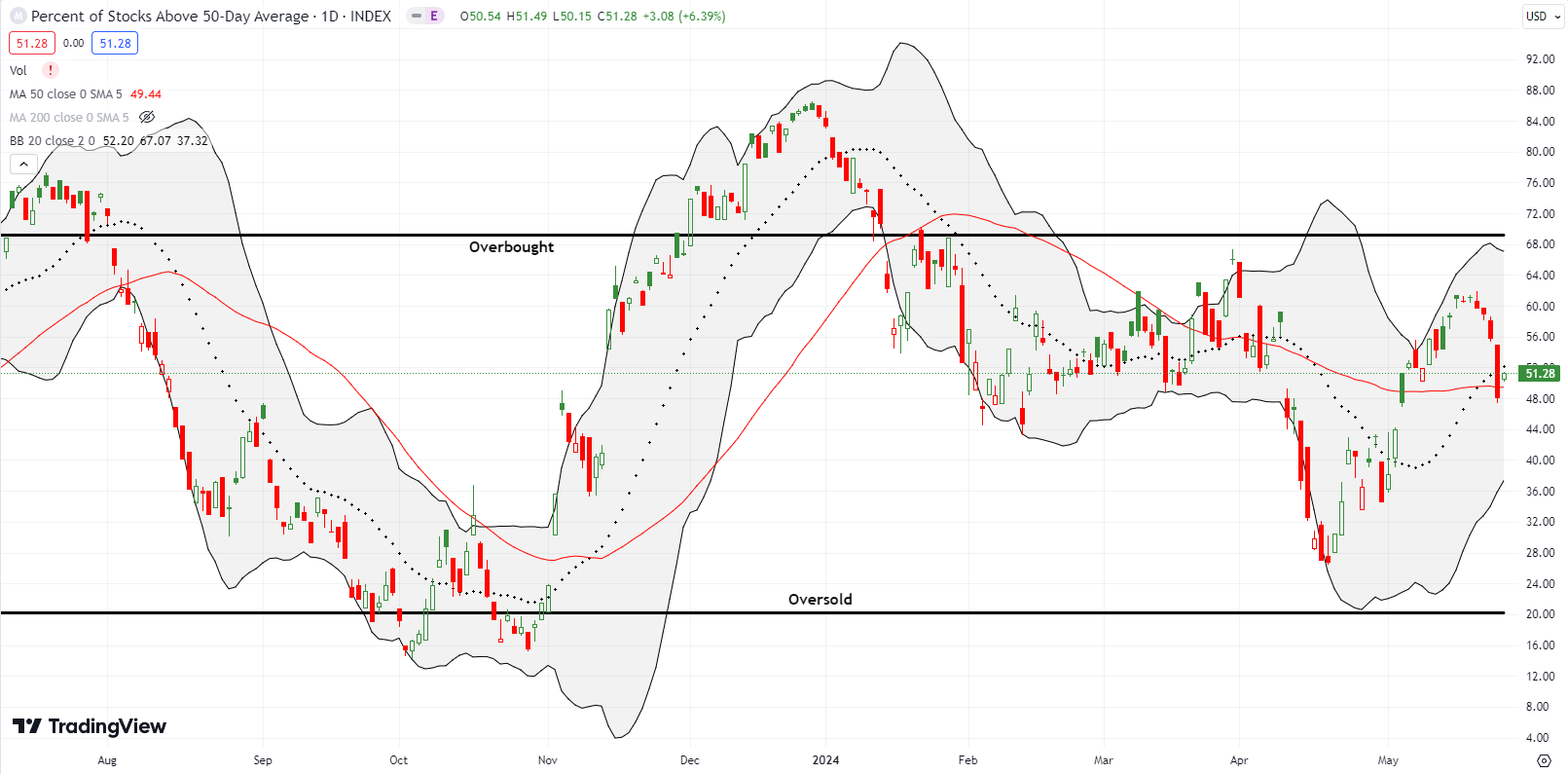

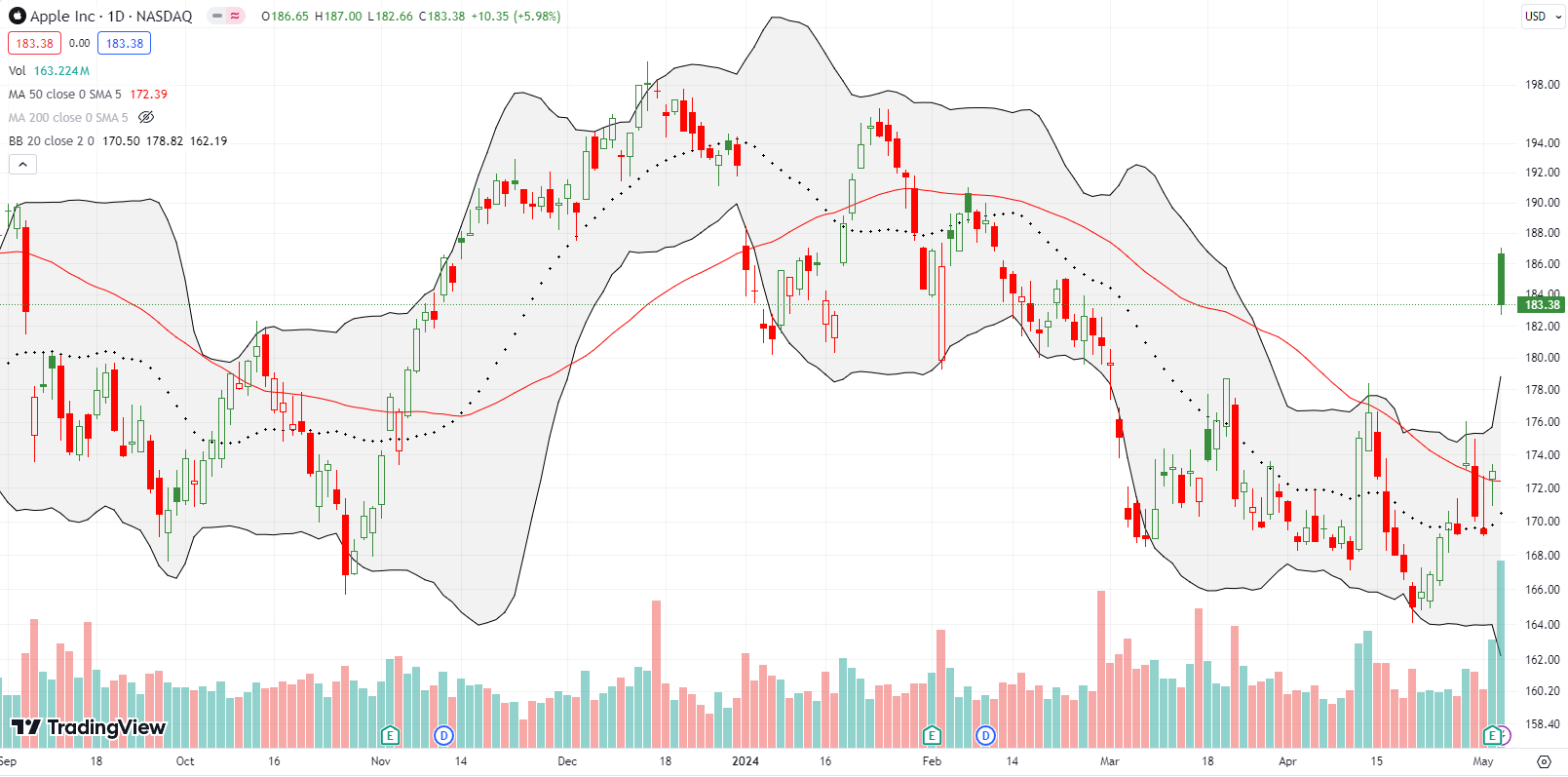

Stock Market Commentary A plunge in market breadth on Wednesday made me expect a more bearish take on the markets for my next blog post. A sharp rebound led by strong earnings from various retail companies, quickly changed the narrative from a continued NVDA hangover to a bullish divergence and then a bullish setup. Friday’s … Read more