Stocks Stand By While China and Yen Surge – The Market Breadth

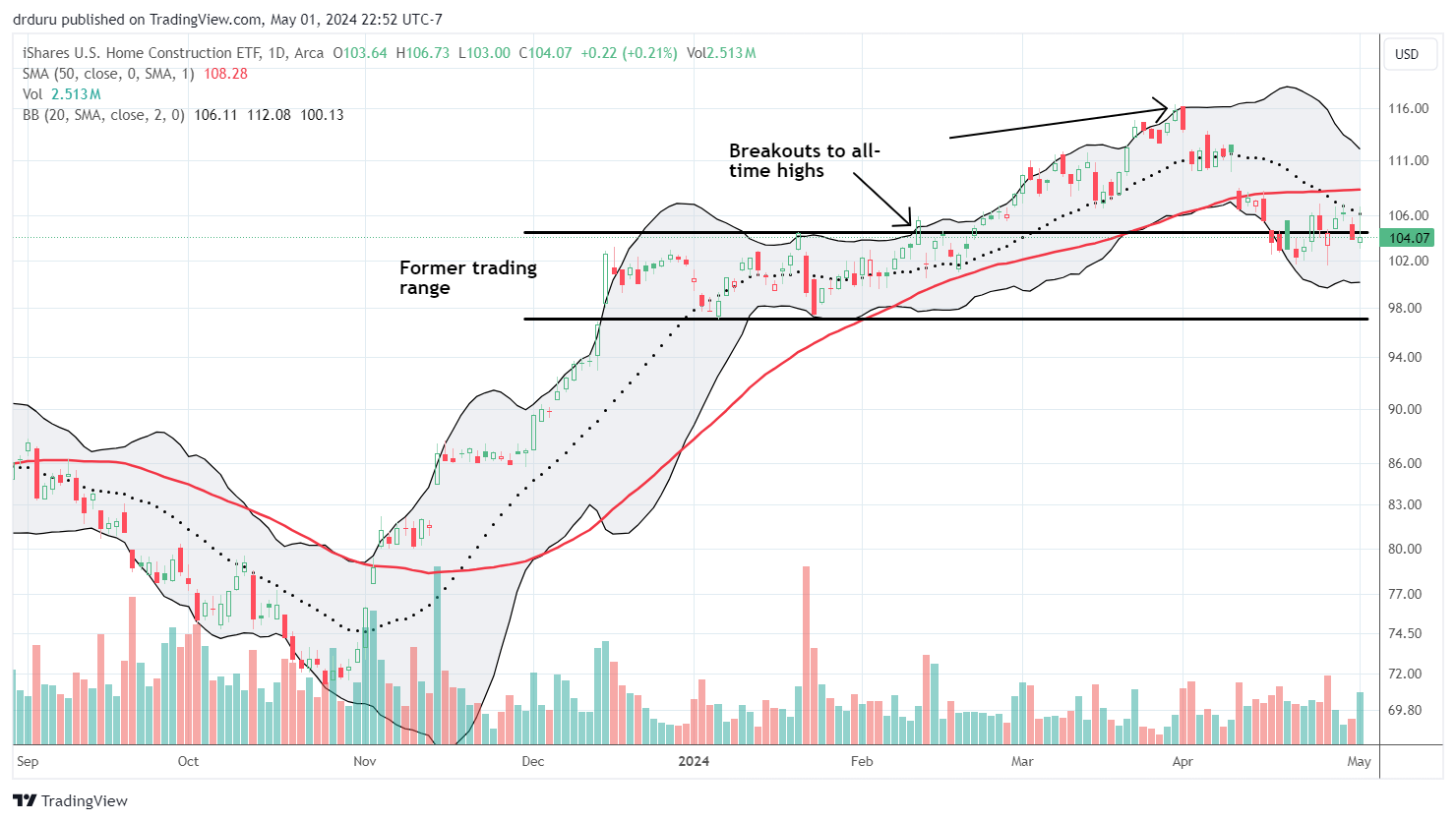

Stock Market Commentary The U.S. stock market hardly reflected last week’s action-packed news. China scrambled to address a weakening economy with a massive stimulus program with news rolling nearly all week. In Japan, voters elected a Prime Minister who favors a stronger currency in the Japanese yen (FXY). Capping the anti-climactic feeling in U.S. stocks, … Read more